Not time to say goodbye to inflation and higher rates just yet

Inflation may remain above Fed’s 2% target until 2027

Despite the Federal Reserve lowering rates at their last meeting for 2024, as the market expected, the capital markets reacted negatively to the announcement. The Dow posted 1100 points for its tenth straight day of losses, a streak not seen since 1974. And the Dow was the better performing of the three major large-cap indices, as the S&P 500 lost 3% and the Nasdaq shed 3.6%. In the bond market, longer-term rates rose, and the yield curve continued its “bear steepener,” where long rates are moving up as short-term rates are falling, that has been in place since the Fed began lowering rates in September. Since the Fed’s first rate cut, ten-year notes are up almost a whole percentage point.

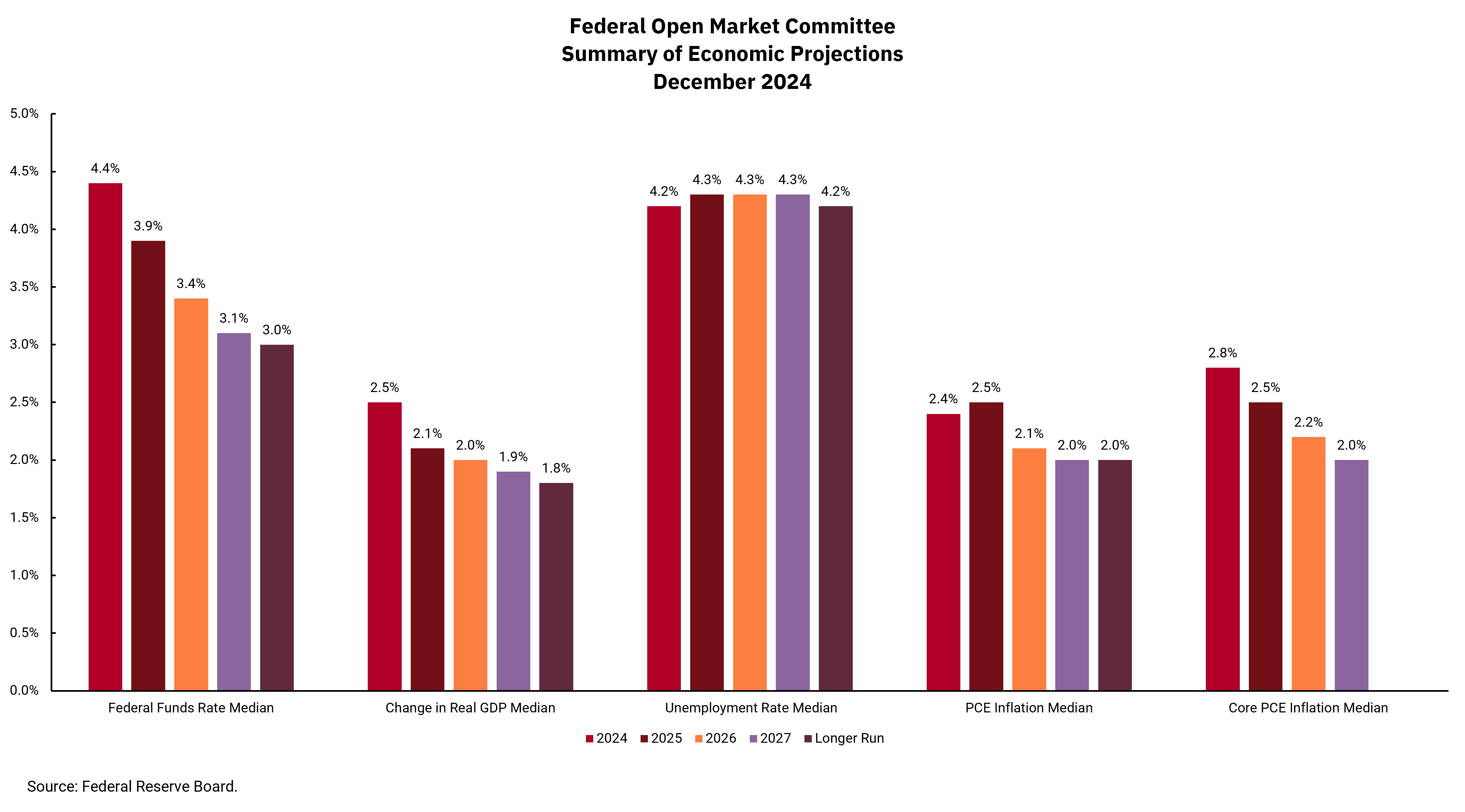

So, what gives? Part of the answer can be seen in the Fed’s updated “Summary of Economic Projections” (SEP). In it, their latest forecast now has inflation above their 2% target until 2027, as opposed to 2026 as previously projected. The number of rate cuts in 2025 have been reduced to two, with two more in 2026. In addition, while the Fed continues to see real gross domestic product (GDP) decline from current levels, the decline is slower than previously thought and the outlook for employment remains, almost unbelievably, stable.

Our overall sense is that the capital markets are now having to reprice to an environment of somewhat higher rates for a longer period than previously thought. Higher rates have the impact of reducing the present value of future earnings, leading to lower stock prices today. We have mentioned in previous commentary the full valuation of equity prices. There is nothing inherently wrong with high valuation. Still, it does reduce the room for error in the case of a surprise, like a missed earnings report or a higher interest rate environment than previously expected.

Fed Chair Powell’s comments during his press conference displayed the nuanced position in which the Fed finds itself. While stating the economy is strong and the outlook is bright, he was still left explaining why the Fed needed to cut rates this time, and his answers were a bit tortured. Chair Powell also stated they do not anticipate or forecast impacts of future fiscal policy. However, an increase in the expected rate of inflation might signal some level of concern as we think about growth and policies like tariffs going forward.

Overall, there was nothing within the Fed’s post-meeting statement, Fed Chair Powell’s press conference comments, or the updated SEP that fundamentally changed our outlook. We see many reasons to be optimistic while realistically acknowledging potential headwinds. Based on that, we remain broadly diversified to prudently pursue returns while managing risk.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)