How to support employees approaching retirement

Workers need to plan how they’ll spend their time—and their money

KEY POINTS

- Retirement planning support: Employers can assist employees by offering group meetings, one-on-one sessions with financial advisors and visioning exercises to help them plan their post-retirement lives.

- Financial preparedness: Employees need to understand their cost of living, retirement plan distribution strategies, projected taxes and Social Security benefits.

- Proactive engagement: Regular check-ins and detailed retirement planning starting at age 50 can help employees stay on track with their retirement goals.

A recent survey found that 57% of American workers feel they’re behind on their retirement savings. This may be an opportunity for employers to consider what they can do to help their workforce prepare.

For past generations, workers had pension plans that employers saved for them for when they’re ready to retire. However, in the 1980s, 401(k)s and other forms of non-pension retirement plans took over, prompting employees to contribute and save for themselves with a tax break and maybe an employer match.

This puts the pressure on employees to be disciplined to save enough, but some may need extra support to reach their goals.

What does retirement look like

Retirement can mean different things to different people. For some, it's the opportunity to explore hobbies they put off during their work years or to travel more than they could with limited vacation time. For others, it's dread of how to fill the time. Still, for others, it might even be starting a new business or working in a different way than a nine-to-five job.

For employee benefit teams, considering different forms of retirement is a way to open the door to discussions around saving for retirement.

Retirement consultants recommend having a combination of group meetings, written materials and one-on-one meetings available to make sure all plan participants are fully informed and prepared.

One approach could be to let employees dream a little and think out loud about what they would like to do in their post-full-time work lives, recommends Brandy Marion, institutional wealth education manager at BOK Financial®. After the visioning exercise, you can demonstrate scenarios of estimated costs and how much they’ll need to save to support such a lifestyle.

"I think group meetings are the best option, followed by one-on-one meetings with a financial advisor," said Ken Etheredge, director of retirement plans and asset services for BOK Financial. "The group meetings allow everyone to benefit from the questions asked, and then the one-on-one allows the employee to talk specifically about their personal situation."

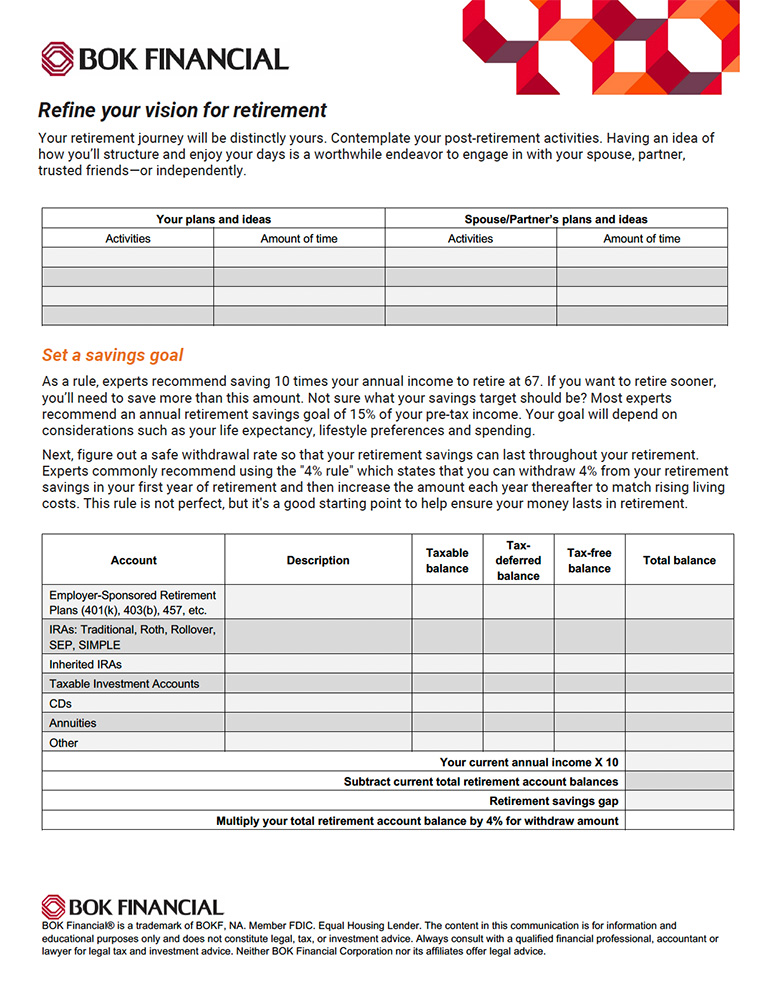

One starting point for benefits teams is to use a worksheet to help employees create a vision for retirement and a savings goal. Then, review how much they have currently saved across all of their financial accounts. This will help them see a clear path and identify the action steps they need to take to fill in any gaps in saving for the future.

The cost of living is changing retirement expectations

With higher inflation the past couple of years, employees are increasingly concerned with having enough money now and in the future. It's also often cited as the reason for the recent trend of "unretirement"—that is, when people find they may not have saved enough and return to work to cover living expenses or discretionary spending. One survey found that as many as 12% of retirees planned to return to work, and 61% of those surveyed said that the high cost of living was driving their decision.

What employees need to know

Plan participants approaching retirement need to understand their financial needs in retirement and how to make withdrawals from their retirement accounts to cover those costs, Marion advised. End-of-career employees need to understand:

- An estimate of their monthly and annual cost of living in retirement.

- Their retirement plan distribution strategy (monthly, quarterly, annually).

- Their projected taxes in the first year of retirement.

- Their projected Social Security benefits and when will they start taking them.

- An emergency savings and contingency plan for stock market drops and unexpected expenses.

- Rules around IRA and Roth withdrawals and required minimum distributions (RMDs).

From there, they should work with a financial advisor to determine if they are contributing enough to their 401(k) account while they’re still working, and if current investment allocations support their tolerance level.

Proactive outreach to employees

Often, the only time an employee looks into their 401(k) is when they are hired and have to set their contribution level and investment choices. Then it may be "set it and forget it." Marion suggests plan sponsors check in with employees every 10 years to see if they are on track. Then, at age 50, they should get very detailed about creating a retirement plan.

“Many benefits teams don't proactively reach out to plan participants in the decades approaching retirement—but they should.”- Brandy Marion, institutional wealth education manager at BOK Financial

In sum, it’s not enough for plan sponsors just to encourage employees to contribute a portion of their income to a 401(k) account, Marion said. Additionally, plan sponsors need to go the extra mile to help employees have a fulfilling retirement overall.

Hero image: ©Getty Images / bankerwin