What follows periods of uncertainty?

Historical look at investment returns after policy uncertainty

It's one thing to know that the stock market can be --and is-- volatile. It's another thing to be able to stay calm and use periods like this as opportunities for future growth as opposed to selling. One can never know for certain when periods of volatility will end, and the reasons for volatility always seem worse than past periods from which we have recovered.

Our most recent Weekly Market Update was a chart of our current level of policy uncertainty, which showed levels are now higher than at any time since the worst of the pandemic. Even worse than during the depths of the Financial Crisis. Put into numbers, our current reading sits at 233. And why not? Daily headlines on tariffs and their potential impact on growth and inflation, but also policy changes around immigration, regulatory and energy policy, and the growing threat of a government shutdown all combine to create an environment where clarity is sorely lacking. Within this environment, sellers of stocks become more motivated than buyers, resulting in falling prices. And when business owners and consumers do nothing, economic activity slows. Not a good combination.

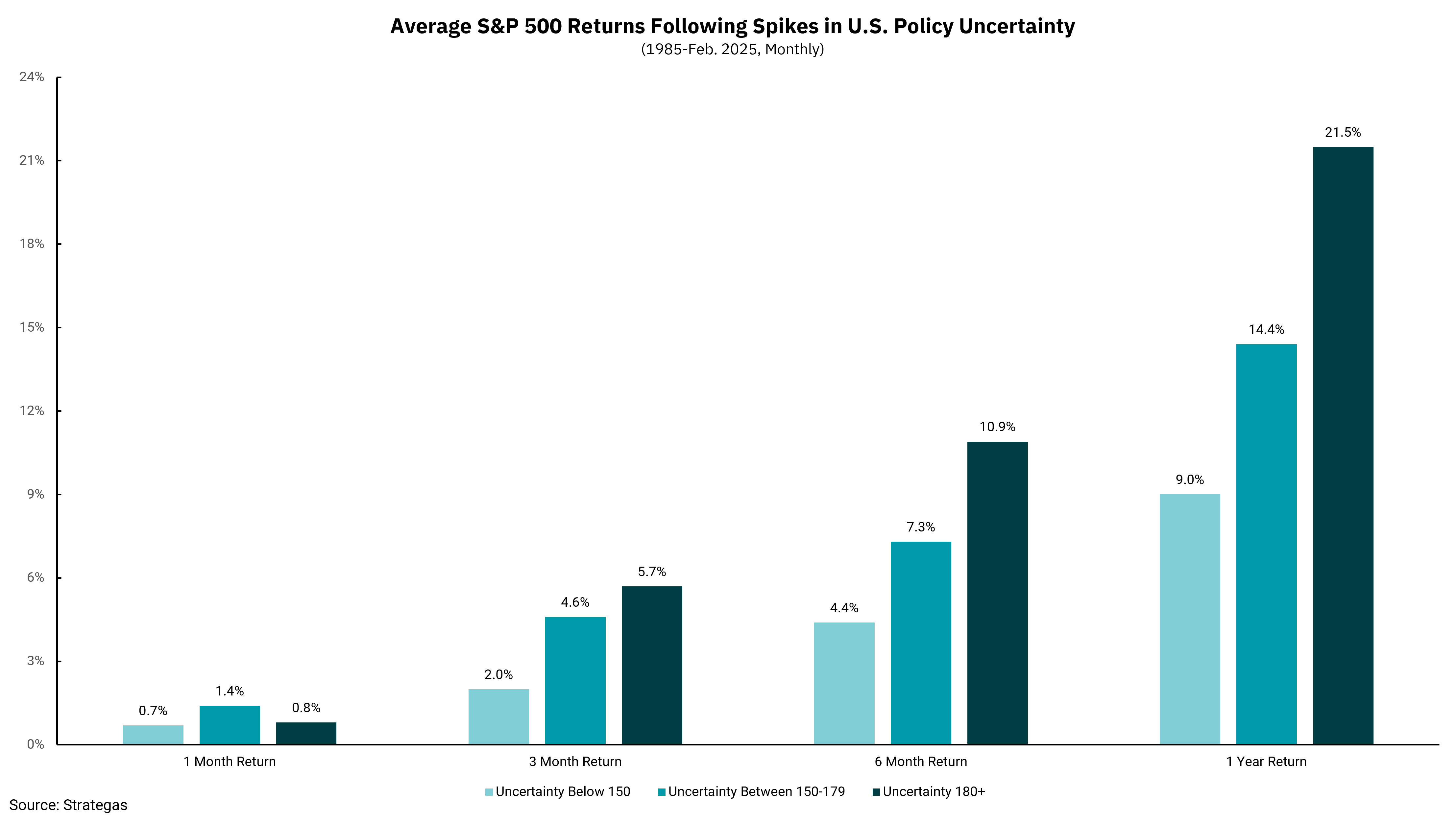

Yet, we also know periods like this pass, so we wanted to provide a chart showing the forward returns from past periods of policy uncertainty. This week's chart shows returns for one month ahead, three months ahead, six months ahead and 12 months ahead when the uncertainty index is below 150, between 150 and 179, and above 180. We would note that one-month forward returns are a bit mixed, although still positive, as the highest levels of policy uncertainty had lower returns than 150-179 and about equal to below 150. This might reflect the fact that higher levels of policy uncertainty can take a bit longer to resolve themselves.

However, look at what happens as we move further out from the uncertainty period. Forward returns begin to show materially higher levels for investors willing to buy during high levels of policy uncertainty. As always, past performance is no guarantee of future returns, but this is a reminder that equity price declines triggered by an increase in policy uncertainty have historically resolved themselves and rewarded investors.

One could reasonably look at the current period of policy uncertainty and think it might last a bit longer based on the number of policies in a state of change. One could also reasonably look at the speed at which we are moving on several policy fronts and conclude the risk of a mistake is high. One might even consider current actions and raise the possibility of a recession. Yet, history would also indicate we should consider the possibility of opportunities for the longer term. We remain more optimistic than pessimistic.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)