It’s not just you—yes, it’s harder now to get a job

Number of open jobs to unemployed persons has fallen to 1:1

The mosaic of the job market is weakening, but it is too early to say the job market is signaling a recession. The first week of the month always provides a series of employment reports. With roughly two-thirds of U.S. gross domestic product (GDP) based on consumer spending, it is easy to see why the job market is so important. Consumers with jobs are in a much better position to continue supporting economic growth.

We began this week with the Job Openings and Labor Turnover Survey, also known as JOLTS. This monthly measure provides us with the number of open jobs in our economy, as well as the number of people quitting their jobs and the hiring levels. At its peak, this survey showed two open jobs for every unemployed person. Not surprisingly, the quit rate was elevated, too, as employees felt highly confident about being able to find another job easily. Wage pressures were evident during this period as companies paid more to retain and recruit workers in high demand. In the latest report, however, the number of open jobs is now about equal to the number of unemployed persons and, as one would expect, the quit rate is much lower, reflecting less confidence in finding a new job. Anecdotally, conversations with business owners show turnover rates have slowed dramatically, and with that, wage pressures have subsided as well.

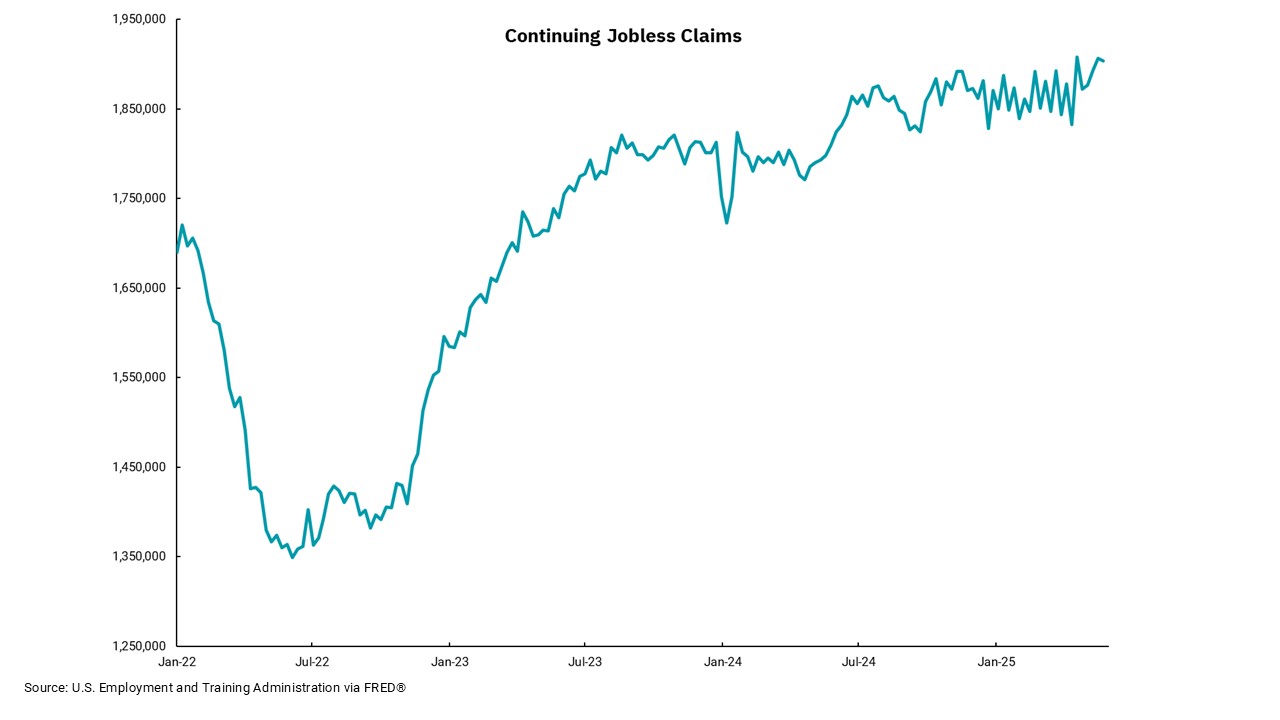

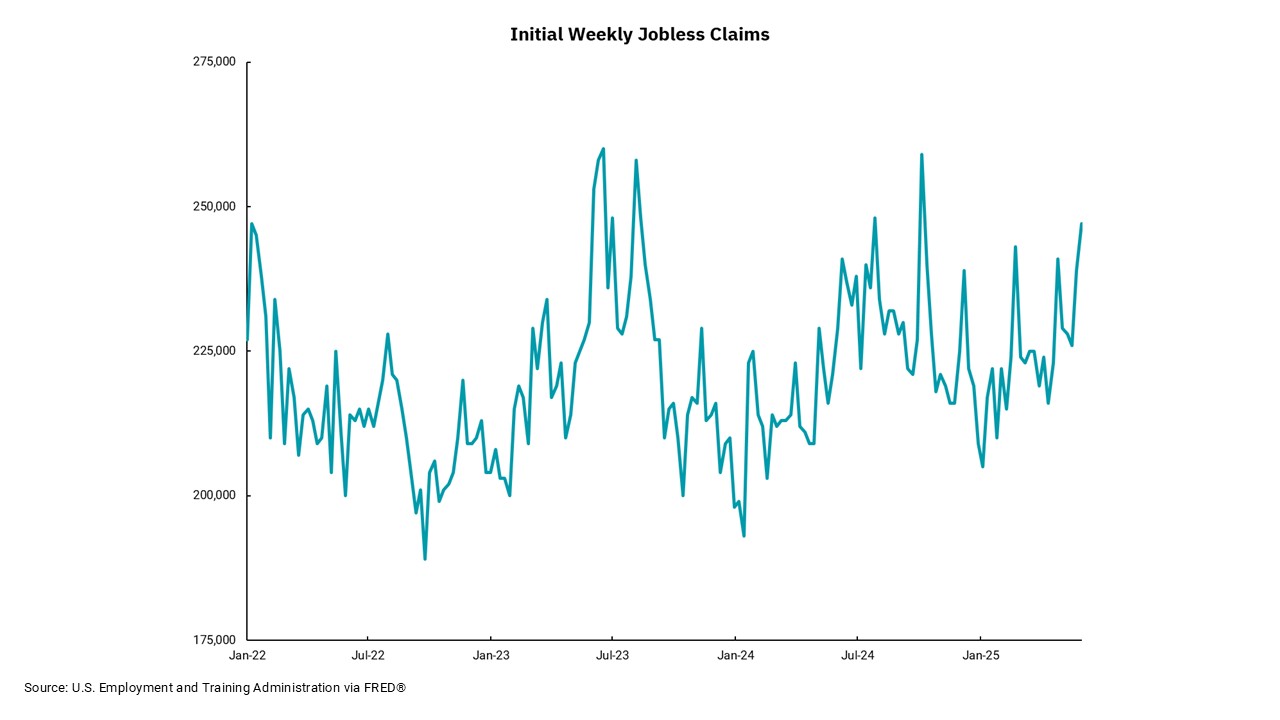

Our charts this week show two parts of the weekly jobless claims report. We see this every Thursday morning, and it provides the timeliest information on the job market. The initial jobless claims report those individuals who are filing for jobless claims for the first time. In effect, this is a measure of firings within the overall job market. Jobless claims have been relatively stable over this period, and a longer-term chart would show jobless claims at remarkably low levels. The upper chart shows continuing claims. And here we see a rising trend indicating that those laid off are remaining unemployed for longer periods. Put another way, getting a new job is harder.

The monthly Department of Labor (DOL) report this month showed the headline unemployment rate remaining stable at 4.2%, while job growth slowed to 139,000. There were also downward revisions totaling 90,000 jobs to the previous two months’ reports. In aggregate, it appears that we are seeing a job market where employers are hesitant to cut a lot of jobs but are also slowing their new hiring plans. This makes sense in a period of uncertainty, as companies remember how hard it was to hire workers over the past couple of years, but they don’t want to add workers when policy shifts might slow economic growth. For now, we can say that the job market is still supporting positive economic growth. However, without policy clarity and a path forward for further growth, this economic support could falter.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)