What we know (and don’t know) about the job market

The government shutdown has delayed the release of some important data

KEY POINTS

- The government shutdown has halted the release of some economic data, including the September jobs report.

- Labor market trends are increasingly influencing Federal Reserve policy, with rate cuts likely despite persistent inflation.

- Recent job data, including JOLTS and ADP reports, signal a cooling employment landscape, raising concerns about future economic momentum.

The government shutdown is impacting many people, and we hope we can find a resolution quickly. Beyond people's jobs, we are not getting several key data points, including what is probably the most important information within our economy at present: the monthly jobs report for September.

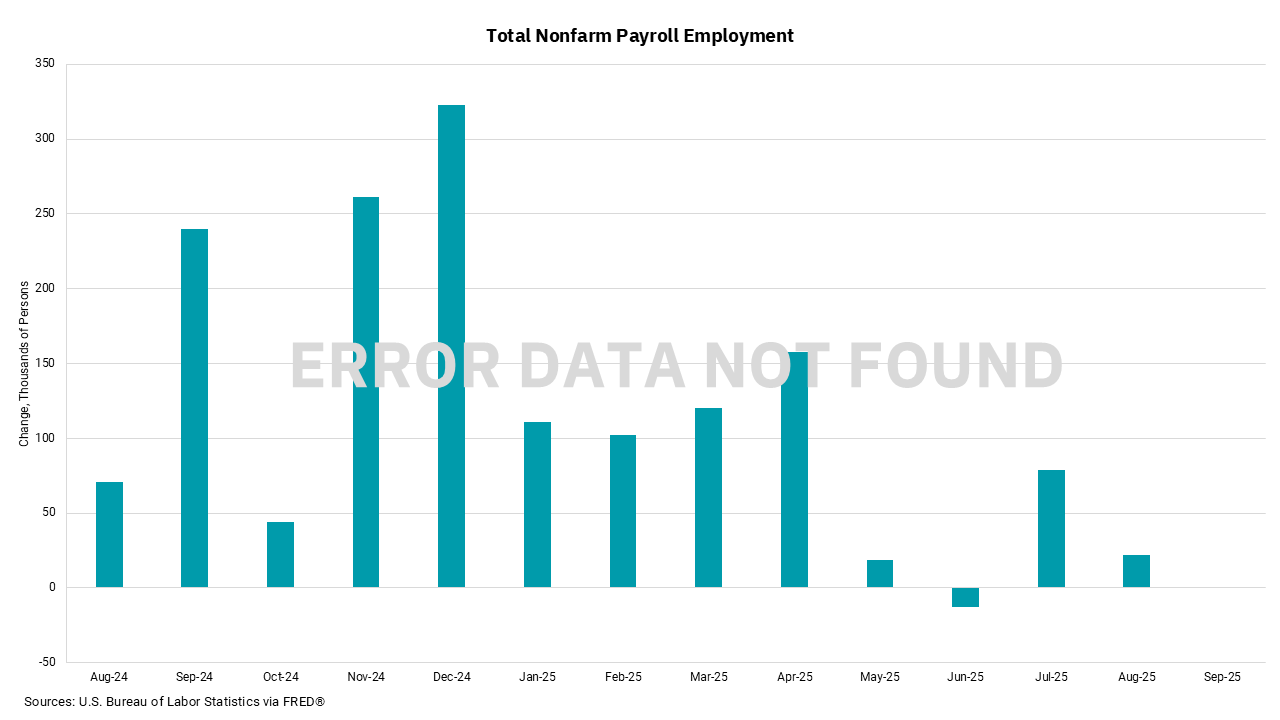

The Federal Reserve indicated that increasing downside risks to the job market were the primary reason they lowered rates at their last meeting, despite inflation remaining above target. This shift in focus from the inflation mandate to the labor mandate only increased the importance of the data we normally receive on the job market. Recent data showing a slowing rate of job growth, evident in our chart even without a report this month, along with a huge downward revision in new jobs over the last 12 months, has the markets primarily keyed on job-related data as we try to ascertain future actions from the Fed.

That's not to say we didn't get any job-related data this week. The Job Openings and Labor Turnover Survey (JOLTS) data on Tuesday showed a continuation of recent job market trends, as job openings remained subdued while the number of unemployed exceeded total job openings. This is a big reversal from earlier in the pandemic, when we reached a level of two open jobs for every unemployed person. Then, on Wednesday, we got a report from ADP on the private sector job market showing the first outright decline in employment since 2023. In fairness, the JOLTS data is not "bad," as the numbers are still better than average in the longer term. Additionally, the correlation between the ADP report and the monthly jobs report has lessened over the last few years. All this means that we are left with imperfect and incomplete information.

Our sense is that in the absence of data showing a marked improvement in employment, which we are not getting, the Fed is set to lower rates again at their late October meeting. It is hard to say that a 4.3% unemployment rate and positive gross domestic product (GDP) growth, 3.8% in the second quarter and a recent Atlanta Fed GDPNow model reading of 3.8% for the third quarter, means the Fed needs to get aggressive or outright accommodative in their policy. However, we do not want a negative trend in the job market to begin to accelerate. Our views on the positive outlook for growth in 2026 and 2027 help further lessen this risk, but some reduction in the restrictive nature of interest rates is still an acceptable policy outcome.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)