Small business is big business for Hispanic entrepreneurs

This group is three times more likely to open a business

KEY POINTS

- Rapid growth: Hispanic-owned businesses are growing at an annual rate of 34%, contributing over $800 billion to the U.S. economy annually.

- Key drivers: Population growth, improved access to capital and tech adoption are fueling this entrepreneurial surge.

- Challenges: Despite success, Hispanic entrepreneurs face barriers like limited access to credit and cultural obstacles, but initiatives are helping to bridge these gaps.

Despite their label, small businesses loom large in the United States and one community, in particular, is seizing the opportunity. The U.S. is experiencing a remarkable transformation in its entrepreneurial landscape, with Hispanic business owners emerging as one of the fastest-growing segments of the nation's business community, according to the United State Senate’s Joint Economic Committee.

This community is one of the most entrepreneurial-spirited groups in the nation, said Jhoanna Astudillo, BOK Financial® Hispanic segment leader.

“Hispanic-owned businesses are a huge economic powerhouse and contribute more than $800 billion to the American economy annually,” Astudillo said. “They are also three times more likely to open a business than the general population.”

In the past three years, the country has seen the fastest creation rate of Latino-owned small businesses in over a decade. The U.S. Joint Economic Committee estimates Hispanic-owned businesses grew at an annual rate of 34% between 2019 and 2023, strongly outpacing the overall U.S. business growth rate of just 1%.

The Stanford Latino Entrepreneurship Initiative's 2023 State of Latino Entrepreneurship Report revealed that Hispanics collectively contribute $3.2 trillion through ownership of nearly 5 million businesses. The Small Business Administration has also reported that 80% of Latino business owners say their business has grown in the last year, 7% percent higher than the national average.

Key drivers of growth

Several factors contribute to this entrepreneurial surge.

Population growth: The Hispanic population in America is growing fast, creating a natural expansion of business ownership. But according to Astudillo, it's more than just numbers. “Hispanic entrepreneurs are really good at spotting opportunities and many, especially immigrants, aren't afraid to take risks.”

Latino-owned businesses span various sectors, with notable concentrations in certain industries. Construction, accommodations and food service, and professional services lead the way, according to data from the Census Bureau. Administrative, healthcare and retail businesses round out the top six business sectors for Hispanic business owners.

Improved access to capital: Access to capital has improved, though challenges remain. Financial institutions are recognizing the potential of supporting entrepreneurs, and some have developed specialized programs for Hispanic business owners.

“We recognize the significant growth and youthful demographic of the Hispanic/Latino population,” Astudillo said. “We are looking at the fastest growing segment of the population that also tends to skew younger than the general population. We aim to build on our existing efforts and unlock new opportunities for mutual success.

Tech adoption: Technology adoption has also played a role, according to the State of Latino Entrepreneurship Report. This demographic has shown particular aptitude in leveraging AI, digital platforms and e-commerce solutions to reach broader markets.

Rise in overall entrepreneurship: Starting a business is generally on the rise, across all demographics. There were nearly 1.8 million high-propensity business applications in 2023, up from about 1.3 million in 2019, according to a 2024 Pew Research report.

These businesses are significant job creators, with Hispanic-owned firms employing millions of Americans across various sectors. The multiplier effect of these businesses extends beyond direct employment, supporting supply chains and stimulating local economic activity.

What’s next?

Despite the impressive growth, however, Hispanic entrepreneurs face distinct challenges. Latino-owned businesses are some of the highest potential but most overlooked opportunities for investors. They have historically not sought funding anywhere near the same levels as their counterparts. Though Latino-owned businesses are likely to apply for financing from banks, they are more tentative borrowers, seeking smaller amounts of funding, according to a Bain & Company report. If existing Latin-owned businesses were fully funded, they could generate $1.4 trillion in additional revenue today and $3.3 trillion in additional revenue by 2030, according to the report.

Astudillo points out there are several reasons Hispanics lack access to credit including cultural and language barriers, which can present obstacles in navigating the U.S. banking system and accessing resources. She explained that many Latino business owners she knows use their own savings to start their businesses and assume they will never qualify for a loan or credit.

"Building credit takes time, so while they may not initially qualify, they might in the future," she said. "Our goal is to help clients build wealth and reach their financial goals. We do that in different ways, but first by providing financial education and teaching people how to take advantage of banking resources.”

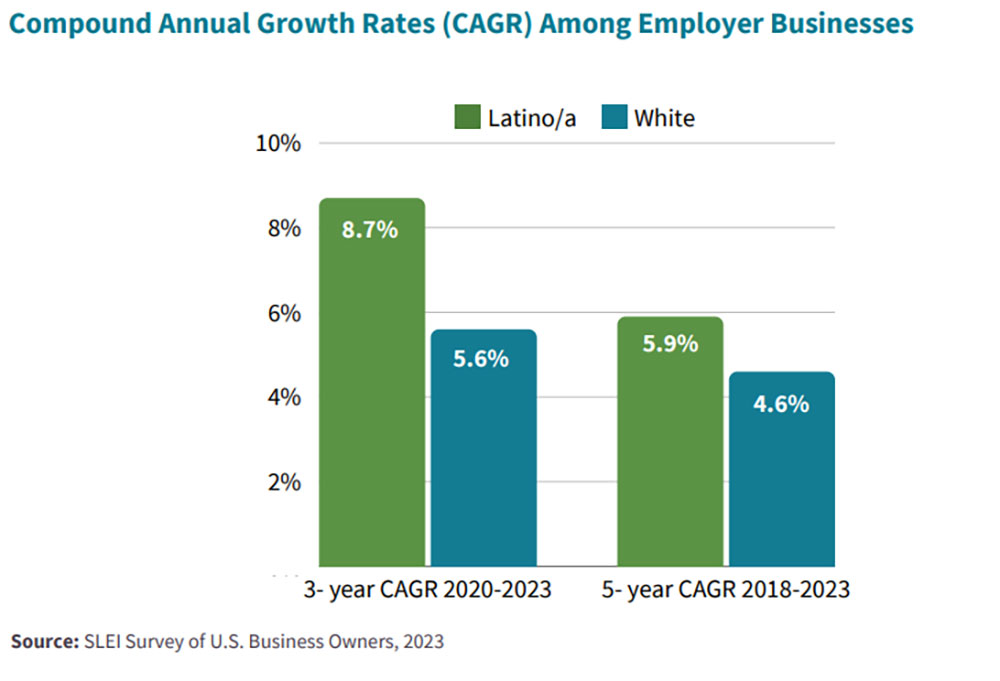

She cites the positive trends reported by the Stanford Latino Entrepreneurship Initiative, which shows that Latino-owned businesses are growing in annual revenue faster than other demographics and are 11% more likely to have a healthy business credit score above 680.

And Astudillo doesn’t see any sign of slowing. “The facts that this population continues to grow, and they are already opening businesses at a break-neck pace, point to further expansion in the future,” she said.

Private sector initiatives also suggest an improving ecosystem for Hispanic entrepreneurship, as do the rising education rates of this population.

As the United States continues to evolve, Astudillo is optimistic that Hispanic-owned businesses will likely play an increasingly important role in shaping the nation's economic future.