The US is on solid footing, even amid uncertainty

The job market is weakening, but there’s no significant economic slowdown yet

The mosaic of the job market has been weakening with reduced open jobs and lower quits in the Job Opening and Labor Turnover Survey (JOLTS), reduced private job growth from ADP and increasing layoff announcements, as reported by Challenger, Gray and Christmas Inc. However, we must also keep in mind that the current situation is coming from a position of the strongest labor market in decades.

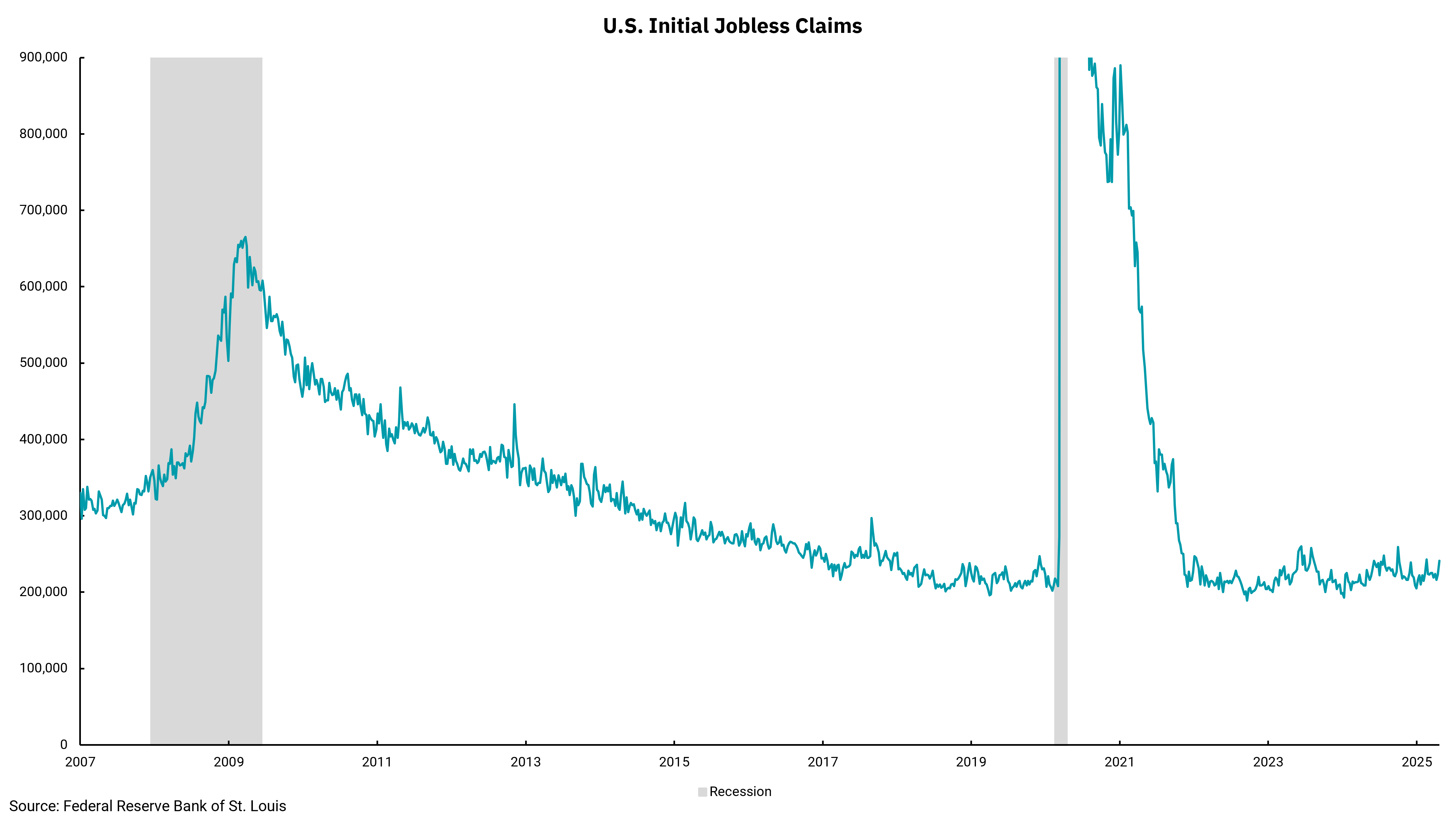

This week’s chart shows weekly jobless claims, which are reported by each state every week. This data can give us insights into the labor market in a couple of ways, and since it is a weekly release, the report can pick up changes more quickly. There are two primary readings within this report: the number of new filings for unemployment benefits, which we are showing here, and the number of continuing claims. Weekly jobless claims for last week ticked higher to a reading of 241,000, a two-month high, up about 20,000 over the four-week moving average. At the same time, continuing claims stayed firm at 1.9 million. As we look a bit deeper into the jobless claims number, we see that it was impacted by a big jump in the state of New York, where seasonal factors might be at play. We watch the continuing claims number as a guide to how easily those laid off can find new work. As this number has been rising and remaining firm, it seems to confirm similar data from the JOLTS report: finding a new job is getting harder.

As mentioned above, however, we went with a long-term chart to provide some broader context about the “weakness” of which we speak. Keeping in mind how much larger our workforce is now, the fact that jobless claims are at levels we last saw in the 1960s is almost unbelievable. This does not mean we can dismiss increases in an offhand way, as we can also see that once claims start to move up, they can accelerate higher quickly. However, the absolute level of jobless claims remains remarkably low.

The granddaddy of all the labor market measures is the monthly report from the Department of Labor. The report from April was better on many fronts. Job growth exceeded estimates, although there were some downward revisions to the previous two months. Meanwhile, the headline unemployment rate was stable at 4.2%, the workweek ticked a bit higher, and average hourly earnings were 0.1% lower than expected. But we also know this survey was taken the week after the tariff announcements, and as such, we must acknowledge the risk of headwinds in future readings. However, this further confirms that the domestic economy is entering the period of tariff uncertainty on solid footing.

As this pertains to the Federal Reserve, the stability of the labor market will keep them from feeling the need to lower rates at its upcoming May meeting. We have yet to see the inflationary impact of tariffs, and we have not seen data showing a significant slowdown in economic activity. The risks of both are still in front of us, but the potential for changes to tariff policies, which could lessen headwinds to growth and ease inflationary risks, will slow the Fed's willingness to reduce rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)