Weighing the ‘pain’ and ‘gain’ from tariffs

Trade policy aims to make US economy more resilient—but with the potential costs of higher inflation and interest rates

KEY POINTS

- In the short term, consumers and businesses may experience higher inflation and interest rates due to tariffs.

- In the longer term, the tariffs could yield a more resilient and independent U.S. economy.

- Whether American manufacturing increases depends on a number of factors, including how long corporate decision-makers think the tariffs will last.

Figuratively speaking, the U.S. economy is going to the gym—and taking consumers and businesses with it. Meanwhile, the impacts are being felt around the world.

“Tariffs, tax policy, energy policy, regulation—all of these changes are moving very quickly because President Trump knows he has a short period of time, and there’s going be some economic pain in the process,” said Steve Wyett, BOK Financial® chief investment strategist. “Trump is trying to get the economy through this initial pain to a point where some of the benefits can be seen so there will be motivation to continue on that path. However, with midterms coming, there's the timing of the ‘pain versus gain’ to consider.”

Wyett likens the economic pain that consumers and businesses may be feeling now from increased uncertainty, financial market volatility, higher inflation and higher-for-longer interest rates to the physical pain that someone feels when they just start going to the gym. At the beginning, there are sore muscles and tiredness, but over time, if the person keeps exercising, they will start to see the benefits. But they must make it through the period of pain first.

Tariffs, tax changes may spur American manufacturing

With the evolving tariffs implemented by the Trump administration, this time at the “gym” could yield a more independent and resilient U.S. economy, as well as a possible resurgence of American manufacturing. As Wyett said, “If the U.S. finds itself in a position where we are highly dependent on a foreign country for a good or service, we risk an inability to get that good and service, whether it's an ally or not.”

However, those end goals will take time—with potential financial costs to American consumers and businesses along the way—he and other experts cautioned. For instance, the Federal Reserve may not be able to cut interest rates as much, and mortgage rates may also stay higher this year.

For perspective on these added costs to achieve the goal of U.S. resiliency, Wyett gave the analogy of a business model. “A resilient business model is not the cheapest business model,” he said. “You don't build resilience to handle everything when things are going great. You build resilience, so you can stay in business when things are not going well. However, as you do that, you're taking on some added cost to have that resilience.”

Tariffs and the corporate tax changes are intended to work together to help build that resilience by discouraging foreign exports into the U.S. and encouraging U.S. companies to conduct their operations and manufacturing domestically, noted Brian Henderson, BOK Financial chief investment officer.

“President Trump believes that, if corporate taxes are low enough and tariffs are high enough, it will make it very punitive for companies that don't have operations here to simply export goods into the U.S.,” he said.

For instance, one of the most overlooked, yet important, aspects of the “One Big Beautiful Bill Act” will allow U.S. companies to fully expense the money spent on manufacturing facilities in year one, noted Matt Stephani, president of Cavanal Hill Investment Management, Inc. “I think the effects are going to be much bigger than people think now and over the next 10 years,” he said. “I expect that will help drive investment in America to rebuild our manufacturing sector.”

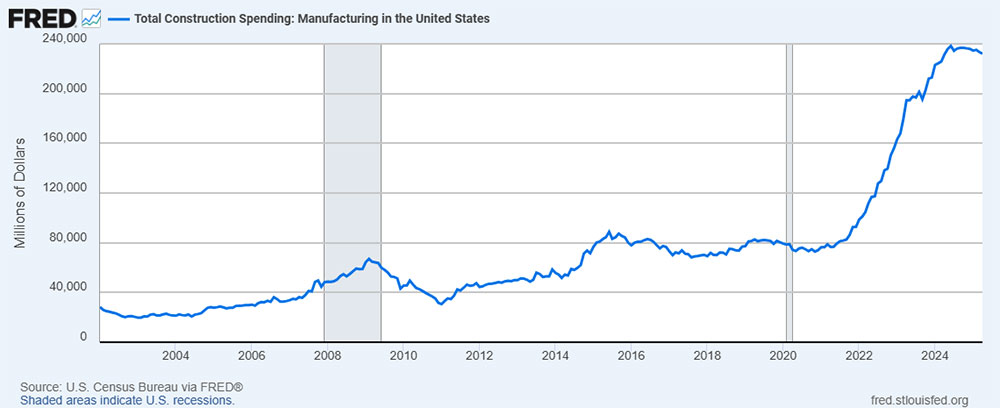

Already, spending on the construction of U.S. manufacturing facilities has increased sharply over the past five years, though it has been declining slightly in recent months as companies deal with uncertainty, according to data from the Federal Reserve Bank of St. Louis.

Extent and duration of changes remain to be seen

Looking forward, how much foreign companies are willing to spend to build facilities in the U.S., rather than just exporting goods into the U.S., depends on how long-lasting they think the trade policies will be, Stephani noted. “If a company has a big facility that they need to build in the United States, they really have to make a calculation of whether the tariff will stay in place or not—and that's not a simple answer. They may decide to wait and see.”

Another overarching question is just how much global trade will be reshaped by the Trump administration’s trade policy changes. Although the value of the U.S. dollar has been falling against other currencies, which makes U.S. exports more competitive, it remains the world’s reserve currency, so there’s always demand for it, Stephani noted. That’s one factor working against the reshaping of global trade.

Yet, at the same time, some reshaping of global trade has already begun as part of the ongoing deglobalization stimulated by the Covid pandemic and polarization of world politics, Stephani said.

Another lingering question surrounds these U.S. trade policy changes coinciding with geopolitical factors such as the alliance of Iran, China and Russia on one side and the U.S. and its allies on the other, he continued.

“Trump is trying to address the trade imbalances he sees, but the fact is he’s doing it against a backdrop where the globe is starting to fracture,” Stephani said.

2025 Midyear Outlook

The first half of 2025 has been eventful, to say the least. A few of the geopolitical factors contributing to this uncertainty seem to have subsided a bit, but the economic impacts of tariffs and a stricter immigration policy, remain. To provide perspective on these topics and more, our investment management team has prepared an in-depth report, articles and webinar as its midyear outlook.