Oil market attempting to restabilize after Israel-Iran airstrikes

U.S. Fed faced with inflation risk on one hand and stressed consumers on the other

The positive sentiment after the recent better-than-expected readings on inflation took a hit overnight as news of Israeli airstrikes against Iranian nuclear facilities and military leadership became known. We will start by stating we hope for a quick resolution to this conflict within a region that seems to suffer from outsized geopolitical risks.

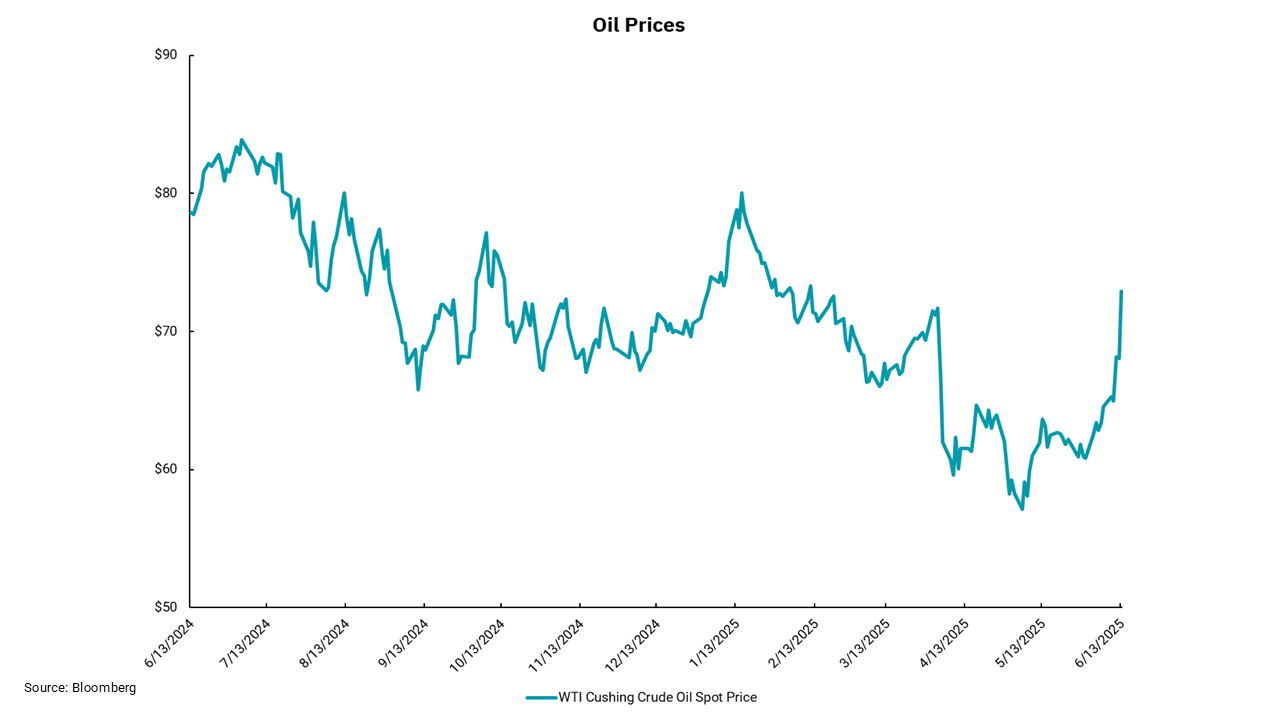

The initial response to the airstrikes has been for oil prices to move materially higher. Our chart shows a spike upward but also reveals that oil prices have been moving higher over the past couple of weeks. Some of that move could have been speculative as Middle Eastern tensions moved a bit higher, but oil prices had begun recovering from the year-to-date lows set in early May.

There are reasons to question the sustainability of this move higher in oil, while also acknowledging that any escalation or broadening of these latest actions might very well lead to even higher prices. Iran's daily oil output is about 3.6 million barrels. Of that, they export about 1.7 million barrels of oil. While not immaterial, this amount is not the difference between an under-supplied versus an over-supplied global oil market. OPEC+ had already agreed to increase production by another 400,000+ barrels per day before this latest event. Indeed, Saudi Arabia, with a daily production of close to 10 million barrels, and the rest of OPEC+ are estimated to have additional production capacity to make up for the loss of Iranian oil. So, just how long these higher prices stick will be driven more by global economic activity and demand than the recent events.

Meanwhile, the recent reports on inflation might portend a bit weaker U.S. consumer. Prices for highly tariff-sensitive items, such as furniture and appliances, were higher but were offset by lower airfares and hotel accommodations, as well as declines in new and used car prices. The consumer is still supported, for the most part, by a solid job market, but evidence of a slowdown there is visible. Add in reduced demand for travel and durable goods, and we can see a picture of an economy whose momentum is slowing. Higher oil prices, which will increase inflation measures and hit stressed consumers, will be a headwind if they stick for long.

It appears that the Federal Reserve is still of the mind that it should remain stable with monetary policy. The risk of higher inflation from tariffs remains, and increasing oil prices add to this perspective. However, ignoring other data that shows a stressed consumer and a weakening labor market is a risk as well. Let's hope Chair Powell and his colleagues at the Eccles Building remain alert to risks on both sides of their mandates

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)