Lessons learned from the recent market volatility

'Goldilocks' scenario of economic news has recession fears fading

It has been an interesting couple of weeks in the stock and bond markets, as economic data has been a bit mixed. The recent meeting of the Federal Reserve's interest rate-setting arm, the Federal Open Market Committee (FOMC), ended with rates unchanged and an outlook that hinted at a rate reduction in September but did not promise one. The next day, a weak reading on U.S. manufacturing gave the market pause, which was followed by the monthly employment report from the Department of Labor (DOL), in which job growth was disappointing and the headline unemployment rate went up more than expected. Suddenly, it seemed the Fed was behind the curve on rate cuts. Then, when Japan's central bank rate increases caused a global rebalancing, we had the biggest down day in some two years.

A better-than-expected report on the services sector, a much larger part of the domestic economy than manufacturing, helped ease some fears, ending in the biggest “up day” in the stock market in two years. Yes, two of the biggest moves, in opposite directions, in the same week.

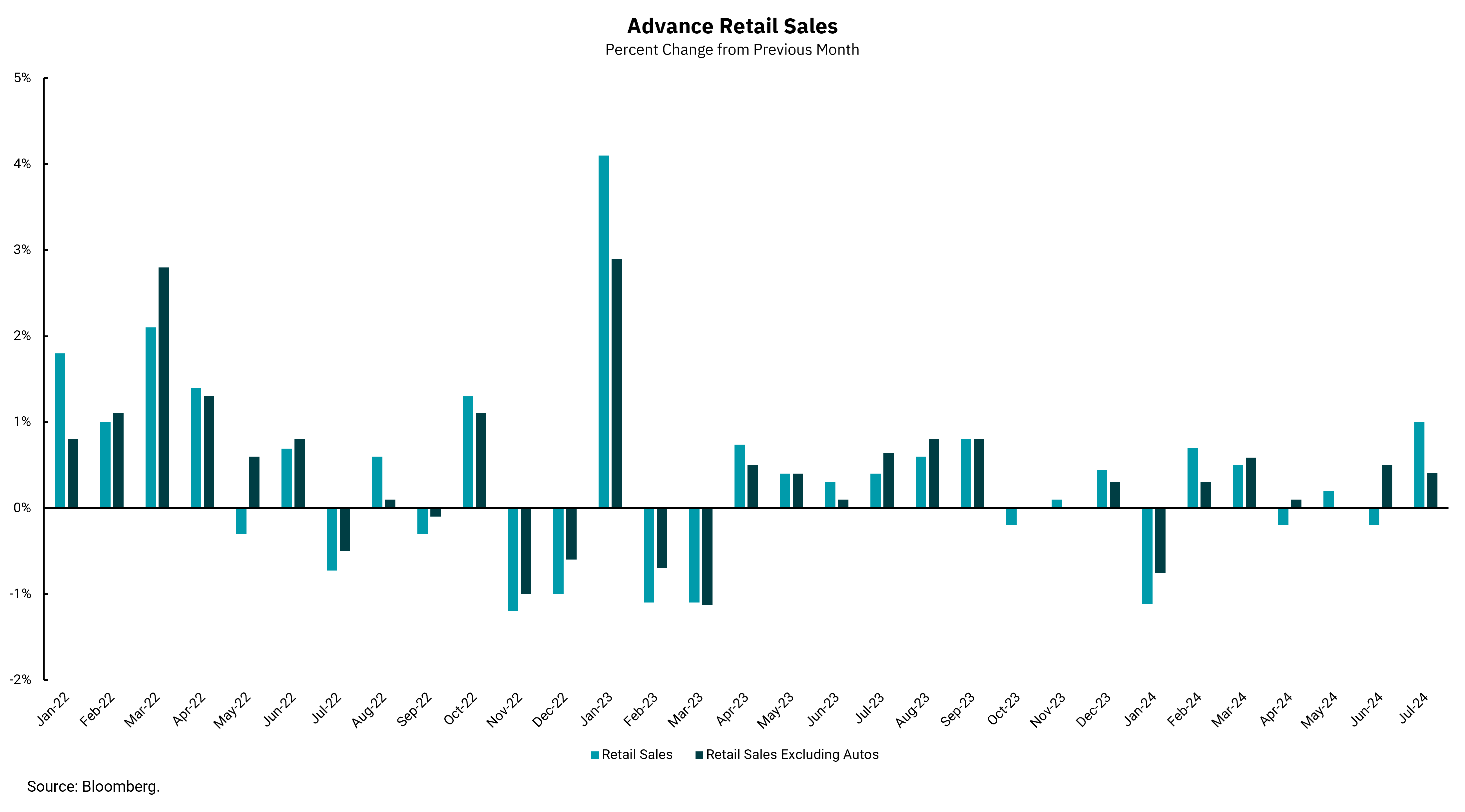

As stocks fell, some were calling for emergency Fed rate cuts. Our sense was that this was unwarranted as stocks were still higher on a year-to-date basis. Additionally, while, yes, the job report was disappointing, job growth remains positive and broader measures are not at recession levels. Meanwhile, recently, multiple reports have showed that inflation remains on a lower path. On Thursday, we received the July retail sales report, which was stronger than expected across the board, while the weekly jobless claims number declined from last week. All of this has led to a material decline in the markets' "fear measure," the volatility index, and a return to an outlook for two, maybe three, rate cuts between now and year-end as recession fears fade.

There are a few lessons worth re-learning from this recent period. First, the post-pandemic economy continues to be very difficult to forecast. Second, trying to "time" the market to avoid down-days or to catch up days remains very difficult. Third, there is no single economic data point that can provide an overall picture of the diverse and complex domestic economy. And fourth, having an investment plan is the best way to avoid getting knocked off course by market volatility.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)