Housing affordability a ‘local market battle’

Neither 50-year mortgages nor declaring a national emergency would solve the problem

KEY POINTS

- Housing affordability is below the 30% income threshold, signaling a challenging market environment.

- Limited housing supply and elevated mortgage rates are major drivers of affordability constraints.

- Potential solutions like 50-year mortgages and regulatory changes would only offer limited relief without broader market shifts.

A new term is becoming more prevalent when describing the difficulties many are facing in today’s economy: affordability. This term encompasses many aspects of how consumers feel about their present situation. Some data would indicate that inflation is subsiding, while consumers see many areas of their own budgets strained with outsized price increases in areas such as insurance and healthcare. For many, the sense is that the cost of overall living is rising faster than the most recent reading on the core Consumer Price Index (CPI) at 3%.

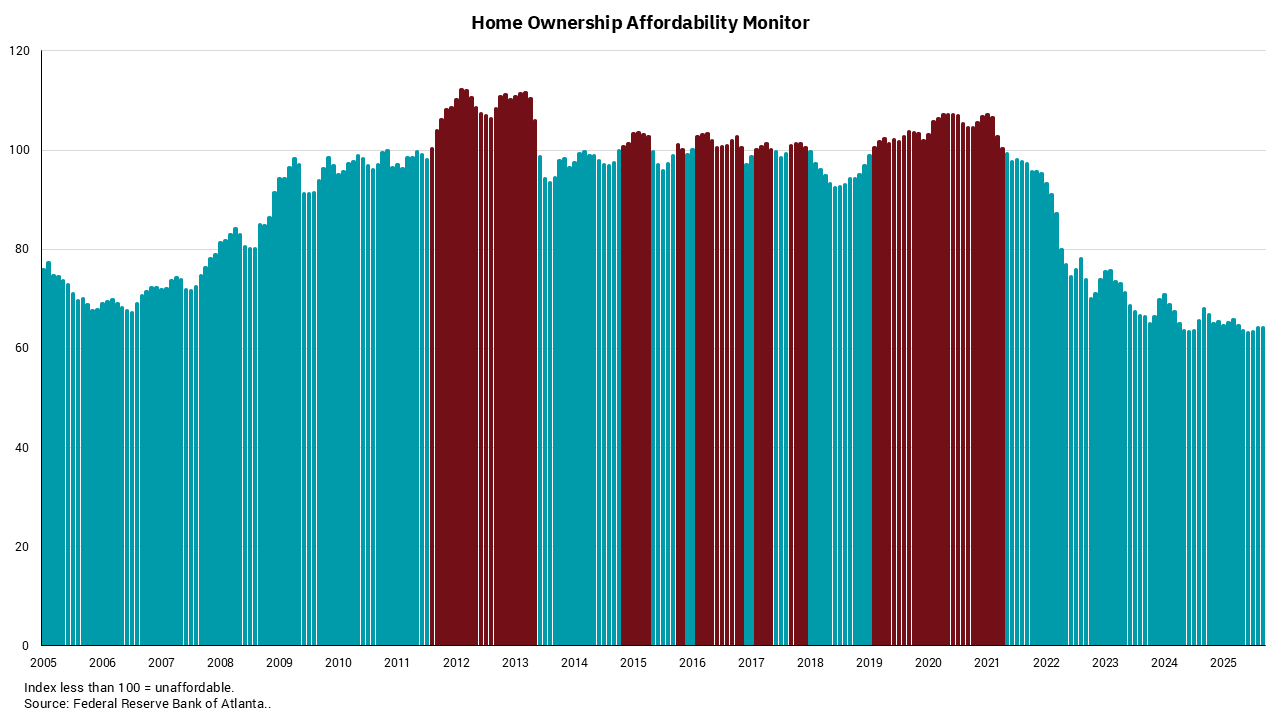

An area where affordability has long been measured is in the housing industry. Our chart this week shows housing affordability back to 2005. For the purposes of this index, the breakpoint of affordability is when the overall cost of ownership exceeds 30% of the annual median household income. This overall cost of ownership includes monthly principal and interest, as well as taxes and insurance on the median price of a home nationally. Obviously, this index will be different for different locales, but looking at the aggregate data can give us an important view into the overall housing market.

The view, at present, shows that we are in a difficult affordability environment, as is evident in this week’s chart. In it, the red bars indicate periods when the total cost of ownership was less than 30%, which means affordability was positive. The blue bars below the line are when the total cost of ownership exceeded 30% and affordability was low. The overall level of homebuilding since the financial crisis has lagged the required number of new homes based on population by around four-to-five million units. This means overall supply is constrained, which is one factor in the higher price levels.

In addition to the cost of insurance and overall tax levels, today’s housing market faces a combination of higher mortgage rates and higher prices. When combined, it is easy to see why affordability is so constrained. At these levels, the path back to affordability will require significant changes in multiple variables. We would need to see a combination of higher incomes, lower prices, lower rates and reduced costs of insurance and taxes. In a supply-constrained environment, this might be difficult to attain.

The administration recently announced the idea of 50-year mortgages, along with the chance of declaring a national housing emergency to reduce the federal regulatory burden. Neither of those ideas would solve the current situation completely. Most housing regulations are established at the state and local levels, rather than the national level. While extending the maturity date of a mortgage might reduce the principal part of a monthly payment, higher rates and slower equity build might offset any advantage of extending. There are several efforts underway to increase the supply of affordable housing, but this is going to be a local market battle on many fronts.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)