Relief is in sight for some renters and homebuyers

Rent costs in some areas are declining, as are long-term interest rates

KEY POINTS

- The CPI release arrived at a pivotal moment, shaping both Social Security COLA calculations and the Fed’s upcoming rate decision.

- Inflation came in slightly below expectations, reinforcing market confidence in a Fed rate cut this week.

- Slowing shelter costs and falling oil prices are easing inflation pressures and lowering long-term borrowing rates.

Despite the ongoing government shutdown, the Bureau of Labor Statistics (BLS) called workers back to the office to produce the Consumer Price Index (CPI) report, as this month marks the end of the twelve-month period used to calculate the Cost of Living Adjustment (COLA) for Social Security recipients. It also happened to coincide with the upcoming meeting of the Federal Reserve's rate-cutting committee, the Federal Open Market Committee (FOMC).

In a market that has been starved of data, this CPI release took on an even higher level of importance. Since our expectations are for the FOMC to cut rates on Wednesday, the general idea was that it would take a material miss to the upside on inflation to alter the rate outlook.

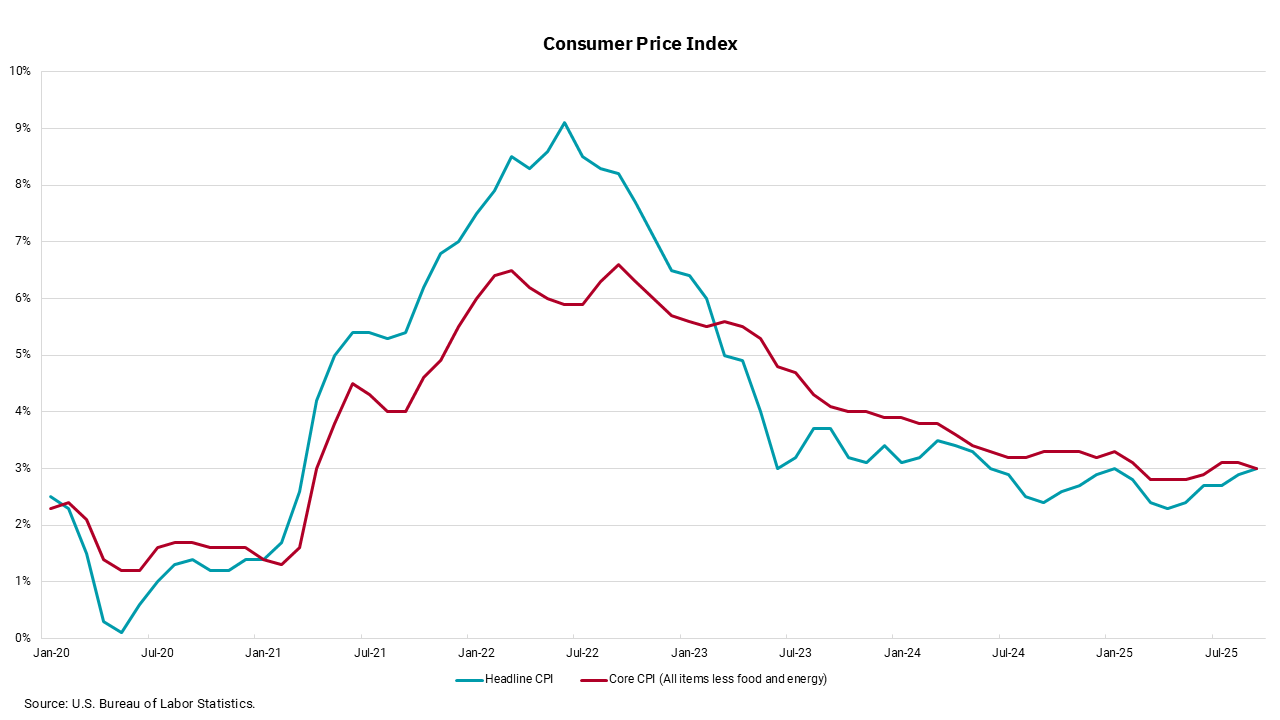

The CPI release showed headline inflation up 0.3% for a year-over-year rate of 3%. The "core" rate came in up 0.2% which produced a year-over-year increase of 3% as well. These numbers are higher than last month’s figures but 0.1% below expectations, so the markets have responded favorably and expectations for a 0.25% cut this week have been cemented.

The reality is, however, that these numbers also show the path to 2% remains slow. Headline inflation showed that there are sectors—apparel, appliances, furniture and toys —where the impact of tariffs can be seen, but overall headline and core inflation are being supported by reduced inflation in shelter costs. Indeed, real-time rent data shows areas where rent declines are occurring. Shelter costs make up a material part of the overall CPI, and while consumers can and do adjust spending patterns in response to many of the areas we measure for inflation, it is hard to escape the cost of where they live.

Reduced shelter inflation, along with lower oil prices, is also leading to a decline in inflation expectations. This is important, as it is longer-term rates that drive borrowing costs, like home mortgages. The 10-year Treasury has fallen below 4%, leading to lower borrowing costs for home buyers and providing more room for homeowners to refinance.

It is too early to say inflation is vanquished, but the trends in place now should allow the Fed to reduce rates this week and again in December, as well as provide some welcome relief to longer-term borrowers, too.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)