First-time homebuyers continue to face challenges

Average mortgage payment remains high despite affordability efforts

We have often written about the struggles of the housing market and heard from our resident mortgage expert, CJ Maloney, on the multifaceted problem of affordability. In short, there is a supply problem, a rate problem and a price problem. At any given time, any one of these can be a headwind to housing, but at present, we have all three working against us.

That said, as the number of organizations, charitable and otherwise, that have identified affordable housing as a crisis is expanding, and we are now seeing higher levels of capital, both monetary and skill-set, focus on solutions. Cities are also becoming more engaged, but even with all that, solving this issue will take time. Also, when considering interest rate policy, we need to remember that a Federal Reserve decision to lower the overnight lending rate may not lead to lower home mortgage rates.

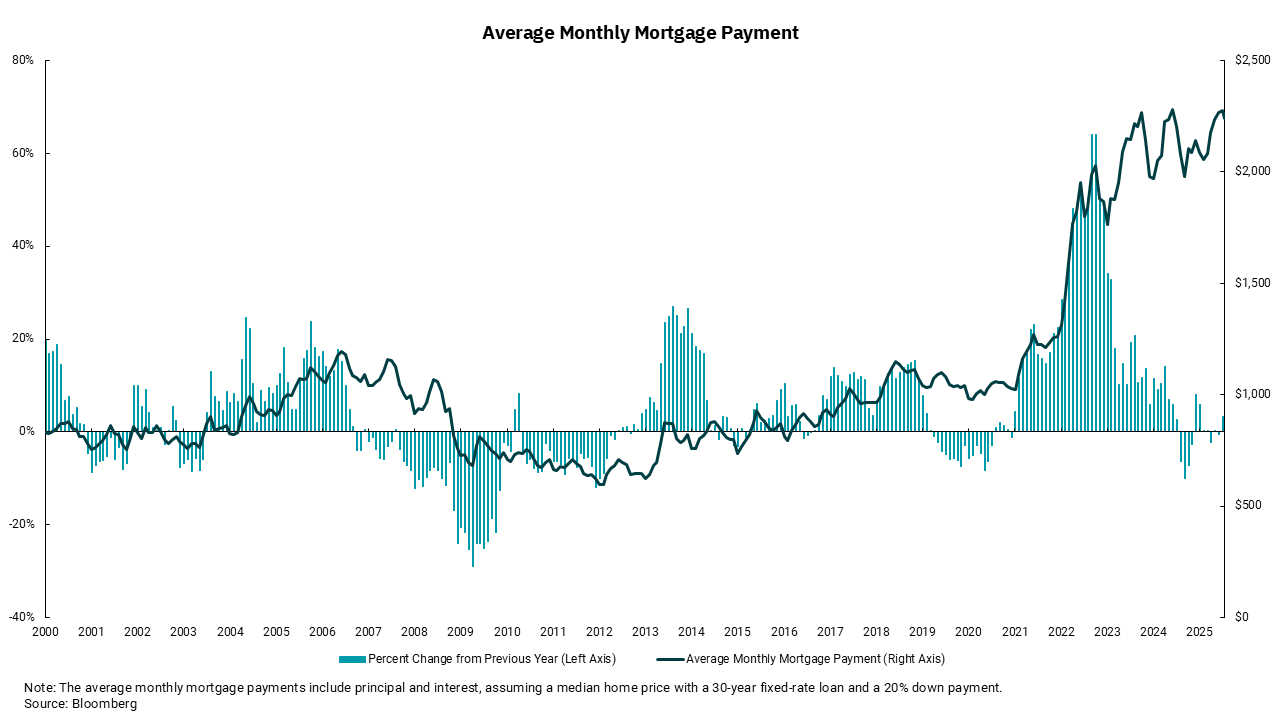

Thinking about where we are today, we came across this chart, which helps us visualize why the housing market seems so bifurcated between the “haves” and the “have-nots.” The dark line is the average mortgage payment, principal and interest, for the median-priced home in the U.S., at the prevailing mortgage rate, assuming a 20% down payment. The light blue shade represents the year-over-year change in payment in percentage terms. I suppose the good news from the chart is that the percentage change has slowed. However, the bad news is the payment level is not changing either. No wonder then that home sales are low, as one must add taxes and insurance to these numbers.

For those lucky enough to have owned and/or refinanced a home with a fixed-rate mortgage prior to early 2022, the sharp increase in rates has been a non-event. It has, in fact, resulted in a rare occurrence as the low-rate debt you carry is almost an asset, not a liability. As an aside, fixed-rate mortgages have not, however, kept the taxes and insurance part of the payment from increasing, and a growing number of households now face the reality that taxes and insurance comprise over half of their overall monthly mortgage payments. For those who have experienced this, it is a stark reminder that even after paying off the mortgage, and about 40% of all homes in the U.S. do not have a mortgage balance, it is still costly to own a home.

For those unlucky enough to be outside the housing market and wanting in? As a reflection of the difficulties faced, recent data shows that the number of households identifying as permanent renters has increased, and sales data show a high percentage of first-time home buyers get assistance from family or others for down payments. For many, owning a home has been ingrained in us to be part of the American dream, a part of what success looks like. From that perspective, a housing market that is becoming more difficult in which to participate is disappointing. Stable prices over time with lower rates and higher incomes can help, but absent a material move in one or more of these factors, it seems we will be talking about a tough housing market for a while.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)