Why the Fed sees ‘no action’ as the best move—for now

Will they wait too long to lower, or even raise, rates?

After each meeting of the rate-setting arm of the Federal Reserve, the Federal Open Market Committee (FOMC), we get a summary statement of the meetings discussions (not to be confused with the actual meeting minutes which are released after a period from each meeting). Fed Chair Powell also normally holds a press conference to answer questions from reporters. Additionally, about once a quarter, we get their updated Statement of Economic Projections (SEP), which the FOMC released on June 18. The SEP is where the Fed provides numerical projections for factors such as gross domestic product (GDP), inflation and its target for the Fed Funds rate. They provide these estimates for short, intermediate and longer-term time frames, which helps us understand how they see the economy evolving from its current state.

We are now in a period during which there is not only debate about the direction of their estimates but also their assessment of the current economic environment. Plus, there are unknowns surrounding the impacts of numerous policy decisions, including tariffs, tax policy, regulatory policy, the debt ceiling and immigration. Some data, such as unemployment, appear strong on the surface while underlying trends indicate a weakening trend. Some data are improving, like inflation, but have known headwinds going forward. Additionally, some data, such as housing, is just in a bad spot with high prices and mortgage rates stuck around 7%. Then, there is confusing data, such as negative GDP in the first quarter, which was driven by a pre-tariff surge in imports that seems to be reversing this quarter.

Overall, as compared to the last SEP release, the Fed lowered their growth expectations a bit, raised their short-term inflation forecasts a bit, kept their view of the long-term neutral rate steady, see unemployment rising to 4.5% by year-end and continue to pencil in two rate cuts between now and year-end. We might all be forgiven if reading this update produces more questions than answers. Slower growth and higher unemployment make lower rates sensible, but not if inflation is expected to tick higher, even for a limited period (I am not going to use the word 'transitory’).

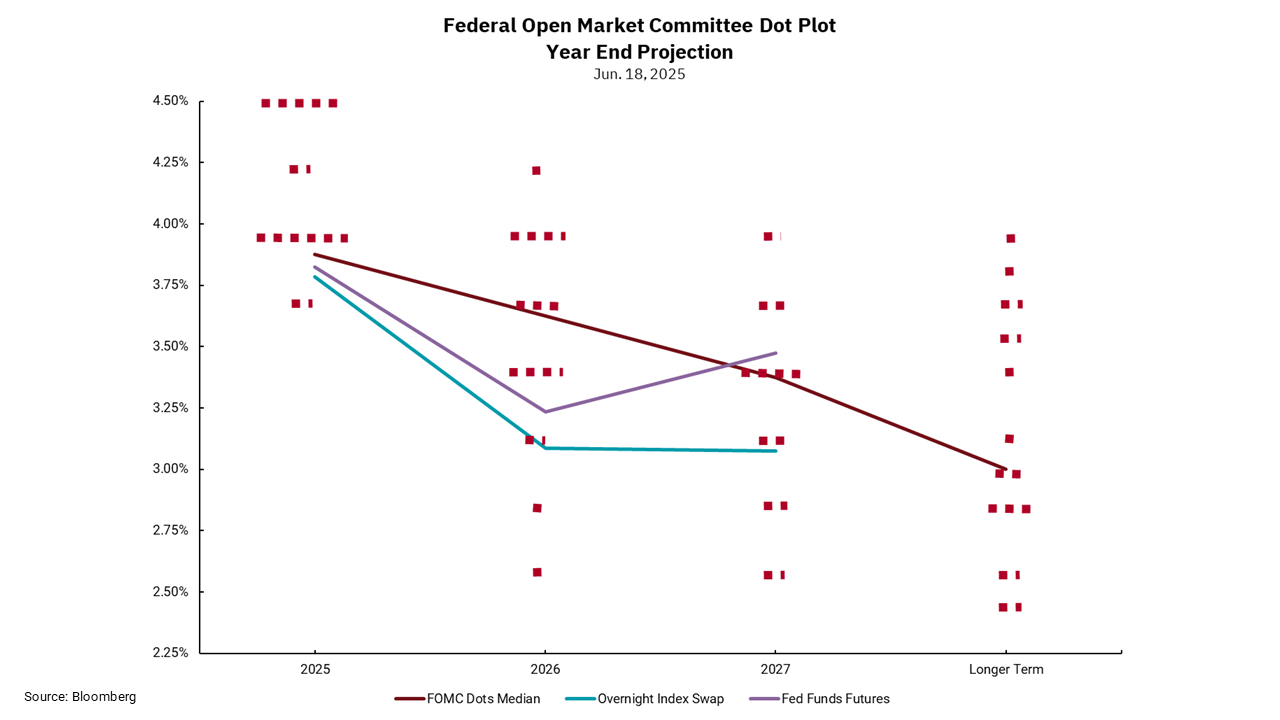

Our chart this week, the Fed's "dot plot", is not intended to be a forecasting tool, although it can be useful to see where the median FOMC committee member stands compared to market-based forecasts, such as the overnight index swap (OIS) market and Fed Funds futures. However, to me, the bigger story is in the dispersion of opinions within the committee. Keep in mind that this committee is made up of surely some of the brightest economic minds with access to reams of information and research. Despite this, their range of outlooks for interest rates in the short run and the longer term is extremely wide, indicating widely disparate views on what the economy will do from here. Within an environment like this, assuming as the Fed does, they are not overly restrictive or accommodative, it seems the best action is to take no action. By definition, this means the Fed will be late to move as most economic data is lagging, and the Fed's monetary actions also act with a lag. The only question remaining is will they be late to raise rates or lower rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)