Economy probably still not out of the woods

U.S. must sell around $9T in bonds this year to fund existing deficits

What a roller coaster of a week in the capital markets. We continue to be buffeted by news on the tariff front as markets desperately try to find a valuation that adequately compensates for a now uncertain level of growth and earnings. The fact that we started at fairly rich multiples and an outlook for ongoing growth doesn’t help as we think about what price to pay for a stock, or index, today.

We began the year with a relatively benign outlook and anticipated growth to slow from the above-trend rates of the last couple of quarters. Included within that outlook were, of course, some risk factors. The biggest risk we saw was some geopolitical event that could shock the economy into slowing more than anticipated. The list of potential shocks was centered on an unwanted escalation in the Middle East, the ongoing war between Russia and Ukraine—or, the big one we thought—China making a move on Taiwan. The geopolitical event we did not have as a risk factor was a press conference in the Rose Garden of the White House.

It was not the announcement of tariffs that spurred the recent volatility, as we had been talking about them for some time. However, the level of tariffs announced was way higher than the market anticipated, resulting in a much higher “cost” to businesses and consumers and leading to significant downgrades to economic forecasts. Indeed, until the President pressed “pause” on the full implementation of the higher “reciprocal” tariff levels for 90 days, some economic forecasts moved to a recession as the base case. These forecasts were revised back up after the pause, but we still have a 10% tariff across the board, plus additional tariffs on steel and aluminum and very high tariffs on China. All this means there is still a headwind to growth, and the tariff levels on China are material in their impact.

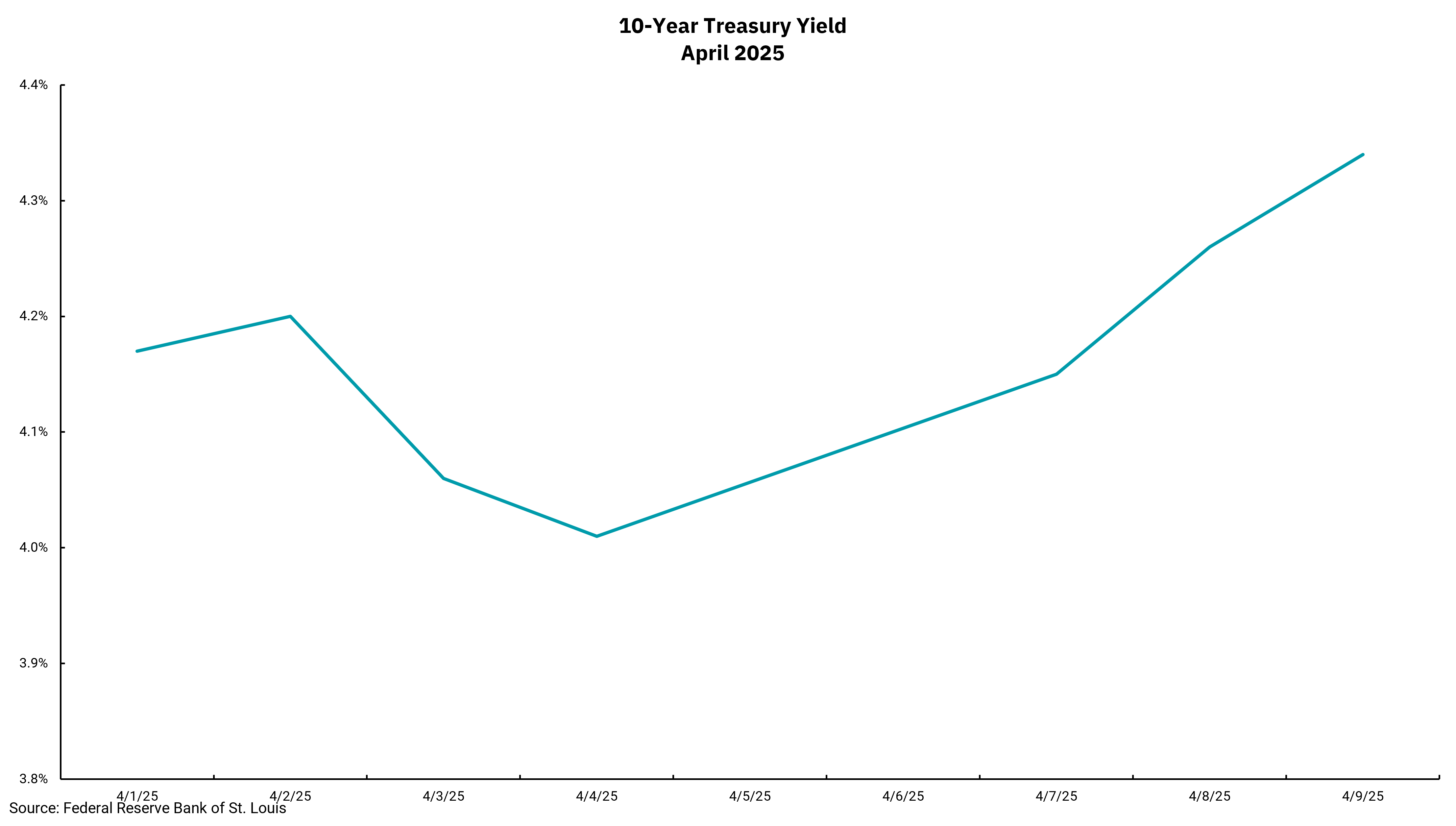

Why did the President blink? Going into this second term of a Trump Presidency, there was a sense he would temper his actions, if not his words, to avoid doing any significant damage to the stock market. We all know he watches the markets closely and uses them from time to time, rightly or wrongly, as a scorecard of how he is doing. However, it appeared this time, he was more willing to allow stocks to fall with his eye on the bigger picture of remaking domestic and global trade. And he may very well have been willing to do that until the bond market reminded him who the boss is in the capital markets.

To paraphrase James Carville, “It’s the bond market, stupid.” The increase in longer bond yields, even as stocks declined, along with signs of stress at the short end of the curve, signaled that the potential was there for a liquidity crisis. A liquidity crisis in the bond market “trumps” all on the spectrum of risks as this puts not only insolvent companies at risk but also solvent companies. The shift in tariff policy does not mean we are out of the woods, but the administration knows they need to tread lightly as we have some $9 trillion in bonds to sell this year to fund our existing deficits. Why rates move matters.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)