Race for AI expands beyond US and China

‘Hyperscalers’ looking for energy deals for the future, potentially massive power needs

KEY POINTS

- “Hyperscaler” companies such Amazon, Meta, Alphabet/Google, Microsoft and Oracle are racing each other to develop advanced AI and datacenters.

- Tech companies and political leaders are now looking to build datacenters in places with an abundance of cheap, reliable energy and low-cost land like the Middle East.

- Access to energy—in particular, natural gas—will be a key factor going forward, as well as access to rare earth metals such as graphite, titanium, lithium and beryl.

Early this year, discussions on the race to develop more advanced AI centered upon the Chinese startup DeepSeek and whether the new AI model it developed could nearly match its U.S.-developed competitors while only taking a fraction of the time and cost to build.

DeepSeek’s claims sent financial markets reeling, sending the stocks of U.S.-based technology companies such as Nvidia plunging on concerns about America’s lead in the artificial intelligence (AI) sector, as well as the large amounts of money these U.S. companies have invested in AI models and data centers.

Half a year later, it seems that DeepSeek’s claims were “largely exaggerated, but it encouraged U.S. companies to accelerate development,” said Matt Stephani, president of Cavanal Hill Investment Management, Inc., a subsidiary of BOK Financial Corporation.

“There will be winners and losers. There will be early adopters, there will be those who are fast followers, and then there will be the ‘late-to-the-party’ companies. I think that the winners will be the early adopters who get it right.”- Matt Stephani, president of Cavanal Hill Investment Management

In the U.S., the race is largely between the “hyperscalers”—companies such Amazon, Meta, Alphabet/Google, Microsoft and Oracle. Among these companies, there’s no real forerunner, according to Stephani. “They're all working on projects that kind of leapfrog each other one at a time.”

Looking forward, the companies that end up being the laggards will be the ones that either make major mistakes in the expansion of AI and data centers, or the ones that don’t put enough money into the space, Stephani surmised.

Money, reliable energy, rare metals needed to ‘win’ in the AI space

Developing advanced AI models doesn’t come cheap, as reflected by the hyperscalers’ large capital expenditures. For example, Amazon’s 2025 capital expenditure budget is projected to top the scales at $100 billion. Stephani estimates that, altogether, the 2025 capital expenditure budgets of Oracle, Microsoft, Alphabet, Amazon and Meta will total around $340 billion. Fortunately, they have the money to pay for it, having a combined $360 billion or so of cash on their balance sheets, according to Stephani’s calculations.

But it takes more than sheer money to win the development and power of increasingly advanced AI.

For this reason, the race is now becoming a global phenomenon, as companies and political leaders look to places with an abundance of cheap, reliable energy and low-cost land like the Middle East, Stephani said.

The poster child of this race is currently Stargate UAE, which would be one of the world’s largest data center hubs when finished. The multi-billion-dollar deal, funded by the Emirati AI development holding company G42, would be built in the United Arab Emirates (UAE) using U.S. technology from companies such as Nvidia, OpenAI, Cisco and Oracle, along with Japan’s SoftBank. The first phase is estimated to go online in 2026, but some U.S. concerns about the security conditions continue to persist, which is hindering finalization of the deal.

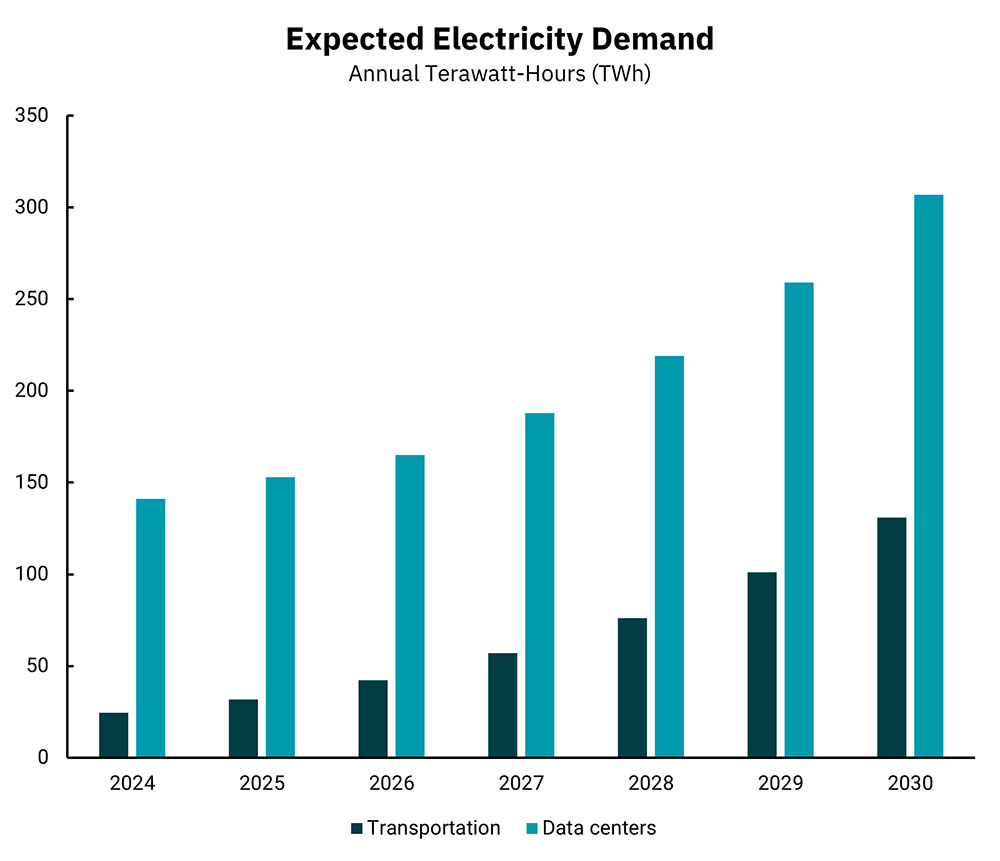

Stephani believes that one of the reasons why tech giants are looking to the Middle East is the abundance of natural gas in the region, which could help fulfill data centers’ immense power needs. In the U.S. alone, the expansion of traditional and AI data centers and chip foundries is expected to increase energy demand more than twofold from 2023 to 2030, to around 307 terawatt-hours (TWh), according to a report from Rystad Energy. To put this number into perspective, the entire electricity consumption in the U.S. was 4,010 (TWh) in 2022.

Due to the immensity of this demand, data centers need not just any energy, but rather cheap, reliable energy such as natural gas and nuclear, Stephani said. Being the world’s largest supplier of natural gas may give the U.S. an edge in that regard; however, non-U.S. allies such as Russia, China and Iran make up the other top four world natural gas suppliers, according to the International Energy Agency (IEA)’s 2022 ranking.

Meanwhile, another factor in the AI race is access to rare earth metals such as graphite, titanium, lithium and beryl, noted BOK Financial® Chief Investment Officer Brian Henderson. And this is where the U.S. may struggle—even with its significant reserves of copper, another key metal. China produces 60% of the world’s rare earth metals and processes nearly 90%, which “has given China a near monopoly,” according to commentary by the Washington-based Center for Strategic and International Studies.

One way that the Trump administration has sought to reduce its dependency on China for the metals that the U.S. lacks was through a deal with Ukraine, which also has deposits. That would have given the United States billions of dollars in Ukrainian minerals as repayment for military aid, Henderson explained. However, the eventual deal included a provision for the U.S. to offtake future mineral resources on “market-based commercial terms,” but not as repayment as Trump wanted.

It’s for these reasons that energy, trade policy, geopolitics and technology all intertwine, Henderson said. “Trump’s policies are from the perspective that the ‘United States is currently the most powerful country in the world, and these policy changes are to maintain this global power into the future.’”

For a deeper dive on AI and its potential impact on jobs and the energy industry, Matt Stephani sat down with Tulsa's News on 6/KOTV. Watch the full segment.

2025 Midyear Outlook

The first half of 2025 has been eventful, to say the least. A few of the geopolitical factors contributing to this uncertainty seem to have subsided a bit, but the economic impacts of tariffs and a stricter immigration policy, remain. To provide perspective on these topics and more, our investment management team has prepared an in-depth report, articles and webinar as its midyear outlook.