Chances of a Fed rate cut in September now at 100%

Disappointing August jobs report shows clear trend of slower growth

The monthly employment report for August surprised on the downside as job growth totaled only 22,000, and the headline unemployment rate rose to 4.3%. In addition, while last month's job number was revised slightly higher, the jobs number for June was revised lower again and now shows negative job growth for the month. There are some areas where we can take solace: stable earnings indicate that wage pressure remains subdued and the labor force participation rate nudged higher. However, the overall trend in the job market is now clearly slower.

In some ways, it has taken the monthly Department of Labor report a while to catch up to other data points showing slower economic growth. Job openings, as reported in the Job Openings and Labor Turnover Survey (JOLTS), have been declining, and this month showed just under one open job for every unemployed person in the U.S. Recall, as we were recovering from the pandemic-related economic shutdown, that open jobs at one time showed two open jobs for every unemployed person. One may also recall the chaos of the job market at that time, as another data point in the JOLTS report showed people were quitting their jobs at very high rates as they pursued other opportunities and higher wages. The "quit rate" within JOLTS is now much lower. Even in the weekly jobless claims data, we have seen an environment where companies are not laying off many people, but hiring has slowed.

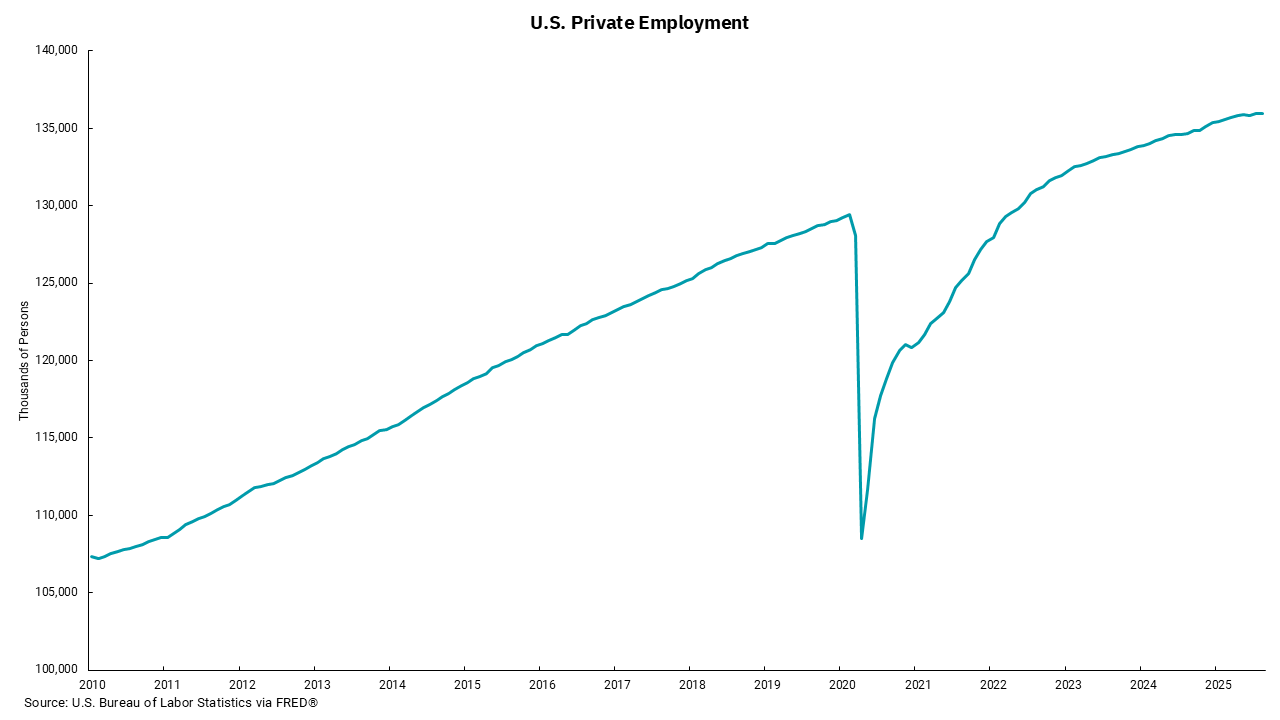

Our chart this week shows the private sector employment within the monthly DOL report. While job growth was robust last year and coming into this year, we can see that growth in private sector employment has begun to slow. It is still positive but growing at a slower rate. We can also see that, even as we have recovered from the steep decline of the pandemic, private sector job growth has not regained its pre-pandemic level. This is not to say public sector employment is not important, it is. However, in the longer term, it private sector growth which will lead to more sustainable U.S. job growth.

Following the release of the employment report, the chances of a 0.25% rate cut at the Fed's meeting in two weeks increased to 100%. There is even a small chance of a 0.5% cut (we are not of the mind that a 0.5% cut will happen). Beyond that, the market is now pricing in as many as three rate cuts between now and year-end.

Based on these projected cuts, Treasury yields fell, and initially, stock prices rose to new records across the large-cap domestic indexes. Lower interest rates can help justify equity valuations and might even help get the housing market going again, but we need to be careful what we wish for. If rates are falling because the employment market is deteriorating, then the growth outlook will moderate as well. Consumer spending accounts for two-thirds of the U.S. economy, and consumers without jobs cannot spend nearly as much. In that case, the outlook for company profits might begin to slow as well.

We do not think a recession is imminent, but understanding why rates are falling is an important part of the actions an investor might take. In short, we do not want a Fed that is having to lower rates aggressively.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)