Yes, where you park your cash still matters

Having cash reserves is prudent—even when rates fall

KEY POINTS

- As interest rates fall, investors may want to reevaluate cash strategies to maintain yield while preserving liquidity.

- Money market mutual fund assets have grown significantly, which some say is a sign of future demand for riskier assets.

- High cash reserves reflect both economic uncertainty and a prudent approach to balancing income, risk, and access.

Cash is king…or is it? One of the benefits of the Federal Reserve raising rates was that for the first time in the better part of 15 years, investors could make some semblance of income on their cash. Granted, when inflation was running at levels far above the overnight rate, investors were not making “real” rates of return—that is, return when adjusted for inflation. However, as inflation began to ebb, we have seen real rates of return turn positive.

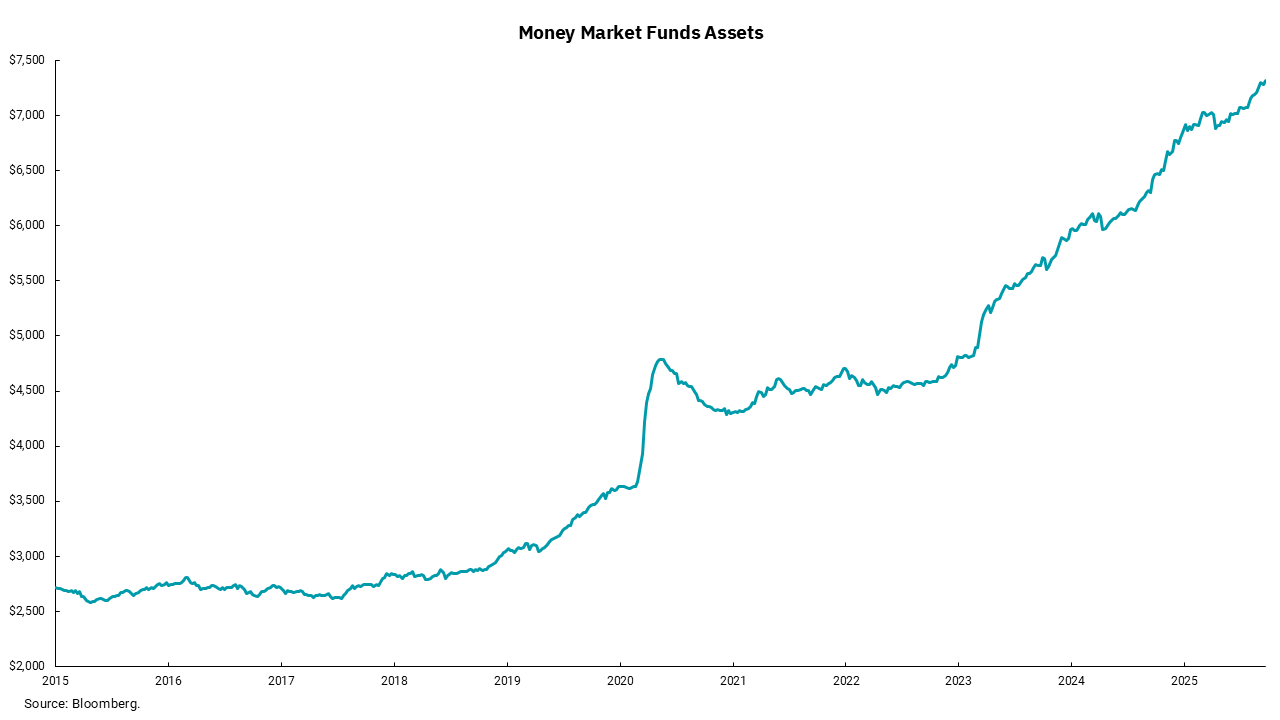

Our chart this week shows the material increase in overnight money market mutual funds (MMMF) assets since 2015. We should expect asset levels, like debt levels, to increase as the economy grows. However, money market assets as a percent of gross domestic product (GDP) have roughly doubled since 2015. A big part of this can be seen during the period of the pandemic when the combination of fiscal stimulus and extraordinary monetary accommodation led to an increase in the overall money supply of over 40%.

Following this period, consumers spent heavily, and inflation impacted price levels, leading to a decline and then a period of stability before beginning another rapid ascent as interest rates rose. For years, it didn’t matter where one parked their money—whether in non-interest-bearing checking accounts, savings accounts, CDs or MMMFs—because rates were at or near 0% everywhere. But then, cash management mattered again, and investors began seeking options that paid interest while also keeping assets liquid.

The liquidity part of the equation can matter too. Risk market participants, such as those investing in stocks, sometimes look at MMMF asset levels and flows as a sign of the potential for future demand. The higher the level of MMMF balances, the more money that might flow to more risky parts of the market.

Where that money might go is an open question. Uncertainty about the economy might mean investors do not move money as “return of principal” outweighs “return on principal.” Conservative investors might look to the bond market or other income-generating assets to maintain current cash flow levels by accepting less liquidity. And yes, some might go to higher-risk areas like the stock market. The bottom line, though, is that most everyone agrees that having some level of cash reserves, while still earning interest, is a prudent action.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)