Is the strong jobs report bad news for stocks?

Jobs data calls asset valuations, future Fed rate cuts into question

The first full week of January 2025 was capped off by a December employment report that exceeded almost every expectation. The measure of new jobs, nonfarm payrolls, was expected to be around 175,000 yet was reported at 256,000. There were very slight downward revisions to the last two months' numbers but, net those, the number of new jobs was still significantly higher than expectations. Along with the steady labor force participation rate, the increase in jobs led to a decline in the headline unemployment rate (U-3) to 4.1%. While more volatile, the U-6 unemployment rate also fell, coming down 0.3% to 7.5% from 7.8%. The only part of the report that did not exceed expectations, thankfully, was average hourly earnings (AHE), which were reported up 0.3%, a 3.9% annualized rate, after a series of reports at 4%.

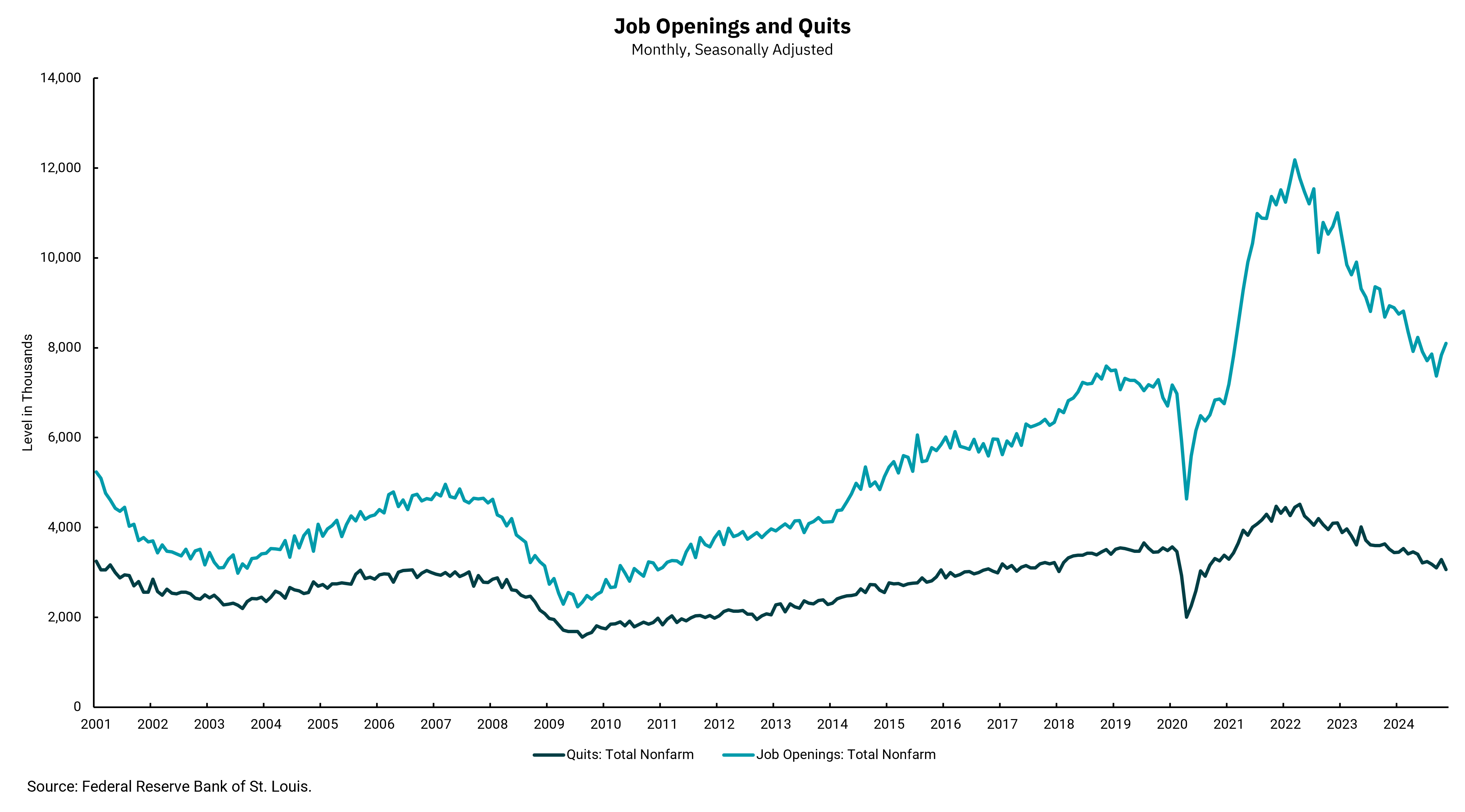

This week's chart shows another part of the jobs data we get the first week of each month. In this case we are looking at the Job Opening and Labor Turnover Survey (JOLTS) and highlighting the number of job openings as well as the number of job quits. In both regards, we see a job market that is becoming more balanced. Normally as the number of open jobs declines, the quit rate slows, and companies see slower turnover rates. This is also tied to an environment where wage pressures tend to recede, allowing that part of inflation to fall.

Yet a close review of the open jobs numbers in this week’s chart reveals a bit of a reversal as open jobs jumped higher. When taken in conjunction with the stronger labor report from the Department of Labor, the markets are now wondering how much, if any, the Federal Reserve really needs to lower rates from here. We have mentioned before that even as the Fed has begun lowering short-term rates, longer-term rates have been floating higher.

After the jobs data release Friday morning, we have seen longer-term rates move up again, and stock prices are declining. Does this mean the employment data was bad for the economy? In short, no. In fact, the chances of a recession are lower now than before the report, as a strong job market is vitally important to supporting the U.S. consumer. However, the math of asset valuation is another story. And the high multiples on domestic stocks are at risk from higher interest rates..

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)