Would new tariffs make inflation rise—or fall?

Trump’s previous tariffs were deflationary, but that doesn’t mean the next will be

Getting past the election process has removed a lot of uncertainty for the capital markets, but questions remain around the implementation of President-elect Trump’s policy platform. Tax policies will be a front-burner item, along with changes in regulatory oversight within many sectors, but our chart this week pertains to Trump’s campaign platform on tariffs.

At their base, tariffs are a tax increase. Placing a tariff on an imported good increases the price of that good compared to goods without tariffs, which are typically domestically produced. However, how consumers react to the imposition of tariffs is not clear-cut. Simplistically, the imposition of a tariff would raise the price of the imported good by the amount of the tariff, allowing domestic goods to more easily compete on price. Overall, this increase would have an inflationary impact as the overall price consumers would pay for goods would be higher than before the imported goods were "tariffed." One must also consider the choice of an importer or seller of a good to "eat" part of the tariff by accepting a lower profit margin to protect sales volume.

But economics is rarely simple. Consumers might be willing to pay the higher price of the imported good, buy a now "cheaper" similar domestic good, substitute an alternative and buy neither the imported nor domestic good...or choose not to buy anything and save their money. Across this range of options, we see impacts on overall economic activity, which could include slower overall growth. In short, the impact on inflation is not clear cut nor is the impact on economic activity. It is important to note that tariffs are in place today and can be used to help level the playing field across countries and economies. However, a policy of broad tariff imposition, which leads to retaliation by other countries, quickly devolves into a much slower rate of economic growth and more losers than winners.

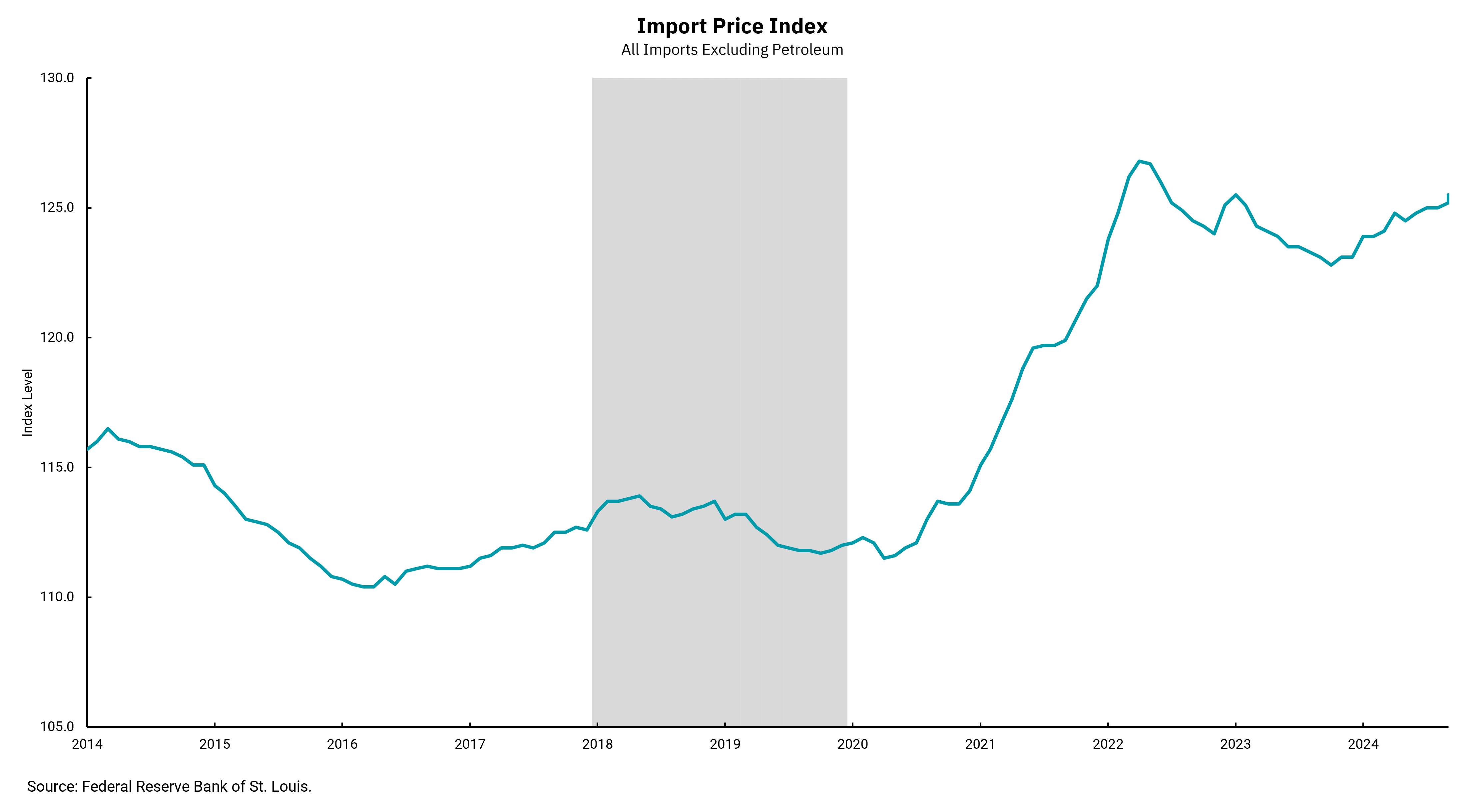

This week's chart shows what happened to the import price index during President Trump's previous administration when tariffs were raised. The data from this period shows that the impact of tariffs was deflationary instead of inflationary, as the overall index of import prices declined. Does that mean we should expect the same thing now? The devil will be in the details of implementation. The threat of tariffs may be more of a negotiating tactic than an actual tool to use. We expect the idea of "reciprocity" to be used as we go through this process. A number of countries have more open access to our markets than we do to theirs. The idea of raising tariffs on a country's imports to the U.S. might lead to the foreign country reducing tariffs on our exports into their economy.

Of course, tariffs can also be an economic "weapon," and the rhetoric surrounding tariffs on Chinese imports has been more severe. This is going to be a policy that we will watch closely as we consider the implications on the economy, markets, inflation and interest rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)