Will the saying be, ‘As NVIDIA goes, so goes America?’

The tech stock was the first-ever to crack the $4 trillion market cap level

It is uncommon for us to produce charts and commentary on individual stocks, but the performance of NVIDIA (NVDA) has been nothing short of spectacular. Regular readers of our work know that we share a bullish perspective on artificial intelligence (AI), and its potential to usher in a new era of productivity gains. Due to the United States’ fiscal position, economic growth is vitally important.

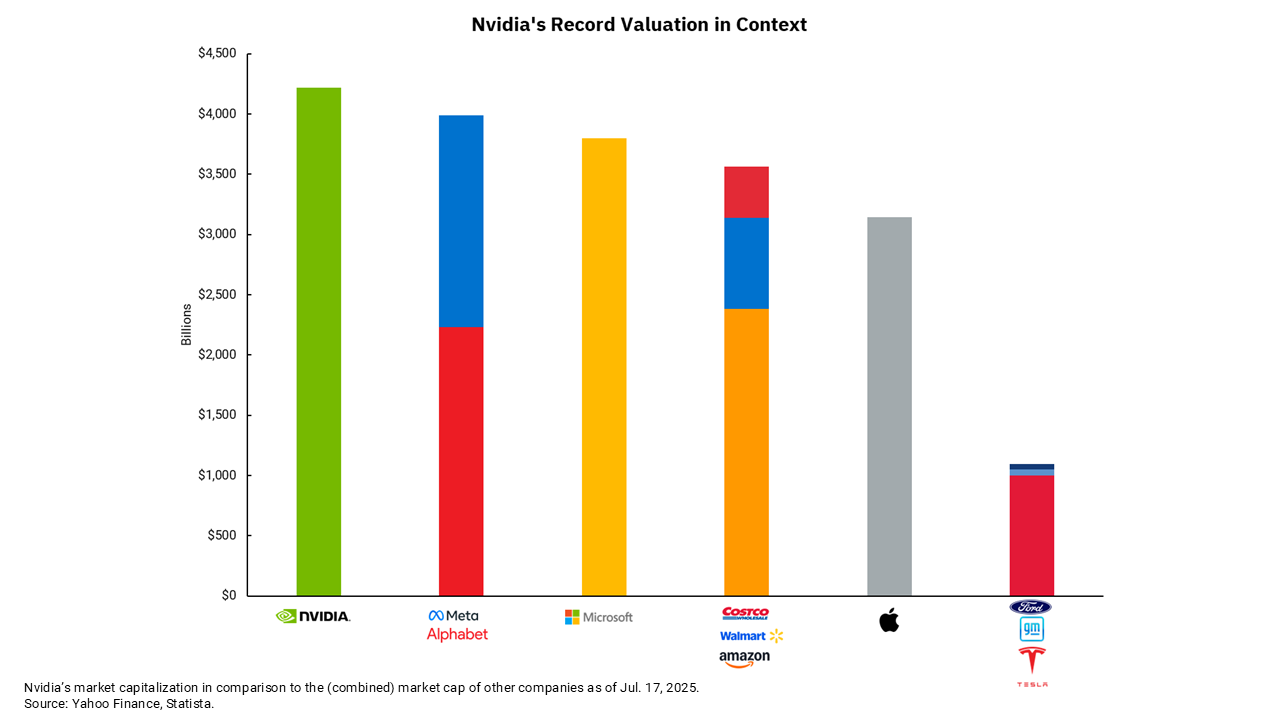

So, with NVDA cracking the $4 trillion market cap level, the first company to ever do that, it seemed a good time to consider the impact of the AI boom from a broader market perspective. The chart we have for this week shows the market capitalization of NVDA versus a few other publicly traded companies. Microsoft (MSFT) is the closest single company in market cap and could very well move to a $4 trillion market cap itself, with Apple (AAPL) in the chase. Still, beyond that, we see that NVDA has a market cap larger than the combined value of many leading companies within the U.S. economy.

NVDA bigger than the combination of Facebook (META) and Alphabet (GOOG)? Wow, that just seems extraordinary. Moreover, we can add Amazon (AMZN), Walmart (WMT) and Costco (COST) and still be behind the value of NVDA. And when we consider the importance of the automobile in our economy, Ford (F), General Motors (GM) and Tesla (TSLA) collectively add up to about $1 trillion in total market capitalization. Who remembers when the saying used to be "As goes GM, so goes America"?

Looking even broader at sector weightings within the S&P 500, it gets even more interesting. NVDA alone accounts for approximately 7.6% of the S&P 500 index. As an aside, the weightings of NVDA, MSFT and AAPL are all above 5%. Why is that a problem? For many active managers, position size limits are part of their risk management process, and historically, anything above 5% has been considered risky from a fiduciary standpoint. This means many active managers, by policy, have an underweight to what have been the best-performing stocks in the index. However, back to the sector weights, NVDA on its own is larger than the entire utility sector (2.4% of the S&P 500), the energy sector (3.1%) and consumer staples sector (5.4%). In fact, NVDA is now approaching the weight of the entire healthcare sector, which has a 9.25% weighting in the S&P 500.

There is nothing inherently bad about the structure of the market today. Yes, it is concentrated with the top 10 stocks making up over 35% of the entire index market cap. However, this is being driven by growth, and unlike the late 1990s and early 2000s, during the internet boom, these companies are hugely profitable and generating significant cash flows. Since the beginning of the year, the multiple on these stocks as a group has declined, as earnings growth has been faster than the level of price appreciation. This might limit the downside risk, as cash flows and earnings are not speculative, but one could also say it seems likely that the rate of growth might slow going forward. The reality is that we do not know the full implications of AI's impact on our economy, businesses and markets. It might be less than currently thought, meaning future returns on some of the stocks involved may be disappointing. On the flipside, it might be even bigger than we know, which would mean today's prices may look like a bargain. What a great time to be alive.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)