Fed zeroes in on labor market data

New job growth is down but wages higher than expected

On Friday, we received the August jobs report from the Department of Labor (DOL), which economists and investors were awaiting for with even keener interest than usual. Given inflation’s continued decline, the Federal Reserve has indicated that its primary focus, as it pertains to monetary policy, is shifting to the labor market. As Fed Chair Powell said in a recent speech at Jackson Hole, "We neither seek nor welcome further weakness in the labor market.“

Since reaching a cycle low of 3.6%, the unemployment rate increased to July's reading of 4.3%. That move was enough to trigger the "Sahm Rule," created by a Fed economist named Claudia Sahm. This rule was designed to provide a signal from the labor market as to when the U.S. is going into a recession. However, Dr. Sahm has since indicated that the post-pandemic economy might be a bit different from what we have seen before, meaning that the signal might not be as certain this time. That said, historically unemployment has started up slowly but then begun to increase at an faster pace, which means spiking unemployment isn’t completely off the table either.

With all this in mind, financial markets were hoping for additional clarity from the August jobs report as we consider the path of the Fed's interest rate cuts. The direction is clear—with rate cuts ahead, almost definitely starting at the Federal Open Market Committee’s (FOMC) Sept. 19 meeting. However, there is still the question of whether they will move by a "normal" 25 basis points (0.25%) or feel the need to do more and reduce rates by 50 basis points (0.50%)?

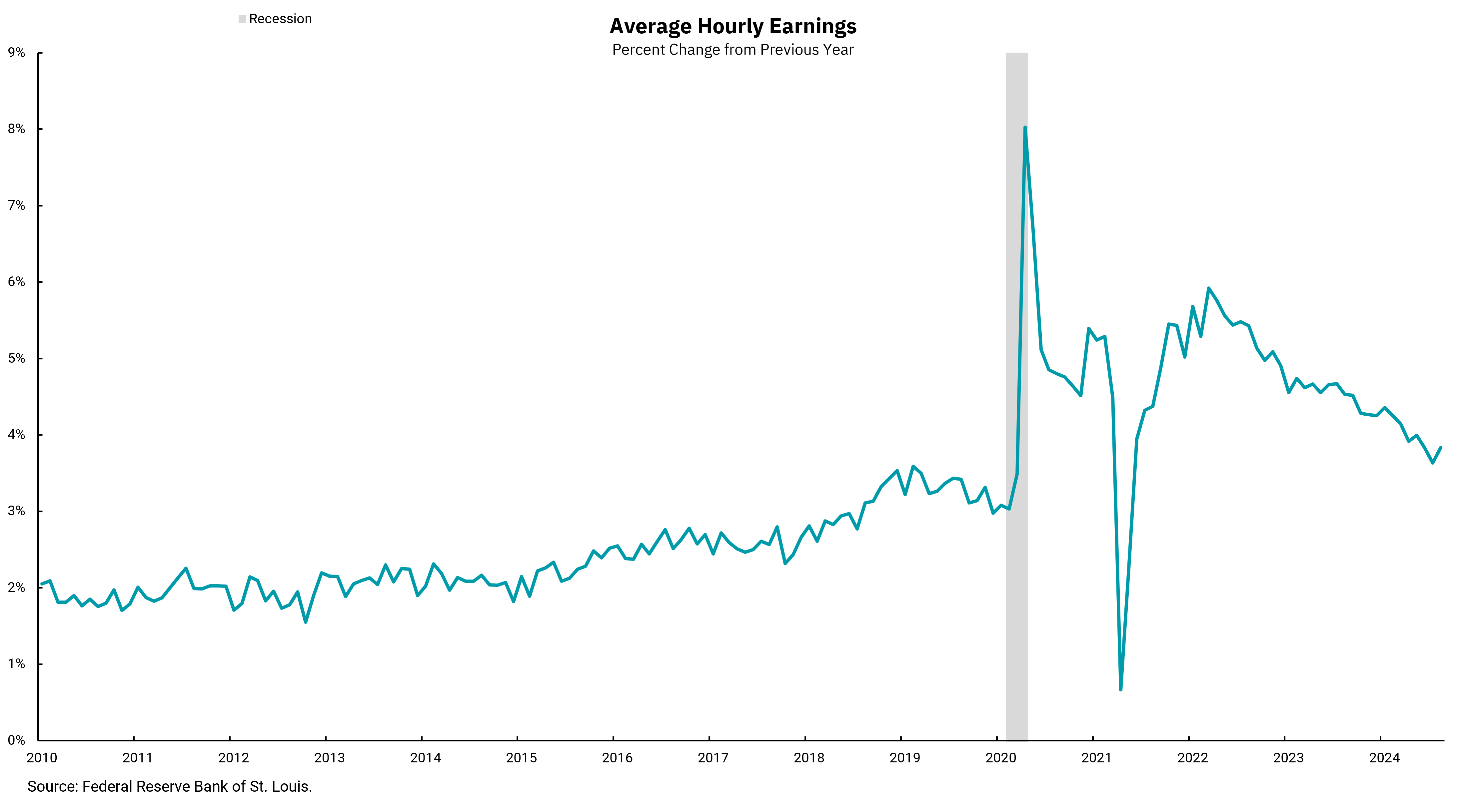

From our lens, August's employment data falls more heavily on the side of a 25-basis point cut. While the number of new jobs missed expectations, coming in at 142,000 versus an expected 161,000, and there were downward revisions to the previous two months of job growth, the headline unemployment rate fell to 4.2%. At the same time, the work week expanded a bit and average hourly earnings, the subject of our chart this week, came in a bit hotter than expected. The Fed's focus may be shifting to the labor market but that does not mean they are going to ignore an inflation measure on wages as they consider their next move.

Moreover, this week’s chart shows that there has been clear progress on wages within recent labor reports. One month of a higher-than-expected reading doesn't change the overall trend, but when we consider that economic growth remains positive along with the fact that there are still jobs being created, it would seem the Fed can begin a measured pace of cuts. The messaging will clearly be to expect more cuts at future meetings, but the need for faster than normal action from the Fed isn't there yet in the job market.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)