U.S. economy healthy—but inflation still high

Lower rents may provide some relief ahead

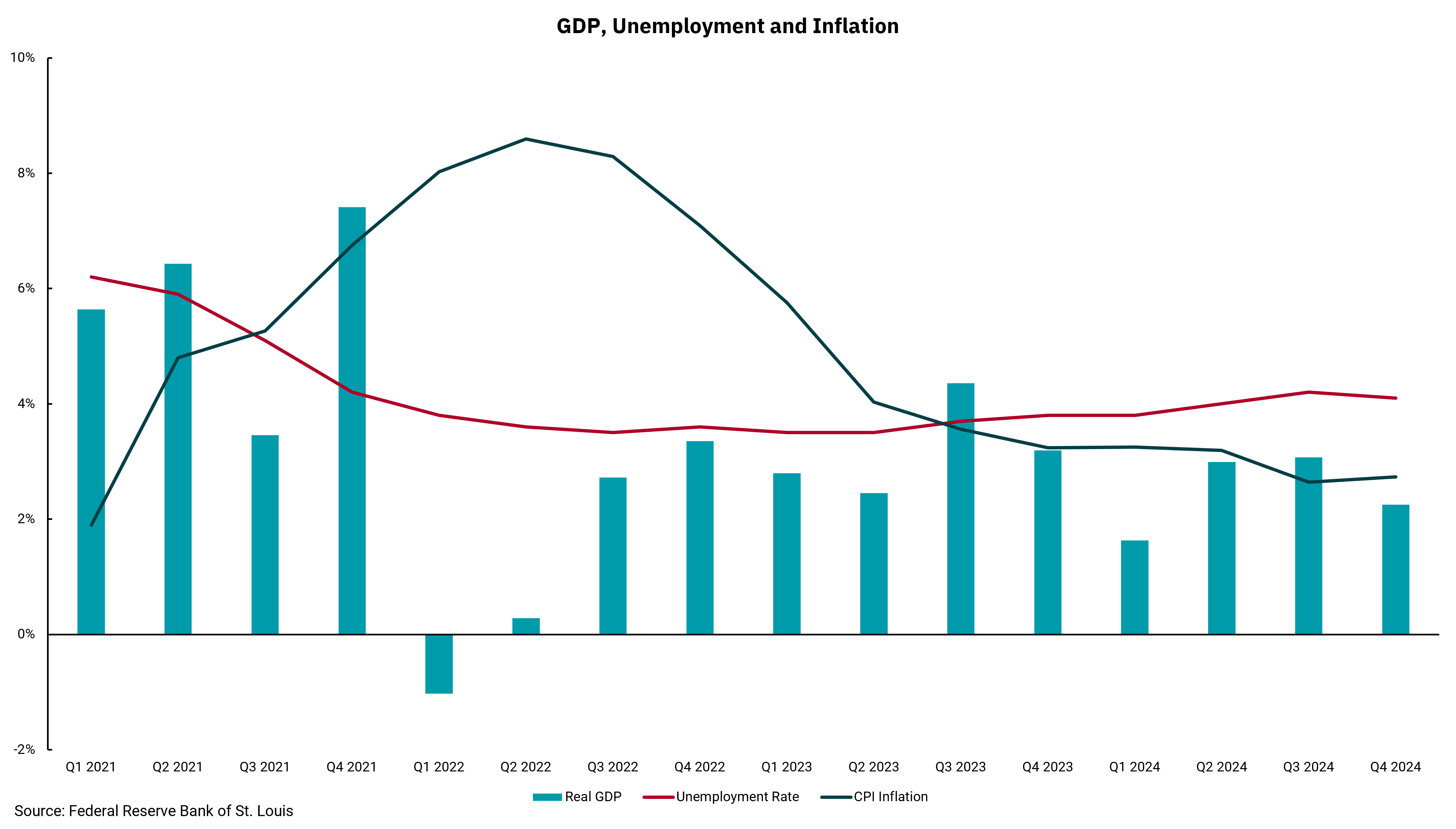

Fourth-quarter gross domestic product (GDP) was high on the list of the most significant economic releases of the past week. Expectations were for approximately 2.5% inflation-adjusted or real GDP growth; however, the actual figure was slightly lower, at 2.3%. This marks the second-lowest GDP print of 2024, following only the first quarter's 1.6% growth.

Should this be a cause for concern? Not really. In a well-functioning, developed economy like the U.S., annual GDP growth should be expected to fall typically within a window of 2% to 3%. In fact, we anticipate moderately firm economic growth in 2025, just somewhat slower than in 2024.

This week's chart highlights key economic indicators, including real GDP, the unemployment rate and headline Consumer Price Index (CPI) inflation. All these data points are not only essential barometers of the health of the economy but also crucial metrics in determining monetary policy by the Federal Reserve. Speaking of the Fed, it held the lower bound of its policy rate steady at 4.25% last week, its first pause since beginning its rate-cutting cycle in September 2024.

It's useful to step back and look at where the Fed stands concerning its dual mandate of balancing the interests of the labor market and inflation. Unemployment has edged up slightly but remains healthy at just 4.1%. The most recent reading on inflation, represented here by the headline CPI inflation rate, is at 2.9%. As a side note, the Fed's preferred inflation measure, core Personal Consumption Expenditures (PCE), came in at 2.8% for December 2024. All this is to say that while inflation has come down dramatically since the highs of 2022, it has not been able to reach the Fed's 2% target.

Overall, most of the current major economic data suggests a relatively balanced domestic economy, though we would like to see inflation a bit lower than the current level. In the coming months, we expect some relief in inflation, specifically on the core measures, due to the housing market and, in particular, rents lowering. In the past, we have referred to this probability of falling rents as real-time rent data catching up with the lagged rent data represented in the CPI and PCE inflation gauges. As for the markets, we remain optimistic for the road ahead in 2025 but expect a more volatile year, primarily due to headline risk surrounding policy at the federal level.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)