Inflation may not go away quietly after all

Housing costs remain tough nut to crack amid home shortages

The Federal Reserve recently shifted some of its focus from inflation to the labor market. That's not to say they were ignoring one of their two mandates before, rather that they had been communicating that inflation was the bigger risk to the economy than the labor market. Then, a move higher in unemployment, along with some weakening trends in open jobs and turnover rates, led the Fed to state that they "did not welcome or seek further weakness in the labor market." These figures also played a key role in the Fed’s decision to reduce rates by 0.50%.

Yet the much-stronger-than-anticipated September jobs report, which included a hotter-than-expected measure of wages for the second consecutive month, reminds us that inflation may not go away quietly. Since the jobs report was released on Oct. 4, expectations for Fed easing have declined, which has led market participants to pay particular attention to this month's Consumer Price Index (CPI) and Producer Price Index (PPI) readings. In both cases, the data on core inflation were about 0.1% higher than expected. This is probably not enough to keep the Fed from reducing rates by another 0.25% at the next meeting, but it significantly reduces the chances of another 0.50% move.

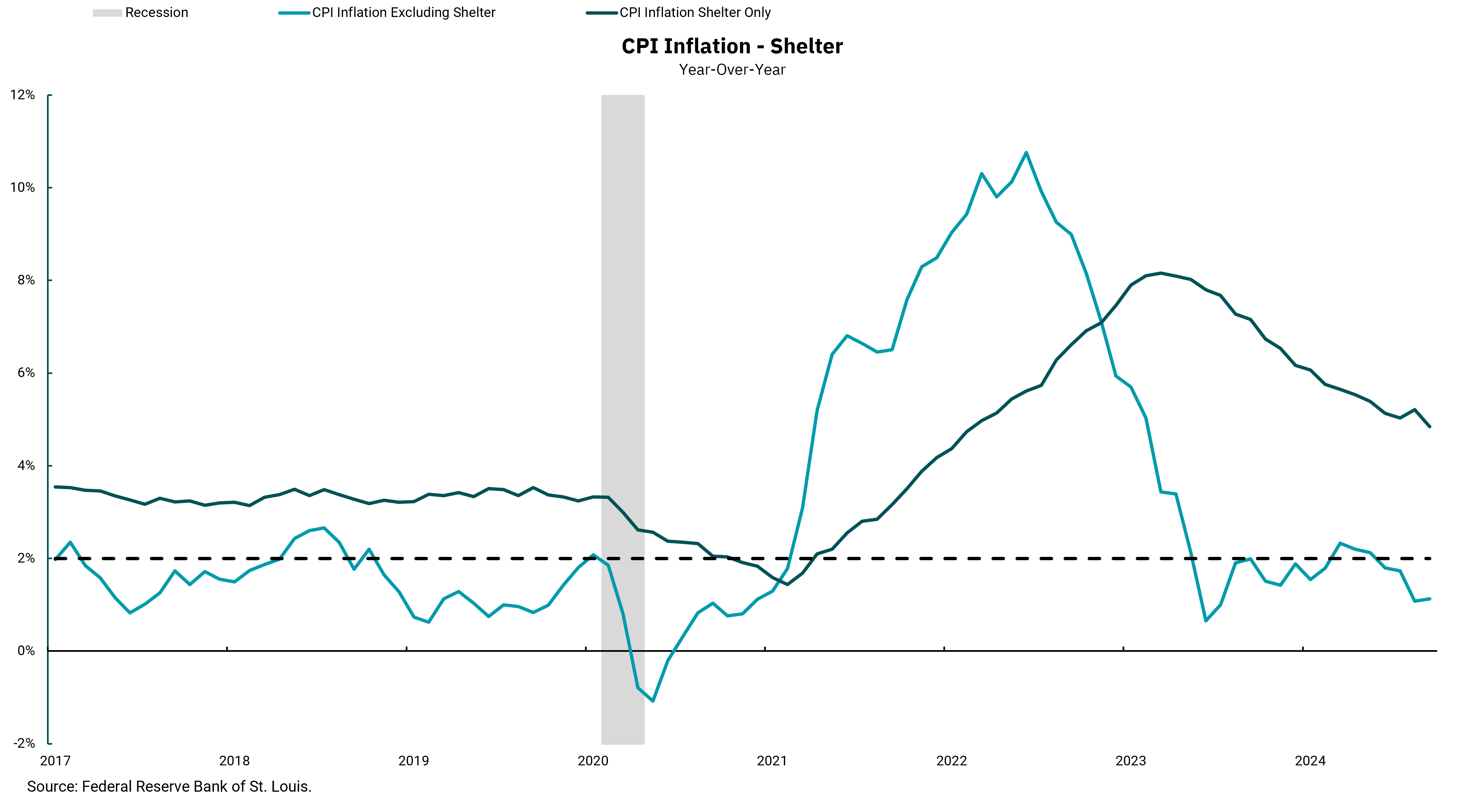

This week's chart breaks down inflation in a way that illustrates the bifurcated nature of the problem for the Fed. The light blue line shows inflation without housing, while the darker line is housing-related CPI inflation. We went back to the pre-pandemic period because this shows that inflation is back to pre-pandemic levels (and back to the Fed's target) in many ways—but not all. Housing, for instance, is a material part of the inflation picture within CPI and for consumers, and clearly it is not back to pre-pandemic levels. The direction of the move is lower, and real-time measures of rents would lead us to expect this trend to continue. However, the massive supply shortage in housing might mean the trip back to the levels we saw before the pandemic will not happen quickly or smoothly. The disruptions from two major hurricanes might also make overall inflation measures a bit bumpy over the next few months. It remains too early for the Fed to declare victory over inflation.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)