What will stop import prices from rising?

Prices of imported goods, excluding petroleum, have massively increased since 2021

I know, yet another chart on inflation…and tariffs. These topics are being discussed, and cussed, everywhere. It seems we get additional news stories on tariffs every day. For an economic tool that is not new and in use by many of our trading partners, it is still unclear what the ultimate impact of President Trump's actions on trade policy will be.

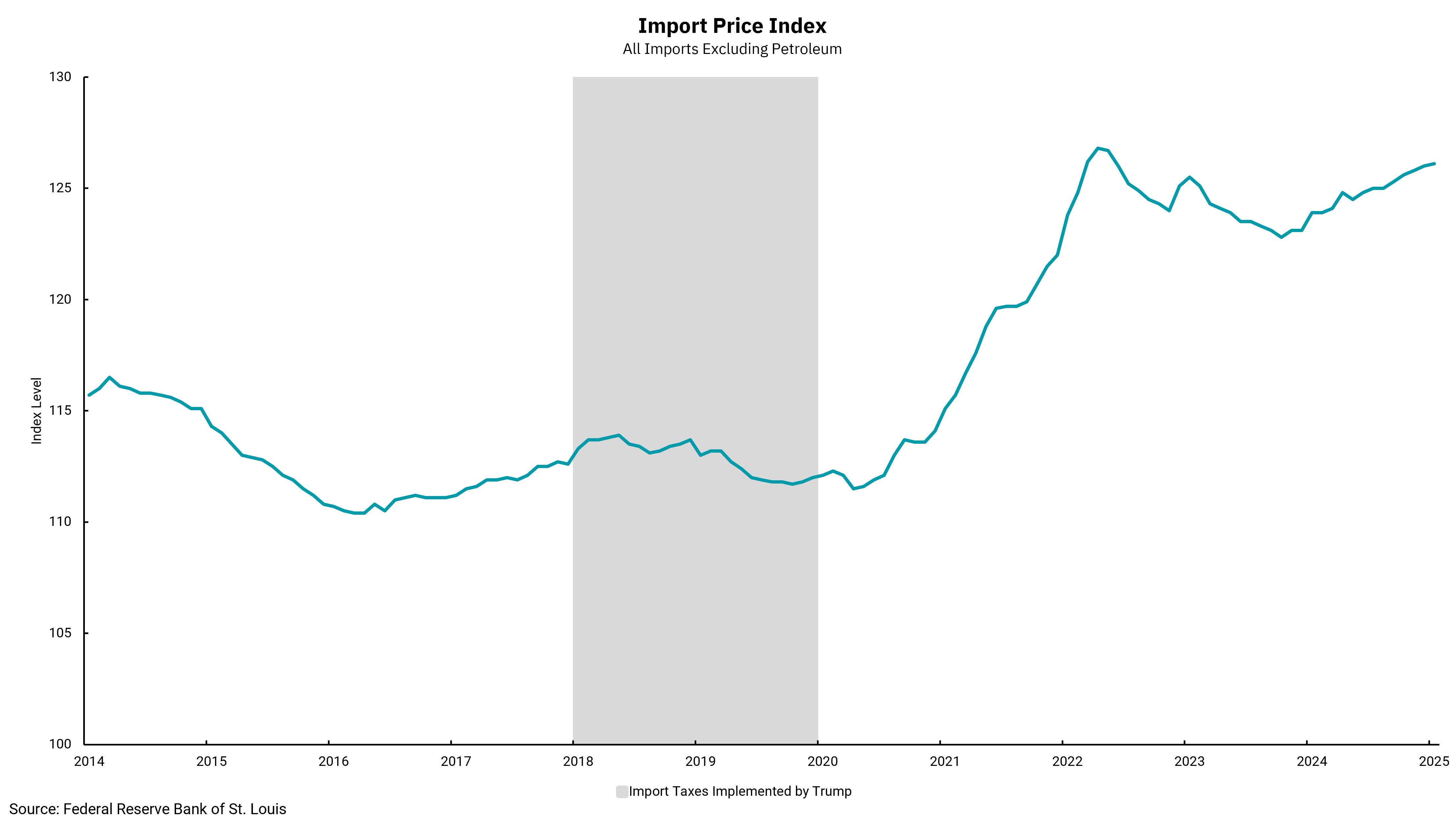

This week we got measures of inflation at the retail level, Consumer Price Index (CPI), and the wholesale level, Producer Price Index (PPI). Then, on Friday, we got the monthly reading on import prices. Import prices, like CPI and PPI, are reported monthly but generally are not followed as closely as the domestic measures of inflation, including the Federal Reserve's preferred measure, the Personal Consumption Expenditures Price Index (PCE). However, with the blizzard of tariff announcements and, apparently, a fundamental difference in strategy around tariffs, we will be watching the level of import prices more closely. Looking backwards, the increasing level of economic globalization led to lower inflation in the U.S. as import prices were flat or even declining. We can see this in the pre-2018 period on the chart. The ability of producers to seek out low-cost areas of production meant overall product prices were a source of disinflation.

The gray bar on the chart indicates when additional tariffs were levied during President Trump's first term. There was some run-up going into the tariff announcements, but we can see that post-imposition, overall import prices (excluding petroleum) were flat to down slightly. The chart also shows the massive increase in import prices as overall inflation increased, but just as importantly, this was the impact of the tangled supply chain issues. The pandemic laid bare the risk of having material parts of our production overseas, as import price inflation exceeded that of domestic inflation.

This administration’s trade policy actions are at least partly an effort to lessen or mitigate this risk going forward. However, in doing so, we risk higher prices and lower production levels, as it will take time to move production and construct new facilities. Furthermore, as we think about our domestic labor force, unemployment is already at a low 4%, with some risks from immigration policy reducing the size of our labor force.

It may be that the rhetoric around tariffs is more of a negotiating tool than a policy to be implemented. Still, the uncertainty caused during the process will keep us keenly focused on measures like import prices along with domestic measures of inflation.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)