Slowing labor market focus for Fed

Inflation trends continue downward ahead of this week’s Fed meeting

The Federal Reserve has a dual mandate of balancing both full employment and price stability. Despite some interruptions, inflation has been moving downward since peaking in 2022. However, in the last few months, certain metrics, such as nonfarm payrolls, have shown some deceleration in the labor market. These developments were reflected in Chairman Powell's speech at the Federal Reserve's Jackson Hole conference, where he spent considerable time focusing on the labor market instead of inflation.

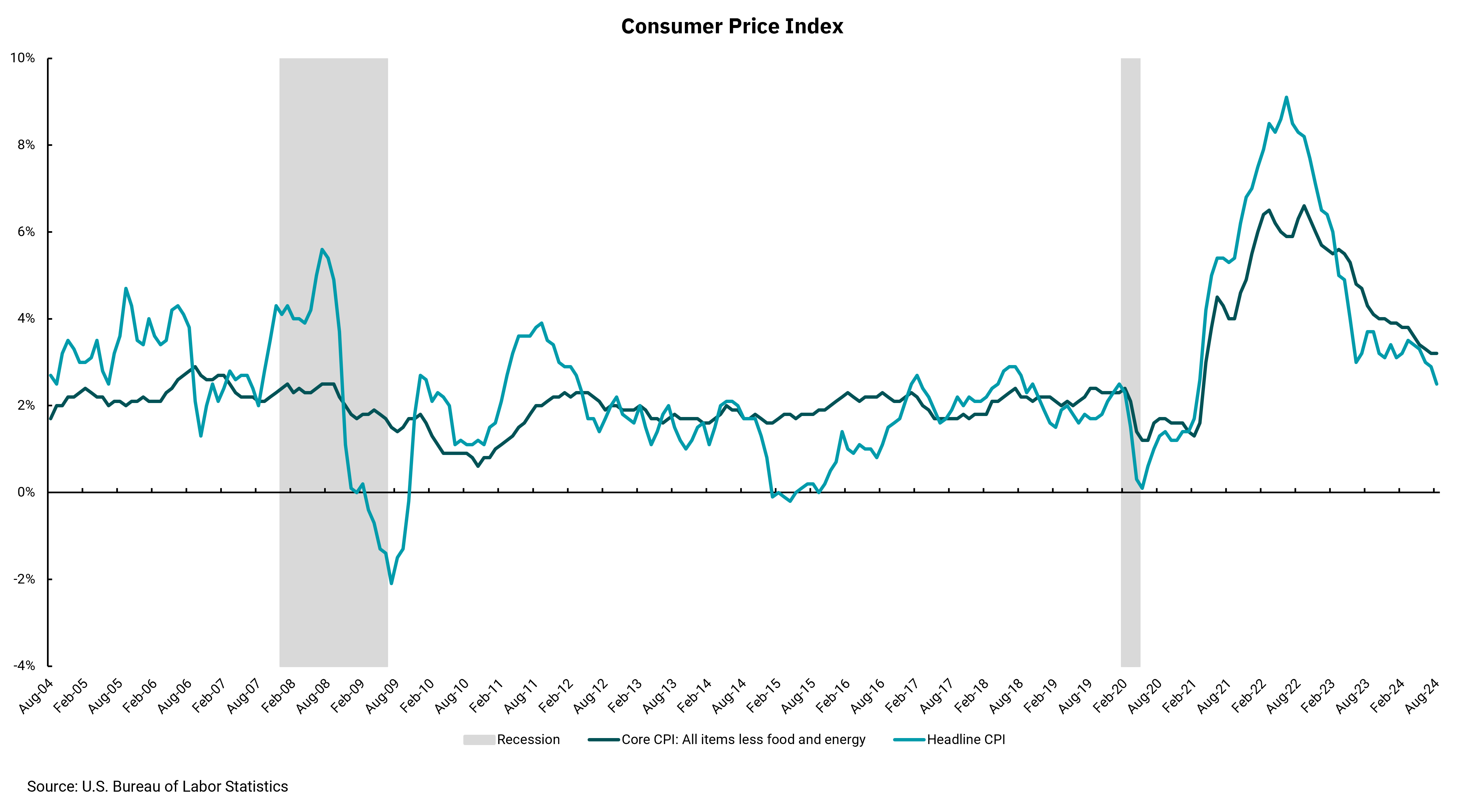

The latest inflation cycle is shown in this week's chart of the Consumer Price Index (CPI) which stretches back to 2004. The CPI reports continue to show inflation in a downward trajectory. There was some heartburn associated with this week's reading on core inflation as it came in a bit hotter than expected month-over-month. But at this point, it's hard not to see the likely route of inflation coming down further over time. Unfortunately, investors won't receive the official Personal Consumption Expenditures (PCE) inflation data until the end of the month, but the CPI provides an appropriate snapshot. The primary driver of inflation remains shelter, which famously lags real-time shelter data not reflected in the CPI. As of this writing, futures markets are pricing in a roughly even split between the probability for a 0.25% rate cut and a 0.50% rate cut at the September 17-18 Federal Open Markets Committee (FOMC) meeting.

The markets should, all else equal, prefer a 0.50% cut over a 0.25% cut. Lower rates do many things, including raising the value of discounted cash flows as well as loosening the grip of higher interest rates on the cost of consumer and business financing. If the Fed were to enact a 0.50% cut, there is an argument in the financial media that this would cause investors to fret. While the initial market reaction to a 0.50% cut is hard to discern, investors should be cheering as the benefits accrued in the form of lower rates are apparent.

Although we remain believers in the positive (but moderating) economic growth story, a 0.50% cut can potentially remove more risk associated with the labor side of the mandate than a 0.25% cut. Investors will be looking forward to the retail sales report this week. The countdown to the Fed's decision is here.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)