Is the US headed for a recession?

Fed likely to lower rates but ‘emergency’ rate cuts unnecessary

We recently wrote about unemployment’s rise to 4.3%, which triggered the "Sahm Rule." This rule, named for former Federal Reserve economist Claudia Sahm, has had a perfect record of signaling when the U.S. economy was sliding into a recession. However, as is the case with many economic indicators, we may have to take a broader view to ascertain our economic position in this post-pandemic period.

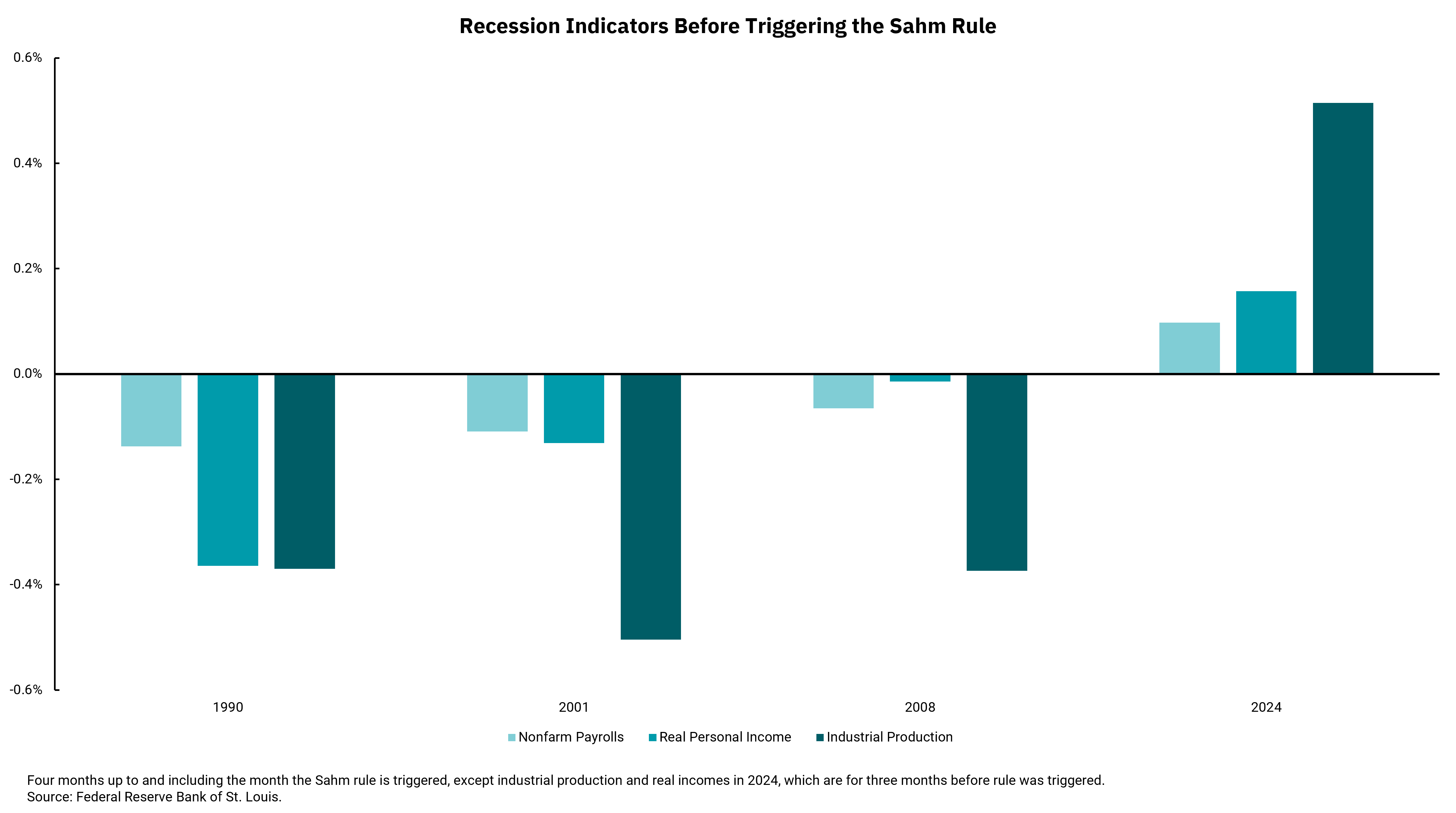

With this in mind, this week's chart looks at the growth rate of nonfarm payrolls, real personal income and industrial production leading up to when the "Sahm Rule“ was triggered in 1990, 2001, 2008 and today. Doing this reveals material differences in the economy today versus past periods.

The factor that jumps out at us the most is the difference between nonfarm payrolls today versus past periods. We can see that, in each previous period, the economy was losing jobs. In contrast today, even though job growth was less than expected in the latest report from the Department of Labor (DOL), the economy is still adding jobs. Additional job market data from the Job Openings and Labor Turnover Survey (JOLTS) shows that, while open jobs are declining, we still have more open jobs than unemployed persons. Indeed, the headline unemployment rate went up in July because the labor force grew, not because layoffs materially increased.

Looking beyond the labor market, though, shows additional factors that remain positive today as opposed to negative in previous periods. While aggregate inflation is still pinching consumers, the recent decline in inflation means real incomes are now rising. Also, the ongoing deglobalization trend might be additive to industrial production, which remains a positive factor in today's economy.

Nevertheless, we cannot say the risk of a recession is non-existent. We agree that it is becoming clear that the economy's overall growth rate is shifting lower. This, along with lower inflation, should put the Fed in a position to begin recalibrating monetary policy by lowering rates. At the same time, calls for an emergency cut in rates spurred by recent market volatility would seem to be premature, at best. Neither the markets nor the economy are in crisis. That said, this doesn't mean we, or the Fed, can ignore signals that have proved worthy in the past. On the contrary, we should remain diligent as it can be very dangerous to think, "This time is different." It remains very difficult to look at single-point indicators and paint a complete picture of our economy.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)