Services not immune to tariffs—but may actually benefit

As tariffs take hold, a look at income groups reveals how spending may shift

Now that President Trump's tariffs are in force, at least based on the most recent update on Truth Social, we wanted to revisit the U.S. consumer. One of the reasons the impact of tariffs is hard to know for sure is that most of our economy is based on services. Of course, services are not immune to tariffs. For instance, pool services, for which chemicals are imported from China. That said, services are much less directly impacted than are goods. Add in the spreading of the cost of tariffs between producers, distributors, retailers and consumers, and we can see that it is hard to draw a direct line between tariffs and inflation measures. In aggregate, higher tariffs, like higher taxes, will impact demand negatively and hence be, in our view, more of a demand issue than an inflation issue.

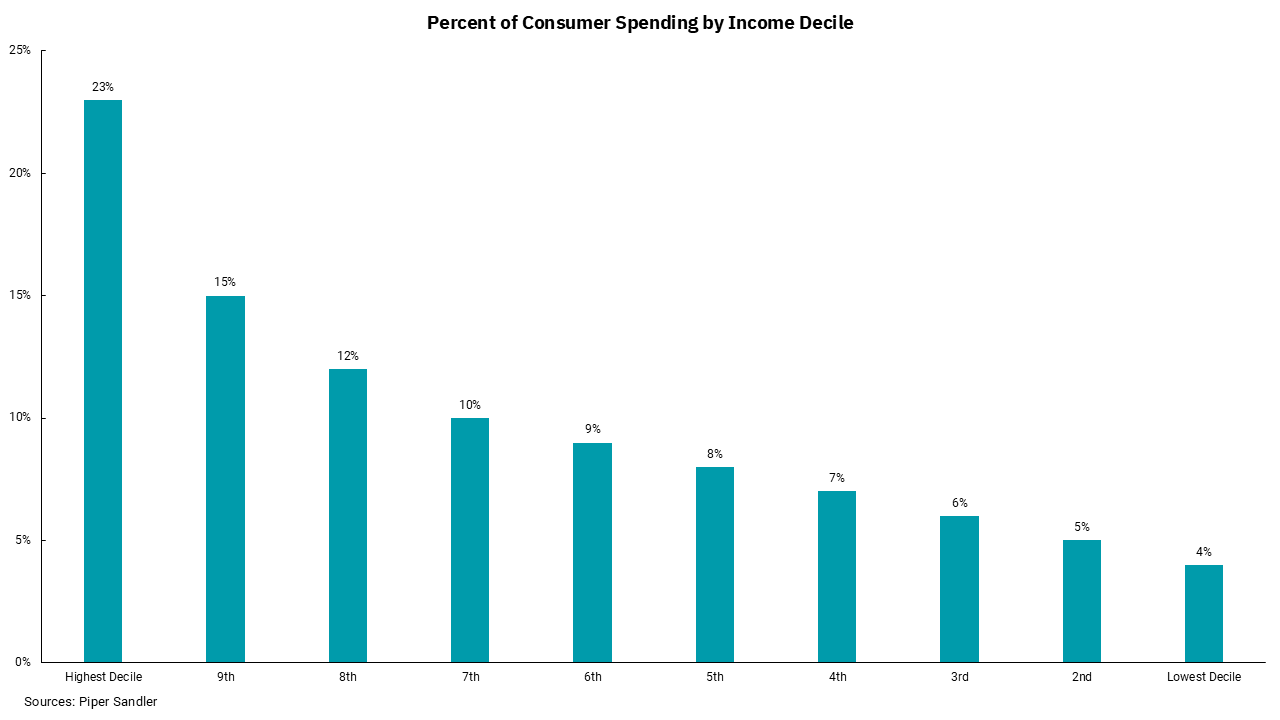

Like almost every other economic data point, however, when we look by income decile, the picture shows a variable level of impact. Generally, lower-income brackets spend a higher proportion of their income on necessities, which makes them more susceptible to the negative impacts of higher prices.

Our chart this week shows the percentage of consumer spending by income deciles. We should expect higher-income consumers to spend more as they are the ones with the highest level of discretionary income. In fact, we can see that 30% of income earners are responsible for half of all consumer spending. The upper income bracket's ability to absorb higher tariffs might mean that tariffs impact spending less overall. At the same time, looking at spending in this manner also helps highlight why the Federal Reserve is focused on getting inflation back towards its 2% target. The lower half of earners feel the impacts of inflation the most acutely, as they have less money to spend.

Moreover, when looking at tariffs and spending, there is another aspect of the makeup of the U.S. economy and the consumers’ outsized influence on it to consider. Consumers choose how to spend their money. A consumer may choose not to buy anything now that an imported good costs more. Alternatively, they might choose to substitute a cheaper good for the now more expensive good. They also might choose to spend their money on services or experiences instead of goods. That last choice, in particular, might mean the economy benefits from this shift. The purchase of an imported good means that at least some of that money goes back overseas to the foreign producer. However, since services are much less impacted by tariffs, additional spending on services means a higher percentage of that spending remains within our economy.

Many parts of the global economy and trade are changing with uncertain outcomes. Yet history is clear that if U.S. consumers have money, they will spend it. The job market and income deciles play a huge role in how much and on what money is spent, but as long as the job market remains positive, our economic outlook will tend to remain so as well.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)