Why the Fed is likely to cut rates this week

Weakening job market overshadowing sticky inflation

KEY POINTS

- The Fed’s dual mandate aims for full employment and price stability, with a 2% inflation target guiding policy.

- Recent rate cuts suggest growing concern over employment risks despite inflation remaining above target.

- Historical context shows evolving definitions of “full employment,” adding complexity to Fed decisions today.

As many of you know, the Federal Reserve has a dual mandate - full employment and price stability. The definition of "full employment", according to what is available on www.federalreserve.gov, is "the highest level of employment or lowest level of unemployment that the economy can sustain in a context of price stability." I see no numbers in that definition. As for price stability, the same website states, "Prices are considered stable when consumers and businesses do not have to worry about costs significantly rising or falling when making plans or borrowing money for long periods." The Federal Open Market Committee (FOMC) judges that an inflation rate of 2% over the longer run, as measured by the annual change in the Personal Consumption Expenditures (PCE) Price Index, is most consistent with the Fed's price-stability mandate. Whew! At least we do have a number here, 2%.

Sometimes, both mandates are calling for action in the same direction. If the economy is running hot, leading to tight employment markets reflected in increasing wage pressures and higher inflation, the course of action from the Fed towards higher rates is clear. On the contrary, if unemployment is rising and inflation is falling as demand wanes, the need for lower rates from the Fed is obvious. Sometimes, however, the Fed is trying to decide which mandate matters the most and the path forward is not without risks. Such is the case today

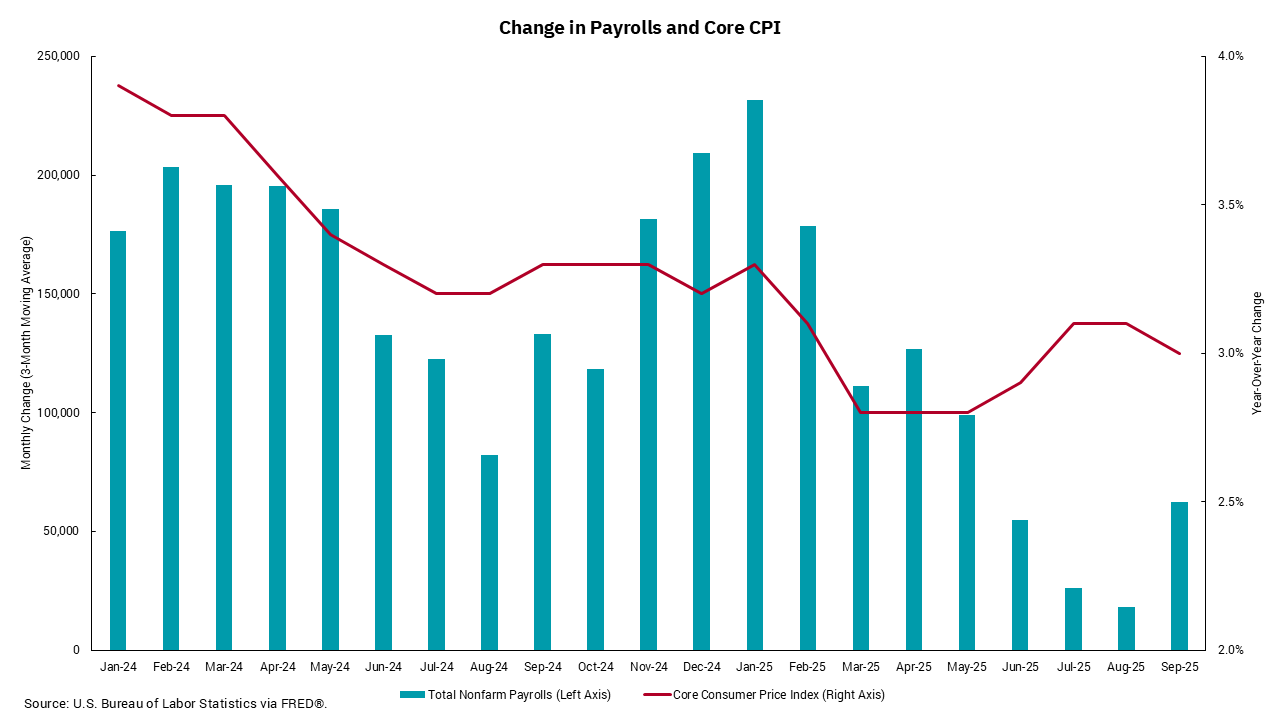

Our chart this week plots the annual rate of inflation—as measured by the "core" Consumer Price Index (CPI), which excludes volatile food and energy prices—against the monthly change in payrolls since January 2024. Over this period, the Fed has reduced the overnight Fed Funds target rate by 150 basis points, or 1.5%, from a target range of 5.25-5.50% to today's 3.75%-4% range. Much of this reduction has been led by the decline in inflation from 4% to the most recent reading of 3%. The need to lower rates due to the "full employment" part of the mandate was less pressing as new job growth remained positive and the unemployment rate has been stable around 4.2%.

Recent Fed commentary and actions suggest a shift in focus from inflation to employment. Core inflation, while lower in September than in August, is still higher than it was some months ago. As a result, recent rate cuts would seem to be driven more by the risks of a slowing job market than continued progress towards the Fed's target of 2% inflation. (One could reasonably wonder why price stability means 2% inflation, rather than something more stable, like 0%, but I digress.) In the past, we have seen the unemployment rate rise quickly once it starts higher, so some measure of caution by the Fed is warranted. Then again, I recall a time when "full employment" was thought to be a 5% unemployment rate. It would seem "full employment' might be a slightly lower unemployment rate now. In sum, look for another rate cut from the Fed this week.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)