Next Fed rate cut likely to come in May at the earliest

January jobs report hinting at wage inflation

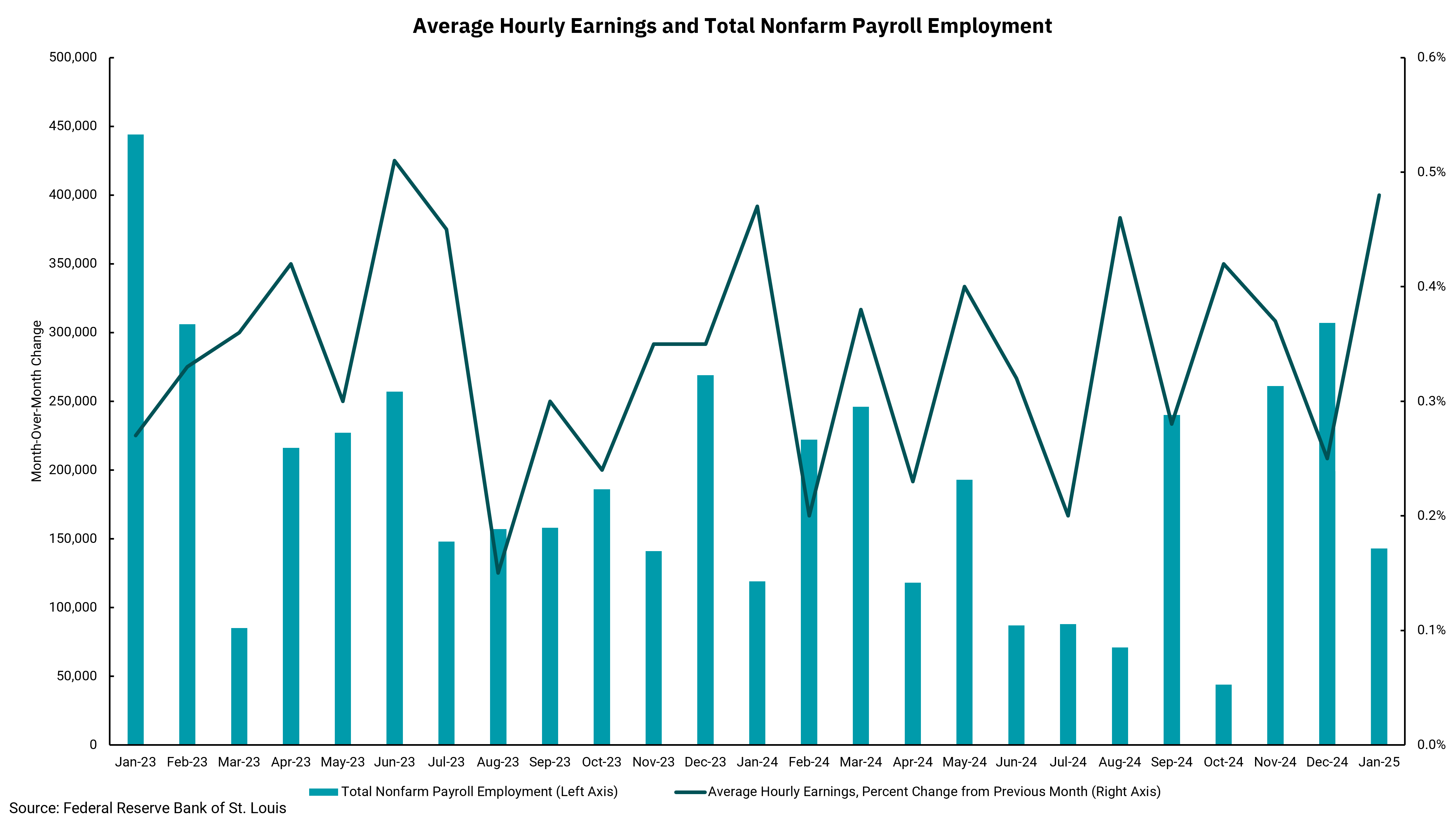

The monthly employment report for January was recently released, with not only palatable jobs data but also declining unemployment. Expectations ahead of the release were for 170,000 new jobs added in January, but the actual number was just 143,000. Still, November’s and December’s payroll numbers were revised up by 100,000 jobs, and the unemployment rate dropped from 4.1% in December to 4.0% in January.

However, the average hourly earnings number was of some concern, as it registered growth of 0.5% on a month-over-month basis, considerably higher than the 0.3% growth expected. Average hourly earnings are significant because wage inflation can indicate future inflation at the general level of prices. This brings us to the Federal Reserve, and the fact that it will likely interpret the earnings data as relatively warm, signifying another reason why they should not be in a hurry to lower interest rates further. It is just one data point, and there are other measures of wage inflation, including the Employee Cost Index (ECI), but wage-related data is monitored very closely.

This data, combined with ongoing developments related to trade policy out of the new administration, should give the Fed pause in the short term in regards to rate cuts. What's more, the University of Michigan Consumer Sentiment survey that arrived just after the jobs report showed that consumers are rapidly shifting their inflation expectations higher. All of this, taken together, is increasing the chance that the next rate cut will be pushed to May, at the earliest, or June.

Markets interpreted the employment reports as negative, as yields drifted moderately higher and weighed on stock market performance. Nobody said it would be easy to handle the potential inflationary effects associated with a change in policy at the Federal level, combined with the fact that the Federal Reserve remains above its target rate of 2%.

All that said, we remain steadfast in our view that, while it may be a bumpier ride in 2025, it will still be a positive year for the stock market. Staying informed about the latest developments regarding economic data and market dynamics will help investors navigate this new environment.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)