Uncertainty defining Fed decisions on rates

Growth seems to be larger concern than inflation

Based on the Federal Open Market Committee (FOMC), the part of the Federal Reserve that sets interest rates, it is clear the Fed is uncertain about the path of our economy and inflation. This uncertainty, a word the FOMC often used in their post-meeting statement and again by Fed Chair Jay Powell at his post-meeting press conference, was the primary reason they chose to take no action on rates. While this was expected, the mosaic of their forecast for gross domestic product (GDP) growth, unemployment and inflation seem to provide a sense that they are a bit more concerned about growth than inflation.

One might be somewhat surprised that inflation is taking a backseat for the Fed. After all, there are almost-daily headlines on tariffs and their potential impact on consumer prices, especially as we approach the April 2 deadline for a robust implementation of tariffs across a broad swath of our imports. However, when asked about this topic, Fed Chair Powell chose to re-use a word with a bit checkered past: transitory.

While acknowledging tariffs' impact on prices, Chair Powell highlighted the "one-time" nature of price increases, which is not unlike a change in tax policy that increases price levels but not on an ongoing basis. It is ongoing price increases that define inflation, not a one-time price adjustment. We must admit that this is parsing the definition of inflation, as almost everyone else would define inflation as something that increases consumer prices, and tariffs fit that definition. Furthermore, in an environment where aggregate price increases continue to exceed aggregate wage increases, higher prices just mean more difficulties for those who can least afford the impacts of inflation.

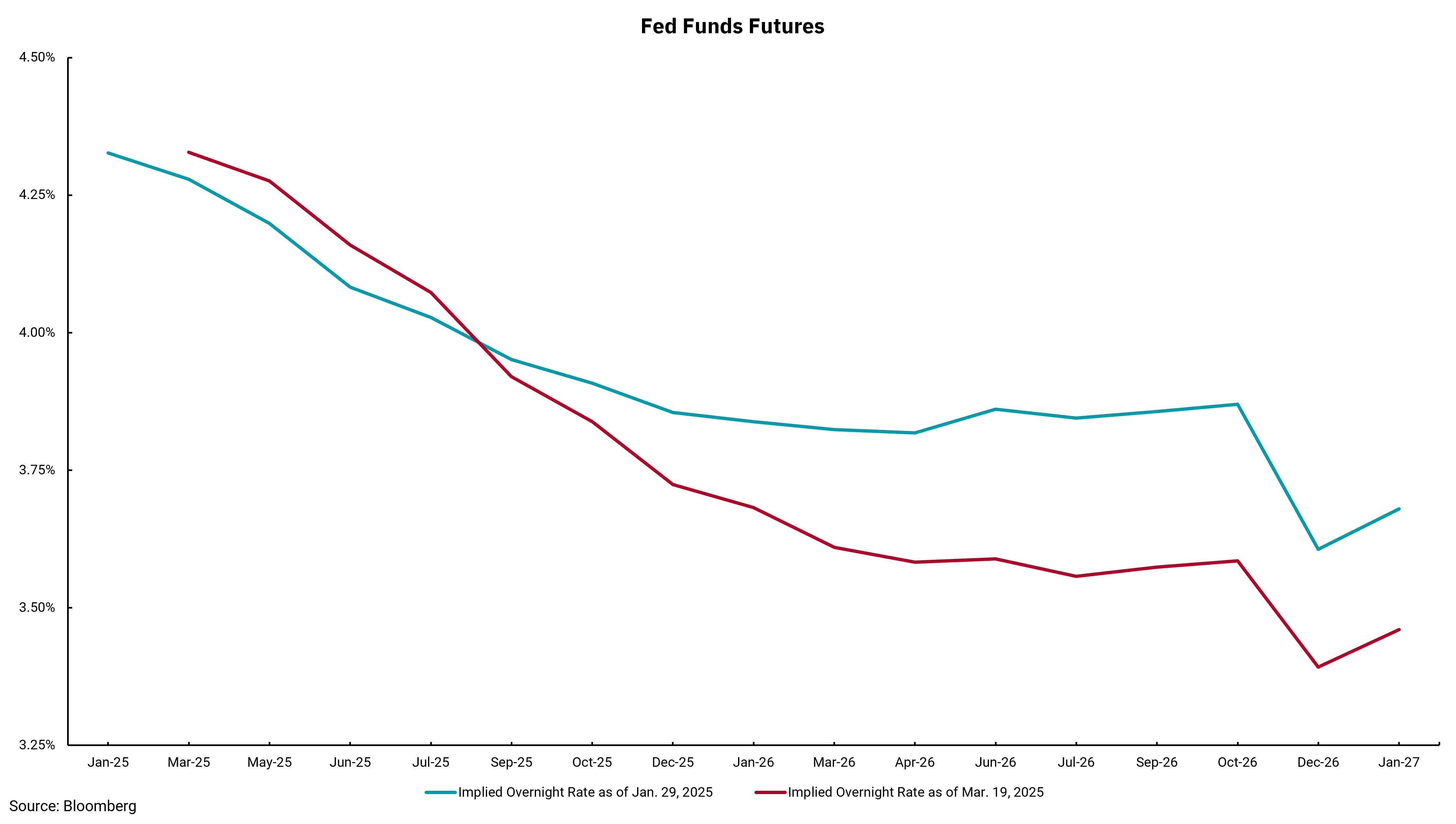

Looking at market-based interest rate forecasts, we see a similar message to that of the Fed. This week's chart shows the outlook for rates based on Fed Funds Futures after the FOMC's January meeting compared to the day after the March meeting. While we see some agreement that rate cuts will start in June, the latest market forecast is for the Fed to cut more and to a lower long-term level than we were thinking in January. Put another way, the market seems to agree that, while tariffs pose a price-level issue initially, the bigger issue is their impact on demand going forward. Ultimately this means the Fed will be cutting rates as GDP growth slows, unemployment increases and overall consumer activity slows.

This, however, is NOT a forecast of a recession. From this lens, we hope we do not see the market, or the Fed, provide an outlook for even more rate cuts. If we see rate forecasts of more rate cuts and a lower terminal rate, this would be an outlook reflecting a more negative economic future than we anticipate. We remain more optimistic than pessimistic.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)