Fed rate cut in September looking more likely

Revisions of earlier data casting doubt on labor market’s health

This week has been chock-full of events and data releases that have moved financial markets. Big tech earnings, a Federal Open Market Committee (FOMC) meeting on rates, lots of data on the job market and, of course, a helping of tariff announcements and Truth Social posts from the President.

For the most part, earnings for the second quarter of 2025 have been better than expected. While expectations were relatively low based upon fears of tariff-related impacts, companies in aggregate, and especially in the big tech area, have exceeded expectations for both revenues and earnings. After reporting better-than-expected earnings on Wednesday, Microsoft (MSFT) joined NVIDA (NVDA) in the $4-trillion market cap club. There have been some misses, Ford (F) comes to mind, but overall earnings are better, and revisions to future earnings are positive.

On the job front, the information we got from the Job Openings and Labor Turnover Survey (JOLTS), the ADP report on private employment and weekly jobless claims shows a continuing trend of a labor market where firings are not widespread but hiring has slowed. This set the stage for the real star of the economic data show this week, with the monthly report from the Department of Labor on Friday morning and those looking for drama were not disappointed.

While the headline numbers on job growth, wages and the overall unemployment rate were fine, the revisions to the previous two months of DOL reports were terrible. Total job growth for the previous two months was revised lower by 258,000 jobs—a number far higher than normal and high enough that it calls into question how confident we can be that this month’s report was, in fact, fine. A similar downward revision next month could mean this month’s job growth was actually negative. The response was for stocks to trade down and bond yields to decline as the odds of the Fed lowering rates at their next meeting in September soared higher.

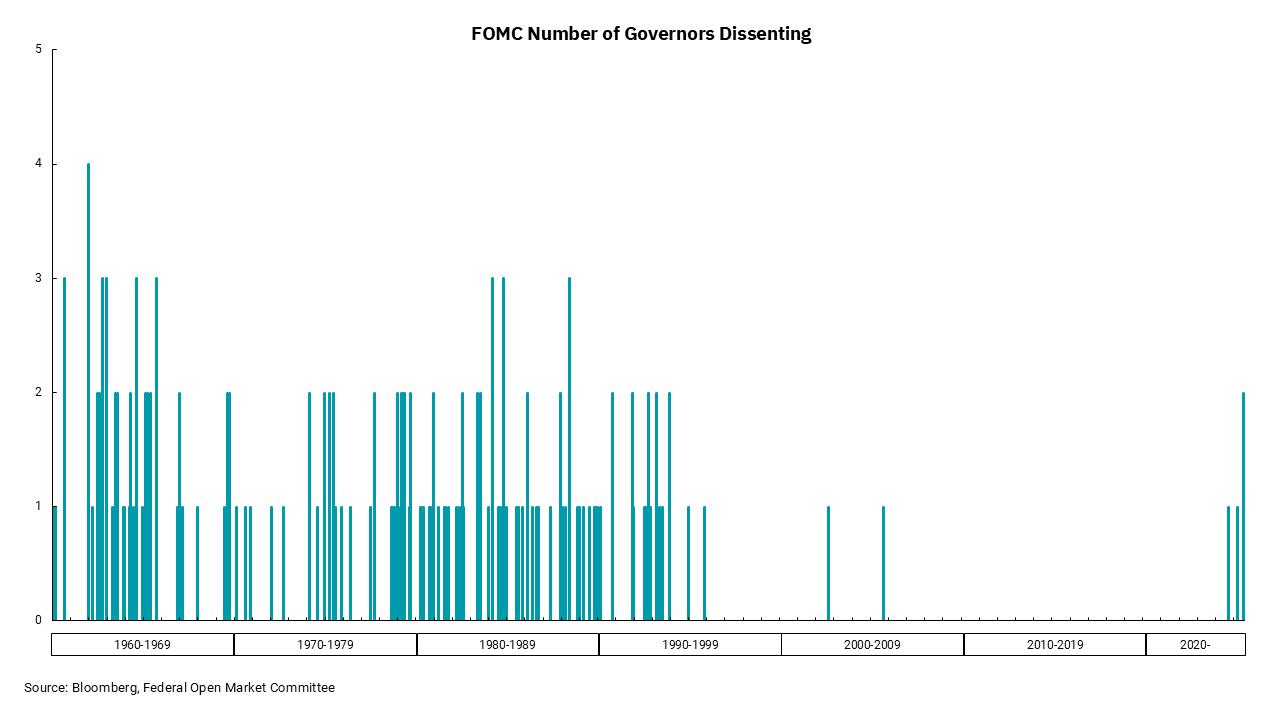

That brings us to this week’s chart. Post FOMC meeting commentary was practically breathless around the fact that we had two voting members of the FOMC dissent with their votes to keep rates stable. Members Bowman and Waller wanted to cut rates, as both have highlighted their feelings about the labor market weakening. Fed Chair Powell has noted potential price impacts from tariffs as a reason to stay stable while reflecting his thoughts on the labor market as ‘firm.” Friday’s release would seem to tip the scales in favor of the dissenting voters.

Longer term, we can see that dissents used to be more prevalent and numerous. What changed in the mid-90s when the Chair of the Fed was Alan Greenspan? In short, the Fed got more transparent and, along with that, dissents were viewed as lessening the impact of Fed policy decisions. This led to the “need” to have a more unified voice coming from the Fed. Is this better? I could host arguments on both sides, but for now, it might be that we see a few more dissents as the outlook on growth and inflation is in question and with it, what the Fed should be doing.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)