Rate cut expectations shift post-election

Strong economic growth may allow the Fed to slow rate cuts

The completion of the U.S. election process has ushered in significant changes across many markets. Much of this was less about who won and more about removing some level of uncertainty. Still, there are significant differences between the platforms of the Democratic and Republican parties. As we have mentioned, the overall capital market reaction has shifted towards an outlook for higher growth as reflected in higher stock prices (across the capitalization structure), higher interest rates, narrower credit spreads and a higher dollar.

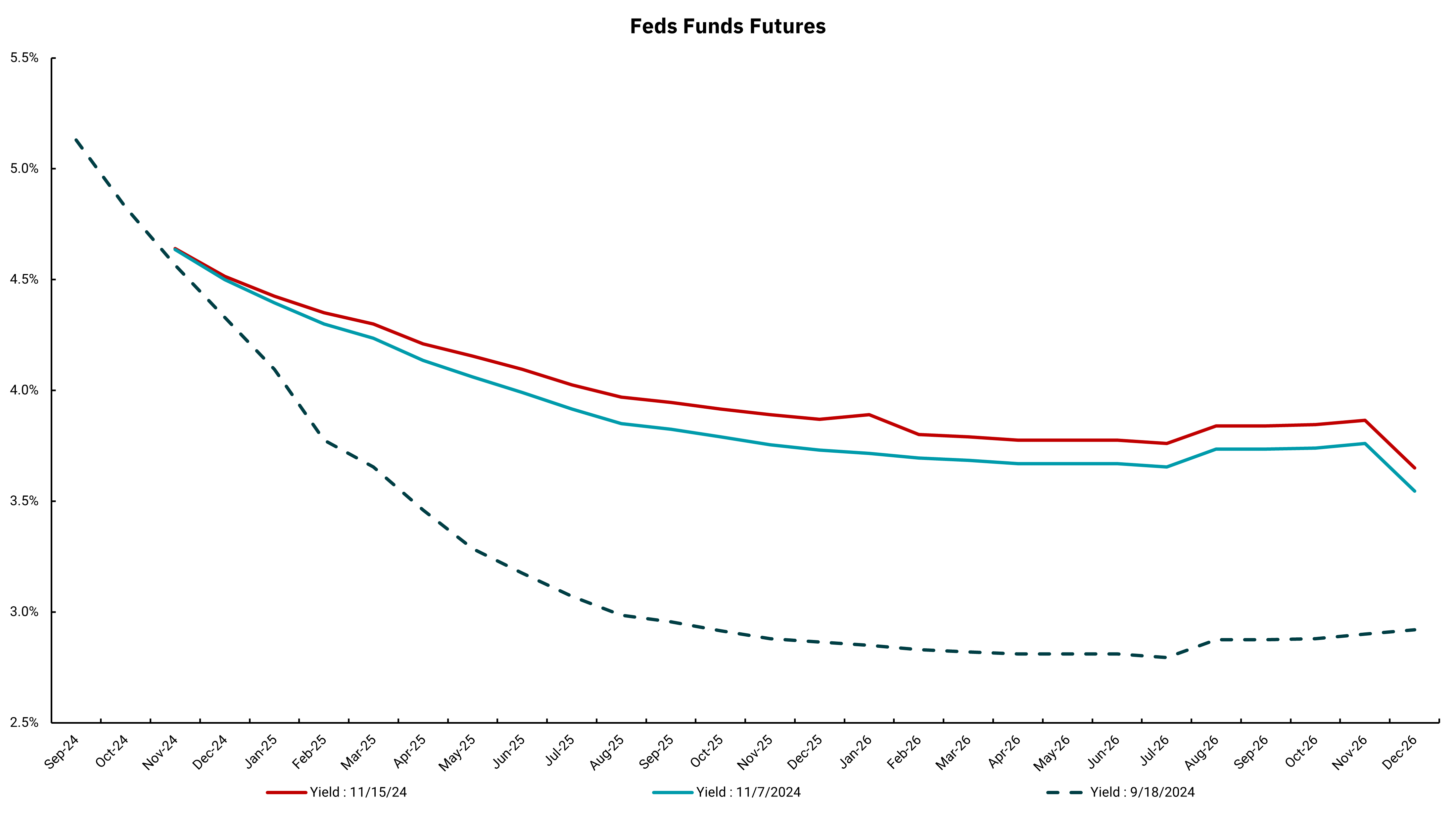

On Thursday, Fed Chair Powell spoke in Dallas and provided a more nuanced outlook for Fed policy than he had only a few weeks ago. He spoke of higher economic growth, allowing the Fed to slow down on rate cuts. This week's chart shows the change in Fed Funds futures from when the Fed met in September, when they cut rates by 0.50%, and the last two weeks covered the period after the presidential election.

The shift upward in the chart between the dashed line and the solid lines shows that the expectation for fewer rate cuts has been fast and material. To be fair, just prior to the election, rate cut expectations had been lessening after a series of stronger-than-expected economic data and multiple inflation readings indicating the path to the Fed's 2% target might be a bit slower than expected. But post-election, the moves have accelerated.

The Fed met immediately after the election and cut rates another 0.25%. They have one more meeting this year, in December, where the chances of another cut of 0.25% have moved from close to 75% to now a 50/50 chance. We will get another employment report and more inflation data before they meet, which will surely play an essential role in the decision.

Another important note: The combination of higher growth expectations and the slowdown in inflation getting to 2% has led to an increase in the anticipated target rate by the market. This so-called "terminal rate" was expected to be about 3% but has now increased to 3.5-4%. This change may seem small, but it is a big shift in longer-term rate expectations. This shift also helps explain why longer-term rates have increased even as the Fed is lowering short-term rates. For example, rates like the "prime" lending rate at banks move lower while home mortgage rates move higher. Higher deficits and the potential inflationary aspects of tariffs are also at play. While higher rates based on an outlook for better growth are not all bad, for longer-term borrowers hoping to refinance based on the Fed reducing rates, those chances look less likely now.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)