How financial markets fared in 2024

It was a ‘fantastic year’ for stocks and gold; bonds also positive

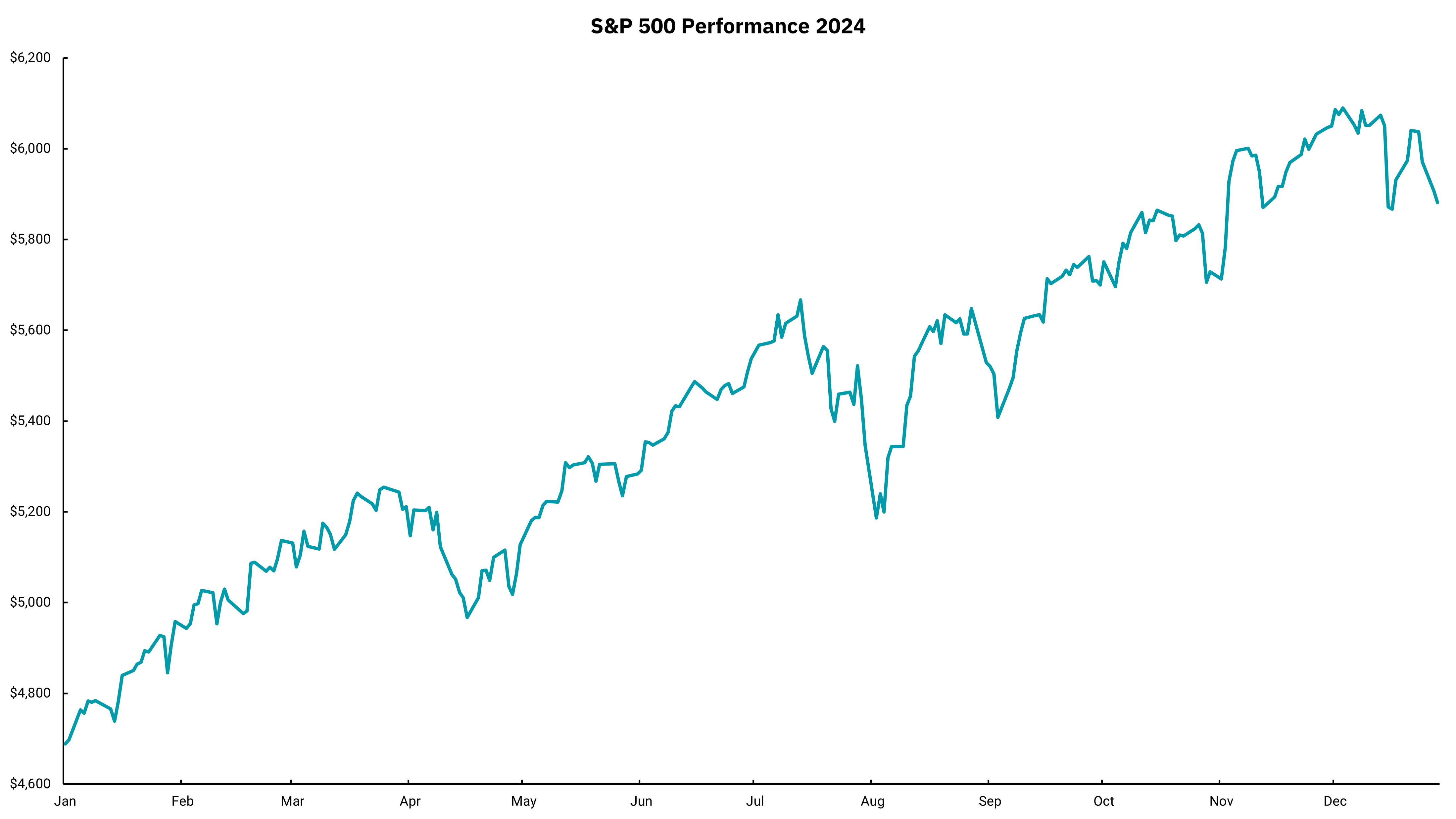

Despite a bit of a stumble as Santa Claus came and went, 2024 was, by most any measure, a fantastic year for domestic stock markets. The S&P 500 hit 57 new all-time highs during the year and closed with a gain of 25%(including dividends). It was the second year in a row of 20%+ gains, and we are now some 70% higher than the mid-October 2022 lows.

Other indexes were mixed, with the NASDAQ outperforming the S&P on the back of its heavier tech weighting and finishing the year with a 29.6% gain. Meanwhile, the 30-member Dow Jones Industrial Average finished the year up 15%. The domination of large-cap companies continued during the year, as mid-cap stocks ended the year up 13.9%, while small-cap companies were up 8.7%. The trend of domestic over international also continued. Developed international stocks, as represented by the EAFE index, were up only 3.8%, while emerging market stocks did a little better at up 7.5%.

For bond investors, the year overall was positive as the Federal Reserve began lowering rates and corporate bond spreads narrowed over the course of the year, but not all interest rates were down for the year. The yield curve, which had been inverted for the better part of the last two years, un-inverted as short-term rates fell while longer-term rates went up. We can see this as a one-year Treasury bill closed 2023 at 4.76% and then fell to 4.14% by yearend 2024. The two-year Treasury note was the fulcrum of rate changes, ending 2023 at 4.25% and closing 2024 at 4.24%, virtually unchanged. The 10-year Treasury note, however, closed 2023 at 3.88% and closed 2024 at 4.57%. This means loans tied to shorter-term indexes, like the Secured Overnight Funding Rate (SOFR), have seen rate declines while loans tied to longer-term rates, like 30-year home mortgage rates, are higher now than at the end of 2023. The broad Bloomberg Aggregate bond index was up 1.3% for the year, while investment-grade corporate bonds were up 2.1% and highyield bonds were up 8.2%.

In commodities, oil was virtually unchanged, closing 2024 at $71.72 per barrel, compared to the 2023 closing price of $71.65 per barrel. We know there was a lot of movement both ways over the year, while another commodity, gold, had a fantastic year, with prices moving from a 2023 closing of $2063/oz to $2624.5/oz at the end of 2024.

Looking forward, there are always cross currents, yet we remain more optimistic than pessimistic as we move into 2025. For more, we hope you can join us for our 2025 economic and market outlook discussion on January 9.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)