Why there’s ‘no riskless path’ forward for the Fed

With rate cuts underway and quantitative tightening set to end, the Fed faces internal divisions and continued uncertainty

KEY POINTS

- The Fed reduced rates by 0.25% in October and plans to end quantitative tightening by December.

- Internal FOMC disagreements highlight uncertainty around future rate moves, including December’s meeting.

- Markets and policymakers remain closely aligned for now, but diverging forecasts suggest volatility ahead.

The rate-setting arm of the Federal Reserve, the Federal Open Market Committee (FOMC), met from Oct. 28-29 to discuss the economic outlook, inflation, the labor market and what, if anything, they need to do from a monetary policy standpoint. Despite having very little information as the government shutdown drags on and impacts the release of economic data, we expected the Fed to reduce short-term interest rates by 0.25%, which is exactly what they did.

In addition, Fed Chair Powell indicated that by December, the Federal Reserve would end its "quantitative tightening" program, which has involved shrinking the size of its bond portfolio, comprised of Treasuries and mortgage-backed securities. Within this process, the Fed had not been actively selling securities; rather, they have stopped reinvesting maturities, which has led to lower overall holdings. Stopping this program should be viewed as an easing of monetary policy, different from a rate cut, but a move towards less restrictive policy nonetheless.

So far, so good...but some additional questions were raised as we saw the vote for the move and then listened to Fed Chair Powell's comments in his post-meeting press conference. In what appears to be an increasingly common outcome, there were two dissents to the decision to lower rates. Recall there recently were two dissents for the first time since 1993, but in this instance, one dissent was in favor of a 0.50% move while the other dissent was for no move at all. This means that there are disagreements within the FOMC, not only about the size of the move but also about the direction. During the post-meeting press conference, Chair Powell described the varied outlooks and stated another cut in December was not "a foregone conclusion." Fed funds futures showed a decline from a 90% chance of a cut to around a 75% chance after his comments.

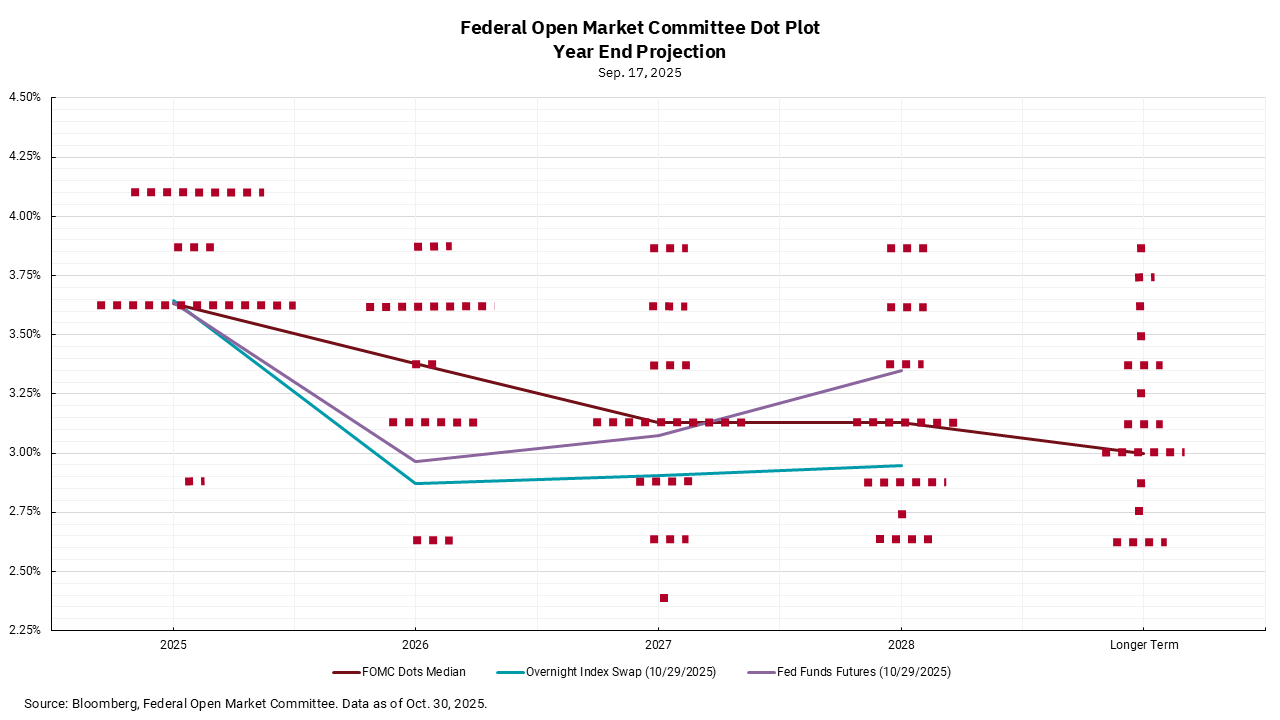

With all this in mind, in this week’s chart we are revisiting the Fed’s recently updated "dot plot." Recall that these are dots representing the outlook of all FOMC members, both voting and non-voting. We have also plotted Fed Funds futures and overnight index swaps (OIS), as they are market-based measures of the rate outlook. The interesting aspect of this exercise is when the market and the Fed hold divergent views on future policy. At this point, the two are fairly close together, but the chart reveals a wide dispersion of individual views going forward. The Fed's current focus is on the labor market and trying to make sure it supports growth from that standpoint. However, we all know that inflation is not going away easily. As Fed Chair Powell has stated, there is no "riskless" path going forward.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)