Tariff concerns trump positive March jobs data

Fed may wait longer to re-start rate cuts—but will its actions be too late?

In ordinary times, the monthly employment report from the Department of Labor (DOL) is the most important and market-moving economic release. Unfortunately, this month's report is being overwhelmed by the market's reaction to the "Liberation Day" tariff announcements on April 2. And while that might lessen the impact, the reality is this month's employment report was better than expected.

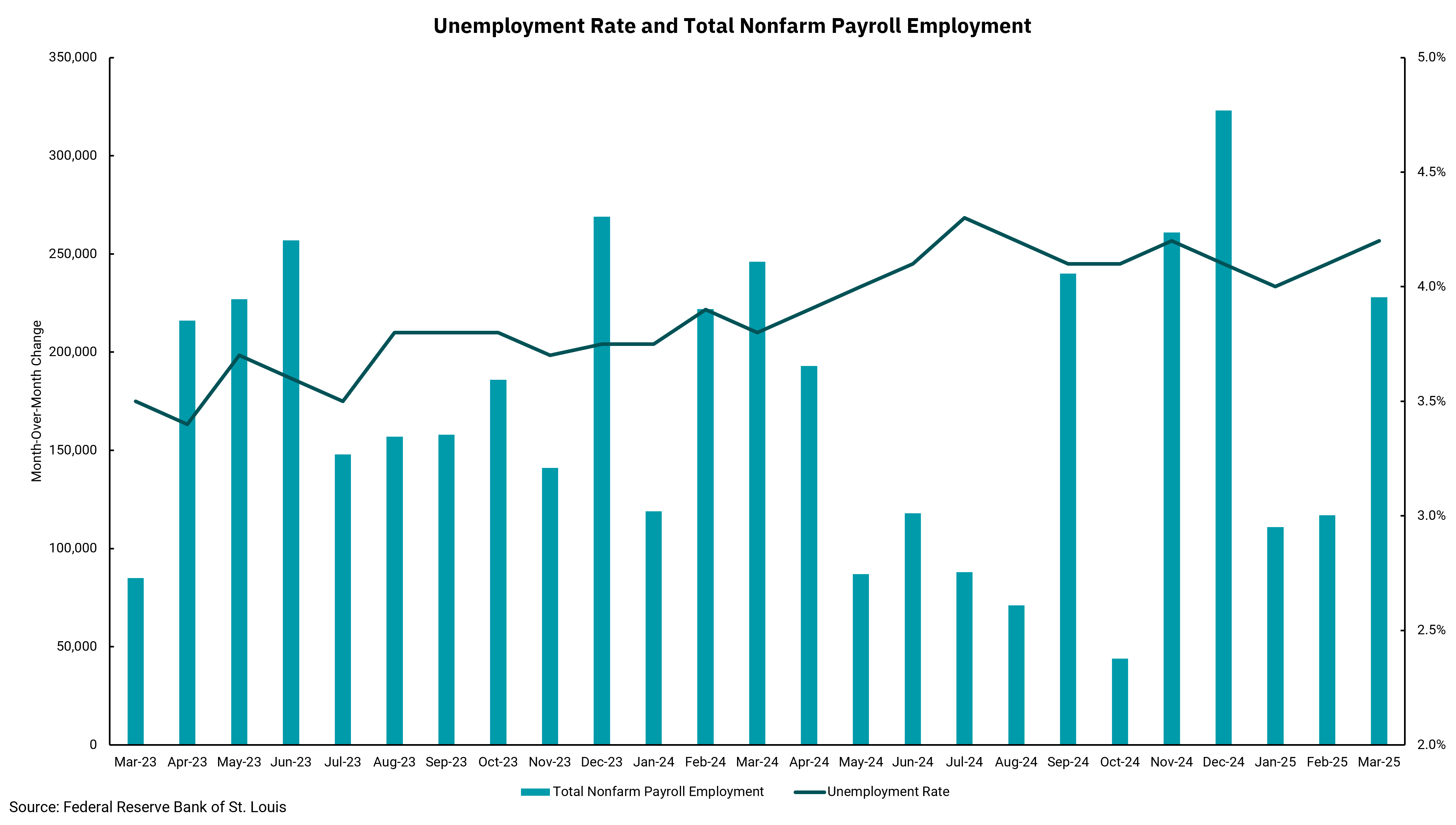

The strength of the labor market has been a key underpinning for the U.S. consumer and, by extension, the overall domestic economy. If nothing else, this month's report shows we are entering this period of uncertainty with a labor market that is still strong. Job growth for March exceeded estimates of 140,000, instead coming in at 228,000. Despite some downward revisions to last month's number, job growth exceeded expectations. While the headline unemployment rate did tick 0.1% higher, we saw the labor force participation rate tick up 0.1% as well. On the inflation front, average hourly earnings came in as expected at 0.3%

On an ordinary day, we could probably expect the equity market to respond favorably to this report. Unfortunately, it was not an ordinary day. Overnight, China responded to the additional U.S. tariffs with higher tariffs of their own on U.S. imports, sparking fears of a broadening trade disagreement morphing into an outright trade war. And while yes, the initial impact of tariffs might be for inflation numbers to skew higher, the longer-term implications for slower growth seem to be the biggest risk.

Ironically, the employment report might make it more difficult for the Federal Reserve to begin lowering rates again. Sentiment and survey data from individuals and businesses reflect a much worse environment than the economic data we have seen. The Fed has indicated they will want/need to see hard economic data start to show some declines before acting with monetary policy. Some of this makes sense as a policy change that ends up not being needed could result in worse outcomes. Nevertheless, the fact that monetary policy tends to operate with a lag means that, by the time the Fed sees weakness, its actions may be too late.

As of this writing, the Fed Funds Futures market is now pricing in five rate cuts from the Fed. This would reflect an outlook for at least a mild recession. That said, we can agree that the risks of a recession have increased, but seeing one is not a foregone conclusion. All in all, uncertainty remains the headline aspect for markets, and markets hate uncertainty.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)