Tariffs a top concern for manufacturers

Some discomfort likely for businesses in the short-term

What will happen with tariffs? Do we need to move our manufacturing facility? How will geopolitical conflicts impact our supply chain? What’s going on with currency exchange?

These questions—and many more—are especially high priorities for manufacturing leadership teams as they try to navigate the current business landscape.

“The level of uncertainty right now is giving business leaders whiplash,” said David Anderson, Colorado corporate banking manager at BOK Financial®. “Raw materials are sourced and assembled around the world for companies producing products in the U.S., and there are so many factors that can change the trajectory of delivering the final products.”

From weather-proofing materials to cabinetry to high-end women’s boots, BOK Financial’s commercial and corporate banking teams are consulting with manufacturers of all shapes and sizes daily—and discussing the high level of uncertainty in the market.

Deciphering tariffs

"The rapidly evolving economic landscape is a major concern for our clients, particularly with regard to tariffs and the global economy," said Greg Atkinson, commercial banking market manager in Denver for BOK Financial. "The frequent shifts in tariff discussions, sometimes occurring weekly or even daily, make planning extremely challenging."

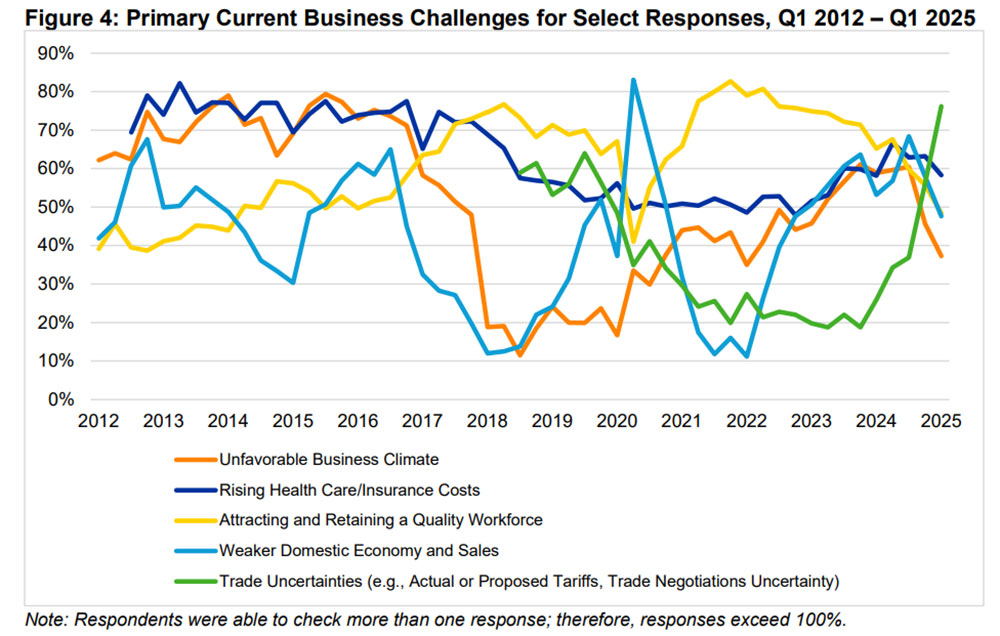

The tariff talk is having a significant impact on the manufacturing industry. Manufacturers expect raw material prices and other input costs to rise 5.5% over the next year, but those surveyed expect prices on their company’s product line to increase only 3.6% over the next 12 months, according to the National Association of Manufacturers first quarter 2025 survey.

Source: National Association of Manufacturers first quarter 2025 survey

Attempting to decipher if raw material costs will actually rise and what costs, if any, need to be passed on to customers in the finished products is a moving target—that seems to be changing by the hour.

“The word of the moment is clarity—or the lack, thereof,” said Steve Wyett, chief investment strategist at BOK Financial. “Businesses are contending with a great deal of uncertainty—and likely some discomfort—at least in the short term.”

That lack of clarity, combined with the nuances unique to each production process, is especially challenging now with the pace of possible changes.

“So many of the changes in this industry over the past few years have been unexpected,” added Anderson. “Obviously, no one saw the pandemic coming, but after so many supply chain issues, businesses are more aware of the need to plan for the unexpected. Clients seem to be a lot more proactive as a result.”

"Post-pandemic, manufacturers have significantly increased the redundancy of their supply chains," Atkinson agreed. "Given that parts, raw materials and ingredients are sourced globally, it's essential to have contingency plans to produce these components elsewhere if disruptions occur in the supply chain."

Business owners, meanwhile, should be looking at their cost structure and, if their businesses have an international component, they may want to ask their financial services providers about currency hedging, Wyett suggests. “However, when making any major decision, it’s important to keep an eye on where best to put capital for longer-term objectives,” he said.

Atkinson echoed the importance of foreign-exchange hedging and shared a recent example. A client needed to purchase a $1-million machine from Europe, and his team, including a Colorado-based foreign-exchange expert, advised on the most cost-effective way to utilize currency hedging throughout the payment process. "With currency fluctuations, adopting a strategic approach to international purchasing and billing can potentially save clients hundreds of thousands of dollars in a single transaction," Atkinson said.

Fortunately, being thoughtful about planning is second nature for manufacturers who are often working years in advance. “By nature, this industry is very capital intensive so access to capital is critical,” Anderson said. “We’re working with clients to forecast years in advance of a major equipment purchase or a facility expansion. Both the challenge and opportunity are for your banker to be in sync with your long-term plans.”

Planning for the future

As manufacturers plan for the long-term, other consistent concerns are labor and technical evolution. One bright spot for the industry appears to be a leveling out of available workers coming closer to the number of job openings, according to a Deloitte report showing US Bureau of Labor Statistics data.

Source: 2025 Manufacturing Industry Outlook | Deloitte Insights

"Finding specialized workers in trades like welding and machining remains a significant challenge," Atkinson said. "While many companies currently have a solid workforce to meet their needs, these workers are aging rapidly. Leaders are increasingly worried about where they will find the next generation to take over as these employees retire."

Adapting to an aging workforce and new technology like AI and automation also requires capital investments and planning. However, plans will need to be continually evaluated and reprioritized as external factors like policy shifts, supply chain disruptions and tariffs come into play.

“The beauty of having a strong working relationship with your banker is that we’re having conversations with multiple clients who are facing similar headwinds,” Anderson said. “We can’t predict the future, but we can always ask good questions and provide support as clients navigate the ever-changing economic conditions.”

Top-of-the-page photo: Family-run Sashco has been in business for nearly 90 years in Colorado.