Has the Fed waited too long to cut rates?

Rising unemployment and weak manufacturing data worry investors

July’s monthly Department of Labor (DOL) employment report was a disappointment. Job growth came in lower than expected, and the May and June reports were revised lower. Additionally, the headline unemployment rate jumped from 4.1% to 4.3%, triggering the “Sahm Rule” and increasing the chances of a recession in the coming months.

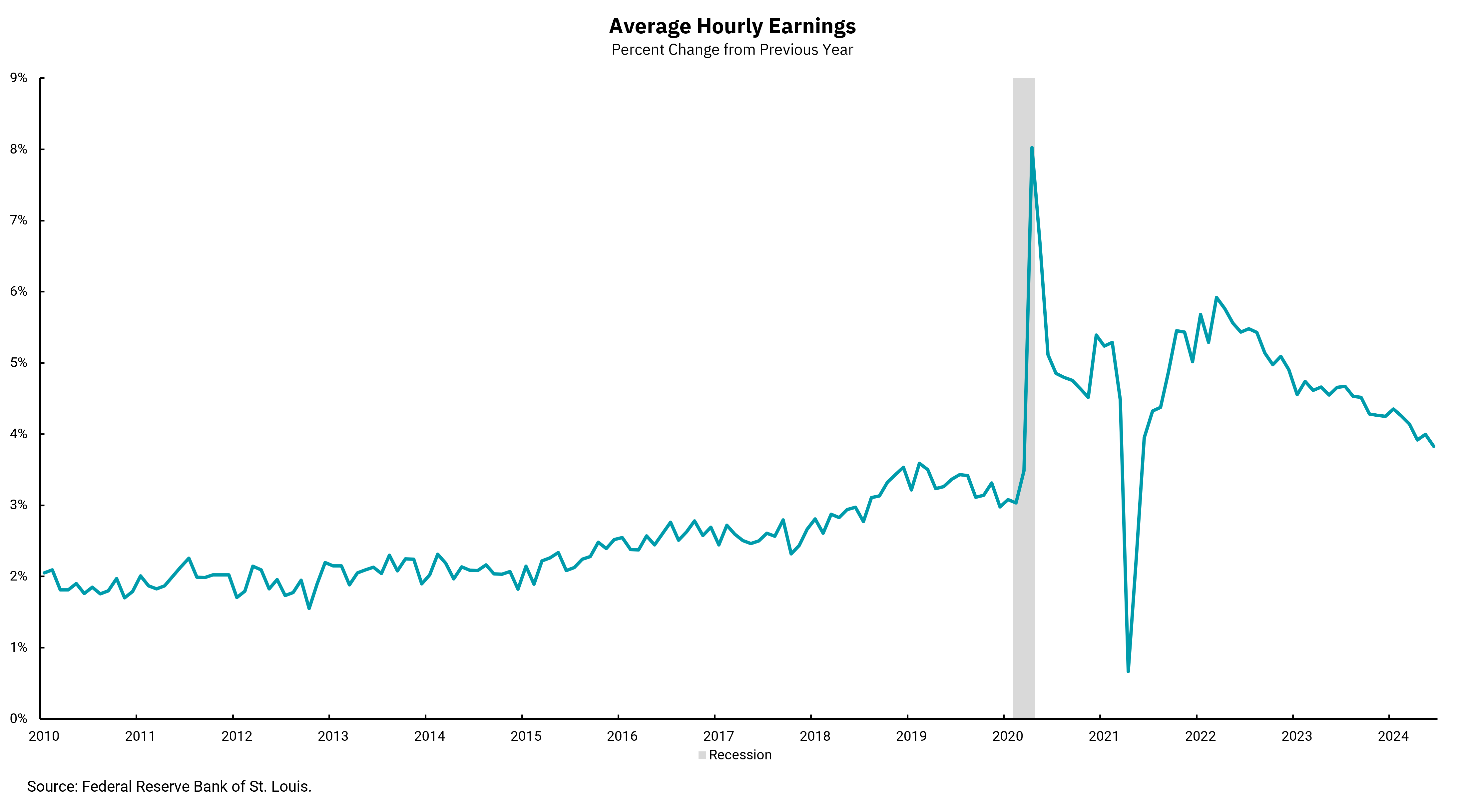

On the inflation front, we did get some good news within the report—and this is the subject of this week’s chart. Average hourly earnings (AHE) were reported at 0.2% versus an expectation of 0.3%. Ordinarily, this would be viewed as good news, as wages are a key part of how the Fed thinks about longer-term, core inflation.

However, in the days following the Federal Open Market Committee’s (FOMC) July meeting, we got a surprisingly weak and broad-based reading on manufacturing. This led to a sharp decline in stock prices and lower interest rates across the curve as investors began to worry that the downshift in economic growth might be more serious than we want. There are still measures of the economy that remain positive. Still, the history of unemployment, arguably the most important part of our economic outlook, is for it to move up slowly before accelerating higher quickly.

The basis for patience on the Fed’s part now seems to be wearing thin. At the recent meeting, the FOMC unanimously voted to keep rates the same, but changes to the language in their post-meeting statement and comments from Fed Chair Powell at his press conference seemed to set the table for a possible rate cut at their September meeting.

Still, one might say they are now behind the curve on rate cuts. After the recent employment report, the chances for a 0.5% cut in September moved above 50%, with a total of three cuts now expected this year. It is important to not read too much into any single data report, and the market reaction might be overdone. However, the trend in economic activity is now clearly slower, and inflation should follow. We know the Fed does not want to ease policy too soon and risk a resurgence in inflation, but keeping policy too restrictive also has consequences.

Second-quarter earnings, to date, have been better than expected, but there have been some big misses and there are stocks that have declined materially. Mentions of higher interest rates and slowing consumer spending have been on the rise, adding to the checklist of reasons for the Fed to begin lowering rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)