A tale of two housing markets

Whether it’s the ‘best of times’ or the ‘worst of times’ depends on your vantage point

How is the housing market? If you are already in the market and have owned your home for some period, you may not see a problem. That’s because you likely have a low-rate mortgage from a purchase or refinance that you did during the ultralow mortgage rate period associated with the pandemic. Since then, home values have increased substantially, meaning your home equity is positive. However, for those trying to get into the housing market, it is a mess. Home mortgage rates hover around 7%, and home prices, on a national average, continue to increase, making affordability hover near all-time lows.

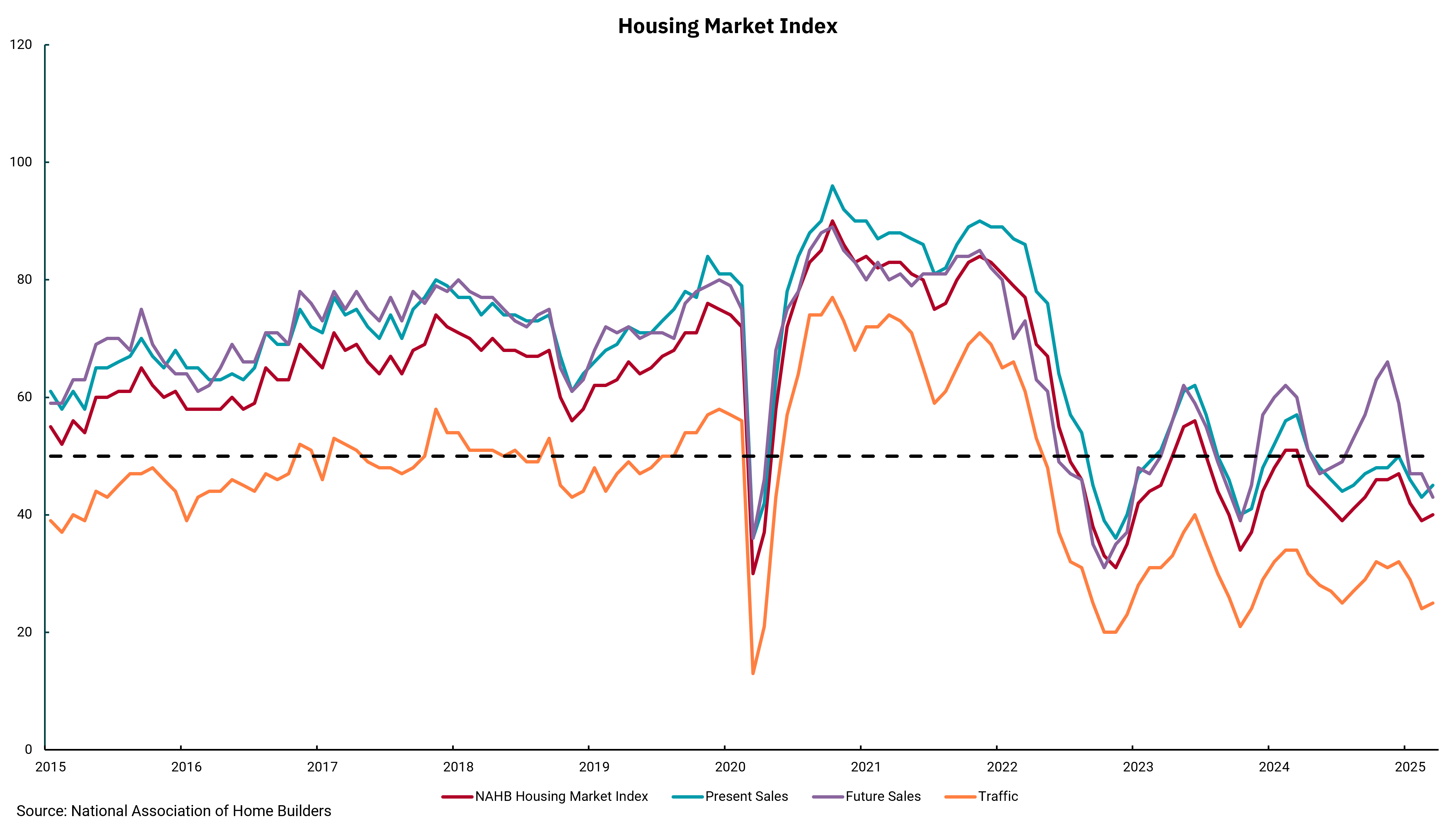

With all this in mind, our chart this week shows several measures pertaining to the housing market: the overall National Association of Home Builders (NAHB) index, along with present sales, future sales and foot traffic measures. As with many indexes, a reading above 50 is expansionary, while a reading below 50 is contractionary. Based on this, it is hard to see anything good about the housing market, as all four measures are mired below 50. What might the future hold?

For one, supply would appear to remain limited. Existing homeowners with mortgage rates well below prevailing market rates are loathe to sell their homes and lose their financing benefits. This means the primary source of supply is new homes. Even though lumber prices are declining as Canadian lumber avoided tariffs, the overall cost of building a house continues to rise as tariffs are impacting a broad spectrum of building materials, while land and labor costs remain high.

Rate relief might be hard to come by as well. The most recent meeting of the Federal Open Market Committee (FOMC) ended with no action on rates. Fed Chair Powell’s post-meeting comments cited a high degree of uncertainty with the risk of higher inflation and lower growth rising. Based on that outlook, it would seem unlikely that the Fed will move quickly to lower rates unless we see economic activity deteriorate quickly, specifically in the employment market. Our most recent reading on unemployment showed the national rate stable at 4.2%.

We know real estate varies by market, and there are some markets where home price weakness is being realized. Overall, the southwest part of the country, including Texas and Arizona, along with Florida, are seeing the weakest price trends. These are also the markets where prices rose the most, meaning some price adjustments as new supply in single-family and multi-family homes come online might be expected. However, broadly speaking, the U.S. remains underinvested in housing, meaning housing affordability might remain difficult for the foreseeable future.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)