Shutdowns aren’t new, nor is market resilience

A look back at nearly 50 years of shutdowns shows that while politics may stall, markets tend to recover—and often thrive.

KEY POINTS

- Shutdowns have occurred under both parties and various congressional majorities, showing they are not tied to one political side.

- S&P 500 performance during shutdowns is mixed, but 12-month returns after shutdowns are generally positive, averaging over 12%.

- Investors are encouraged to stick with their long-term financial plans rather than react to short-term political events.

Now that the U.S. government is in another shutdown—and this one with the potentially higher stakes of some permanent federal job cuts—the question has become: "What is an investor to do?" Without offering specific advice, as everyone's situation is different, let's take history as a potential guide.

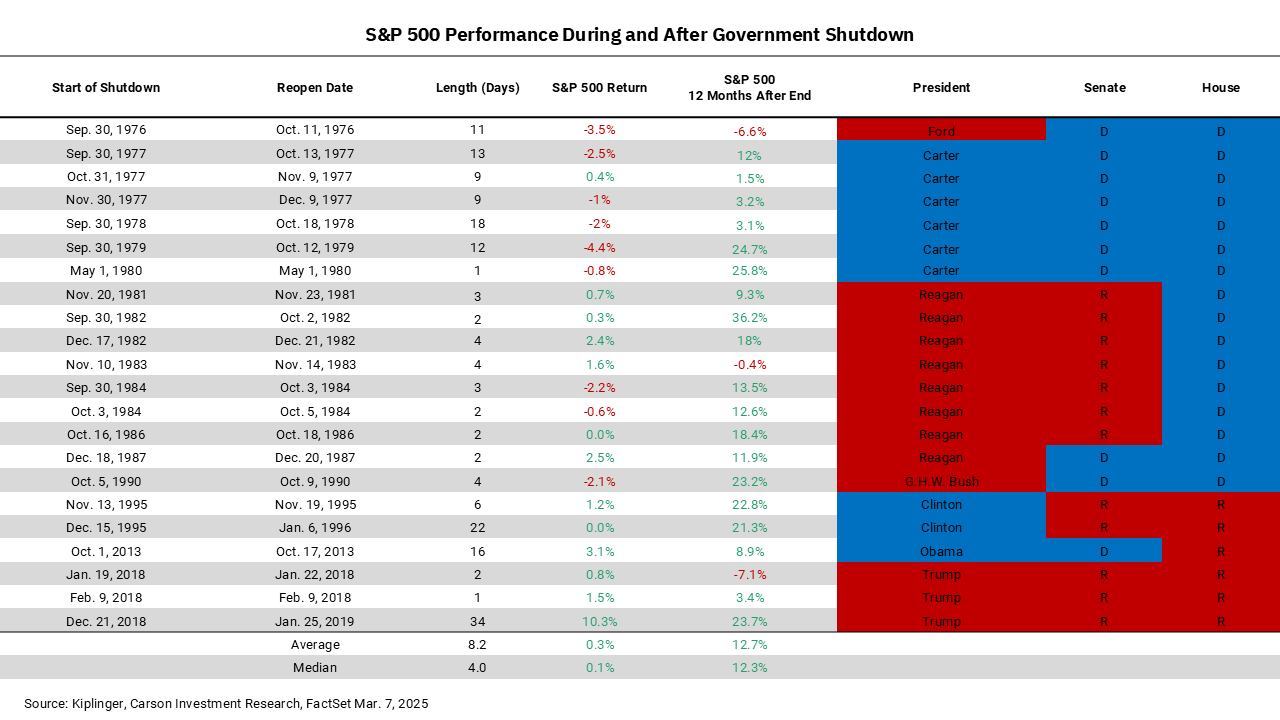

Our chart this week displays the dates and durations of government shutdowns since 1976, along with the names of the presidents and the party with the majority in each house of Congress. As we can see, government shutdowns appear to be a bipartisan event. They have occurred under presidents of both parties and with both parties controlling both the House of Representatives and the Senate. This was one of the more interesting aspects of the data. Intuitively, it would seem to make more sense that we would have more disagreements leading to a shutdown if there were mixed leadership between the Executive branch and the Legislative branch in Washington. Instead, the longest shutdown, lasting 34 days, occurred during President Trump's first administration with control of both houses of Congress. And I did not recall the frequency and duration of the multiple shutdowns during the Jimmy Carter administration from 1977 to 1980. And in fairness, President Reagan, the Great Communicator, had a string of shutdowns as well, although they tended to be shorter.

Clearly, government shutdowns are not new, nor are they the product of one political party over another. What is also apparent, if we look at the performance of the S&P during, and then twelve months post the shutdown, is that investors are generally not hurt by these actions. It is not surprising that the price action during the shutdown is more mixed. On any given day or week, the market's direction can vary. And any time we lengthen investment horizons, the percentage of positive outcomes goes up, but there have only been three instances of stocks being negative twelve months post a government shutdown, with an average return of over 12%.

Much of this might come from the fact that, despite the reasons for the shutdown, the solution normally results in more government spending and faster economic growth. Does this mean higher government spending is the key to economic growth? Of course not. But higher government spending is additive to growth as measured by GDP, and in the end, stock investors like growth a lot more than austerity.

So, back to the original question, "What is an investor to do?" Stick with the plan you have in place. And if you don't have a plan? Let's talk.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)