Car loan delinquencies now exceed Financial Crisis levels

The culprit? Higher prices, higher rates, more expensive insurance and higher repair costs

KEY POINTS

- Consumer spending is increasingly driven by the top 20% of earners, while lower-income households are struggling with inflation and debt.

- Delinquency rates on car loans for less creditworthy borrowers now exceed pre-pandemic and Financial Crisis levels.

- Tax refund season tends to temporarily ease delinquencies, but inflation continues to disproportionately impact those with the least financial cushion.

When considering the health of the U.S. consumer, which is important as some two thirds of U.S. gross domestic product (GDP) is driven by consumer spending, the job market normally tops the list of factors to consider. As the job market has cooled, the Federal Reserve has become more engaged in lowering rates despite continued slow progress toward its 2% inflation target. Yet looking at aggregate data can sometimes provide an incomplete picture or give an overall impression that is different than what is being felt, and lived, by many consumers, especially those in the lowest income brackets.

You may have heard or read commentary highlighting a "K" shaped recovery or economy. The idea is that consumers on the upward sloping side of the "K" are doing fine, while those on the downward sloping side of the "K" are struggling. Not surprisingly, the side a consumer resides on is driven primarily by their income. Higher-earning consumers, who generally own the majority of financial assets, such as housing and stocks, are doing fine, as their net worth has increased by a greater amount than inflation. Presently, the top 20% of wage earners are driving most consumer spending while the bottom 80%, particularly the bottom 50%, have limited reserves or financial assets to help offset the scourge of inflation.

We see a similar dichotomy when looking at consumer debt. Overall consumer debt levels are lower than the pre-pandemic period and are much lower than they were during the period leading into the Financial Crisis. That does not, however, mean that all consumers are doing better at servicing their debt.

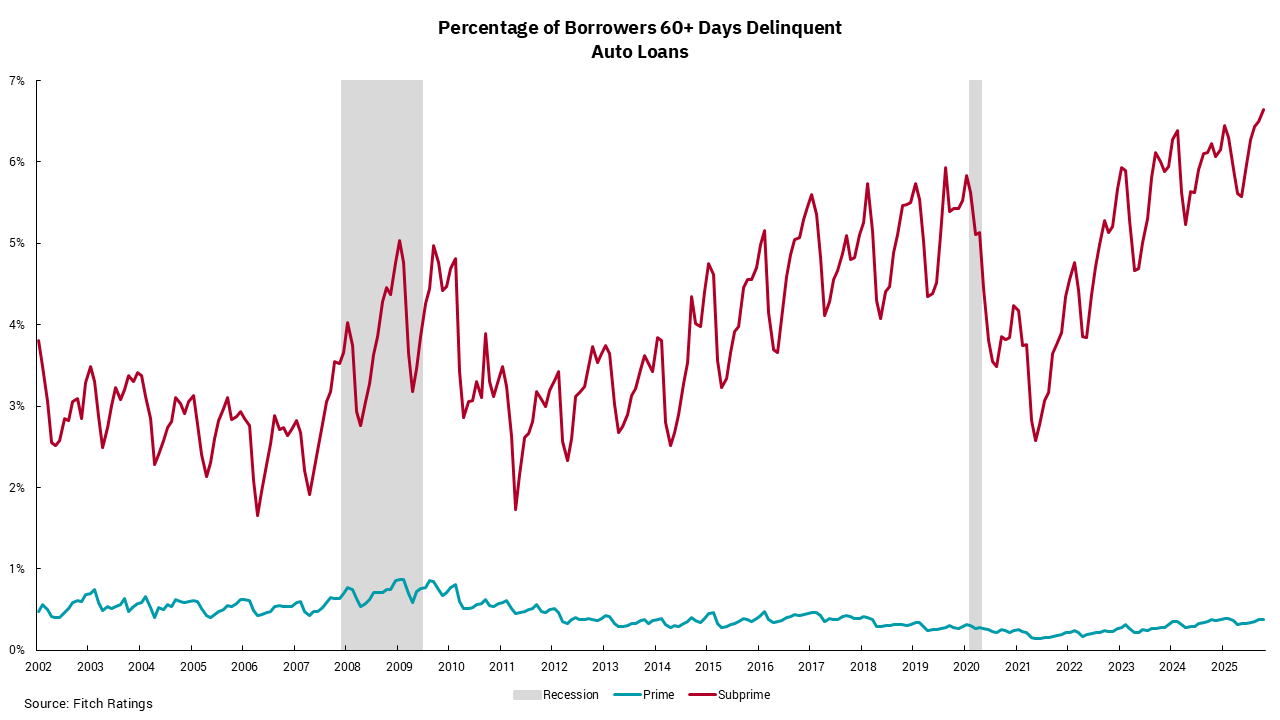

Our chart this week looks at car loans in particular. Recent stories about two large used-car companies going bankrupt have highlighted the divergent positions of consumers. Tricolor Holdings and First Brands both had business models that focused on selling and financing cars to less creditworthy borrowers. As the chart shows, coming out of the pandemic, less creditworthy borrowers saw repayment levels improve dramatically. With the federal government providing trillions in stimulus while pausing debt repayment on student loans, it is not surprising to see this improvement. However, as pandemic-era stimulus was spent and student loan payments have resumed, delinquency rates have climbed rapidly and now exceed pre-pandemic and even Financial Crisis levels. It seems the combination of higher prices, higher rates, more expensive insurance and higher repair costs is more than many lower-end consumers can handle. This increase has meant a boon to one business, though: auto repossession companies.

As an interesting side note to the data, note the consistent decline and then increase in delinquencies within each calendar year. The culprit? It would seem tax refund season leads to lower delinquencies for a period before increasing into the end of the year. Our outlook for a significantly higher level of tax refunds next year could lead to a bigger decline in delinquency rates. This is another example of the insidious impact of inflation on those who can least afford it.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)