Decline in home sales continues

Homeowners with low-rate mortgages still reluctant to sell

Having a robust and healthy housing market is important for many reasons. The housing market directly impacts our economy in a couple of ways, residential and construction, which includes remodeling, itself is not a huge component coming in at 3-5%, but when we add consumer consumption on housing services like rents and utilities, its impact expands to 15-18% of gross domestic product (GDP). Not to mention the idea of owning a home is a key part of achieving the American dream.

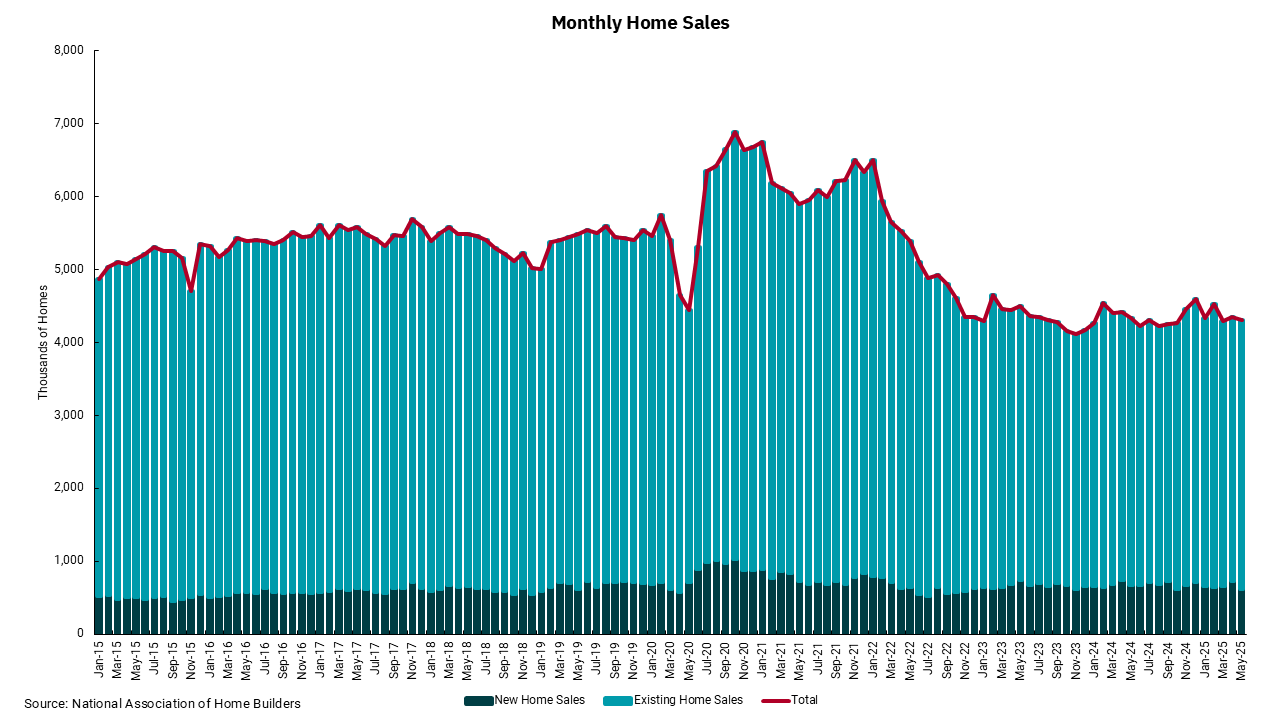

Our chart this week is on monthly home sales and provides some insight into the state of the housing market compared to past periods. This is a national sales chart, and we know that real estate markets are local, meaning individual markets may look different. However, broadly speaking, we can see a material decline in overall home sales, particularly over the last two to three years. We can also see that the biggest shift downward has been in existing homes. The darker shade of the chart represents new home sales, which have been much more stable. However, underinvestment in housing, where we are some four to five million units short, is a key reason why we have a nationwide supply issue. However, the bigger part of the overall housing market is the existing home market—and it is here that we see the result of the ultra-low-interest-rate environment that existed from the Financial Crisis through the pandemic era, until inflation took off.

With most homeowners today holding mortgages at rates below the current level, the concept of selling and giving up the low mortgage to buy another house is at least unpalatable and, in many cases, a bad business decision. The result is fewer existing homes for sale, which is limiting supply and playing a part in holding prices high. The combination of 7% mortgage rates and high prices means overall affordability is at very low levels. Speaking of affordability, recent research has shown that for affordability to return to historical levels, the following would need to occur, if nothing else changed: mortgage rates would need to fall by 3%, home prices would need to fall 25%, or incomes would need to rise by 40%. Now, combining a few of these would reduce the amounts listed above, but the overall message is this: housing affordability is a long way from where it used to be. And one can easily see that within these changes, there would be winners and losers.

Looking forward, it is possible to see some relief on rates as the Federal Reserve lowers rates in response to lessening inflationary pressures. However, despite protestations to the contrary by the president, there are reasons longer-term rates might not go down even if the Fed lowers short-term rates. Yet, our outlook for continued economic growth and a firm, if not robust, labor market supports the idea that the U.S. consumer will remain a positive part of the economy. Over time, lower rates can help, as can slowing or flat prices, and increasing consumer incomes can also be beneficial. It might just take a longer period than we like. In the meantime, a growing trend we are seeing is existing homeowners using their growing equity to remodel their homes, rather than moving. This doesn’t help activity in the housing market but is additive to economic growth.

Recent earnings announcements by homebuilders have led to some positive reaction in their stock prices. Is this a harbinger of a better outlook? Housing expert C.J. Maloney of BOKF says this is “more about gross margins than a sunny outlook on the actual industry.” It would seem that homebuilder stocks have been depressed to the degree that news that is “less bad” is good news.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)