Ongoing shutdown continues to cloud the economic picture

Tighter immigration and aging demographics raising longer-term concerns

KEY POINTS

- The government shutdown has limited access to economic data, prompting reliance on private sector reports.

- The Fed is expected to cut interest rates further, as they’ve shifted focus from inflation to labor market risks.

- Long-term economic growth may hinge on demographic trends and immigration policy.

The government shutdown drags on, and with it, we are bereft of many of the economic data points we would normally have to talk about. All of this is occurring ahead of an upcoming Federal Open Market Committee (FOMC) meeting, where a decision will need to be made on the path of short-term interest rates.

In the absence of government data, we have leaned on private sector measures like the ADP National Employment Report and the Challenger, Gray and Christmas layoff reports. Both measures show evidence of a slowing in private sector hiring, while at the same time, layoffs remain subdued. The Fed’s recent shift in focus towards rising risks within the labor market, as opposed to inflation, which remains stubbornly above its target, has the market anticipating an additional 0.25% rate cut at the end of this month, with another 0.25% cut expected at the FOMC meeting in December. The just-released minutes of the last Fed meeting, where rates were cut by 0.25% in an 11-1 vote, show significant internal discussions around the idea of a rate cut at one or both upcoming meetings, with a very slim margin leaning towards two rate cuts. Looking into 2026, the Fed’s “dot plot,” which is not a forecast according to Fed Chair Powell, forecasts only one additional rate cut in 2026 (see what I did there?).

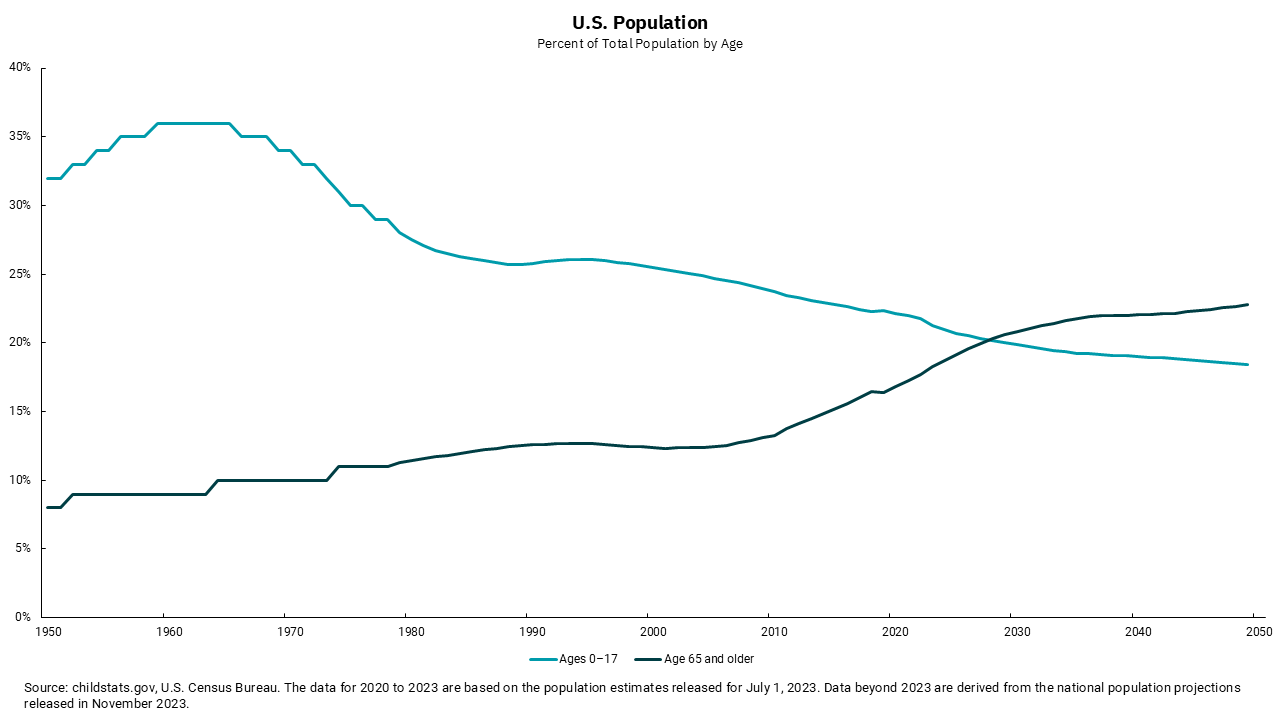

Stepping back from the data we don’t have in the short run, the bigger issue for the U.S. labor market and the overall economy might very well be the nation’s longer-term demographic trend and the shift in immigration policies. Our view on the latter is not political! There are two primary ways to grow the U.S. economy: grow the labor force and/or improve productivity. We may very well be on the cusp of a generational improvement in productivity due to artificial intelligence (AI), but the more stable and long-run way to assure growth is by growing the labor force.

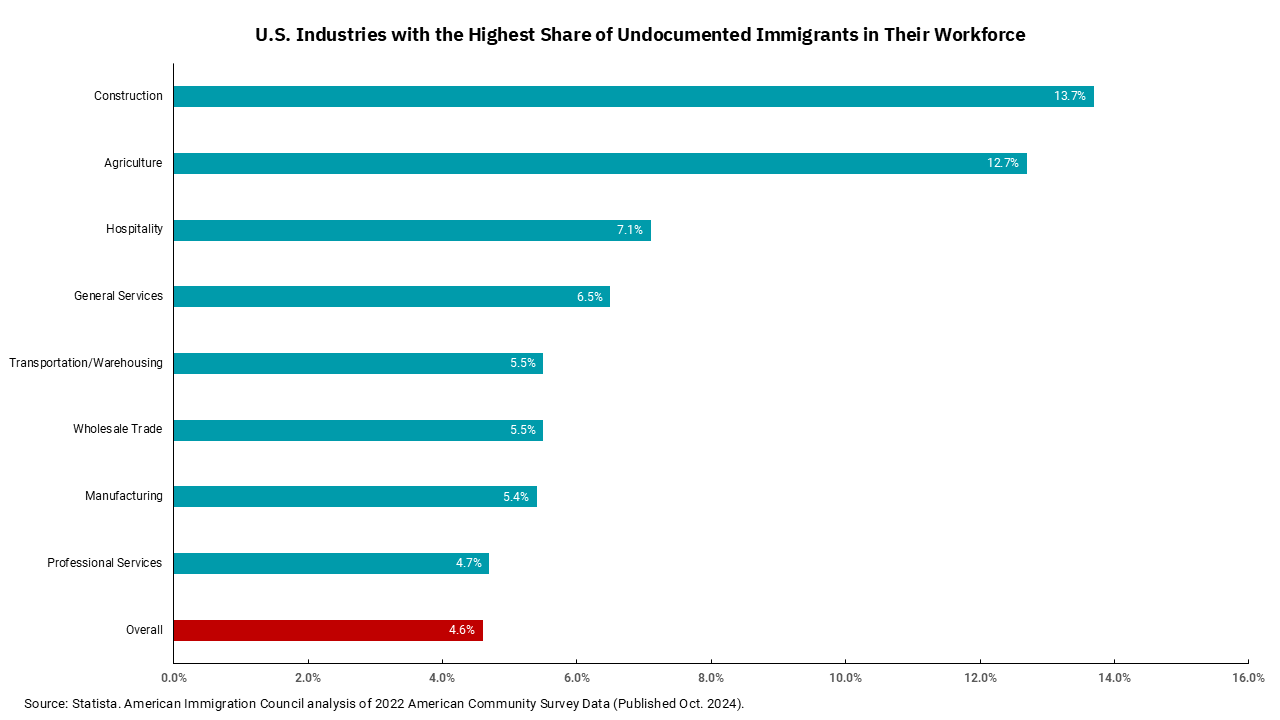

With this in mind, the top chart this week shows the aging of the U.S. population. We are pretty good at knowing what is going to happen over the next 17 years, as those babies are already born. Shifting that line upward is going to take some time. The bottom chart shows the share of various sector workforces made up of undocumented workers. The top three sectors—construction, agriculture and hospitality—are areas where a significant increase in deportations could threaten businesses’ ability to operate.

I think we can all agree that we do not need other countries’ criminals in our society. However, an aggressive deportation policy, which impacts those in our workforce, could lead to lower output and higher wages, potentially exacerbating the Fed’s fight to get inflation back to 2%. In short, there is a lot of room between wide open borders and mass deportation for a cogent immigration policy that helps us all. The sooner our leaders move away from the political aspect of this issue and towards the economic aspect, the better.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)