Tech stocks 'taking a breather' in performance

Outlook for lower interest rates boosts real estate, utility and financial stocks

This year started with a bang, with the stock market delivering strong performance right from the beginning. However, equity market performance was concentrated and driven primarily by large mega-cap technology companies. Many of the largest technology-related names charged to the upside only to leave much of the rest of the stock market in its collective dust.

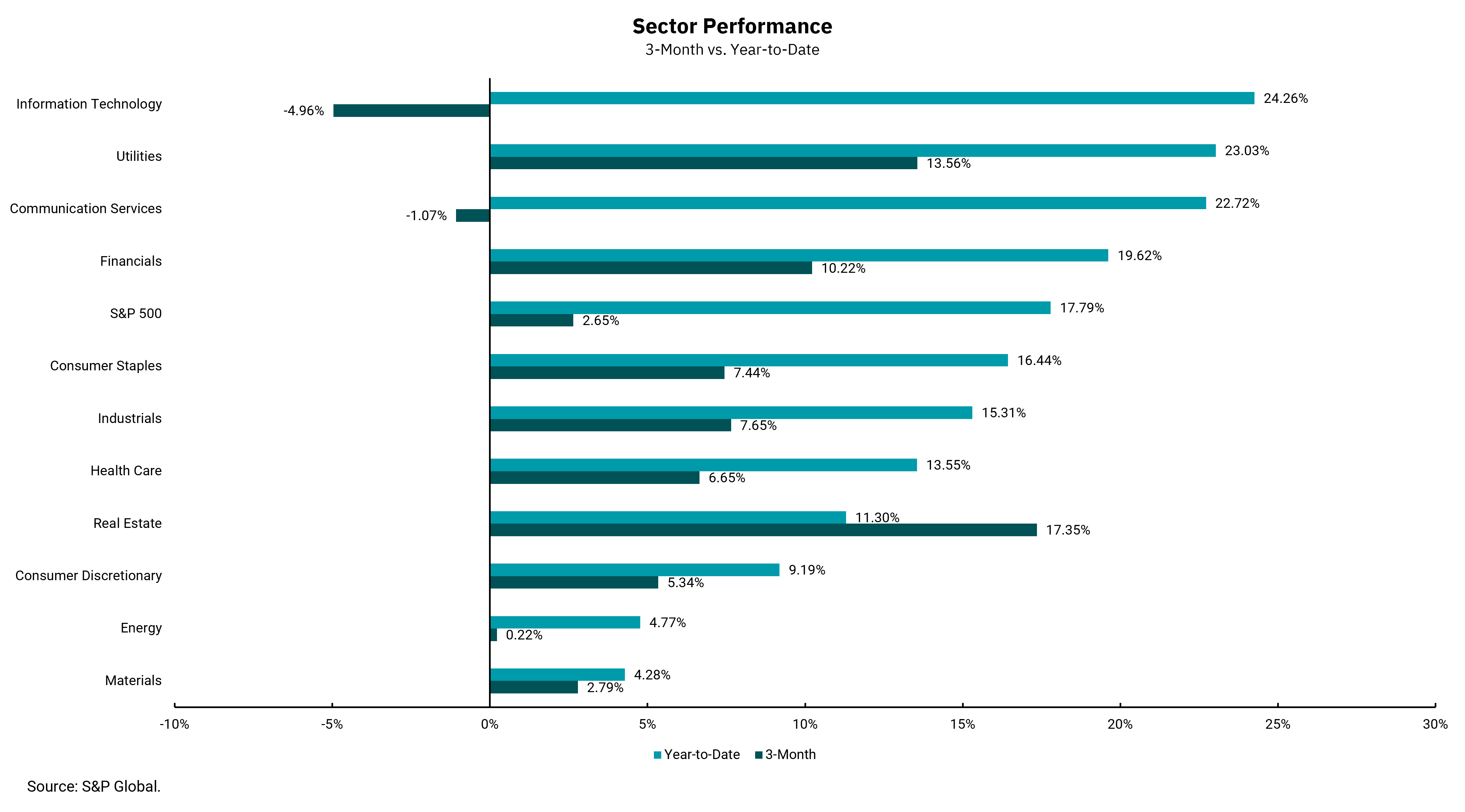

In the last few months, this market dynamic has changed. And so, as mega-cap technology's relative performance moderates, where could the markets look for performance? Welcome to the rise of the rest, driven primarily by interest rate-sensitive sectors such as real estate, utilities and financials. Specifically, this week's chart displays the performance of the various S&P 500 sectors year-to-date and the most recent three-month period.

Technology—a sector that houses heavyweights like Nvidia, Microsoft and Apple—comprises over 30% of the S&P 500 index and drives a great deal of the index's performance. The communication services sector—which also has large exposures to companies that might otherwise be considered technology companies, such as Meta and Alphabet—has performed well year-to-date as well.

So, what has been the most important driver of performance in the rest of the stock market? While there are numerous reasons to cite, it seems the most important is the outlook for a lower interest rate environment. The rise of the rest does not necessarily mean poor performance for technology related companies. It just means that there may be further relative outperformance in the short term by other sectors and corners of the market.

Looking further into the future, it's hard to see the immense trend in artificial intelligence and other technologies not having further room to expand, along with the winners’ shares of these respective spaces. New technologies typically take years to mature and become widely adopted over substantial periods of time. This means that while the technology trend is currently taking a breather in terms of performance, it's healthy for the market to have rotations into other sectors and themes. And if a soft landing is approaching, backed by a market-friendly Federal Reserve, the current bull market likely has much further to go.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)