Existing homeowners hesitant to put up for-sale signs

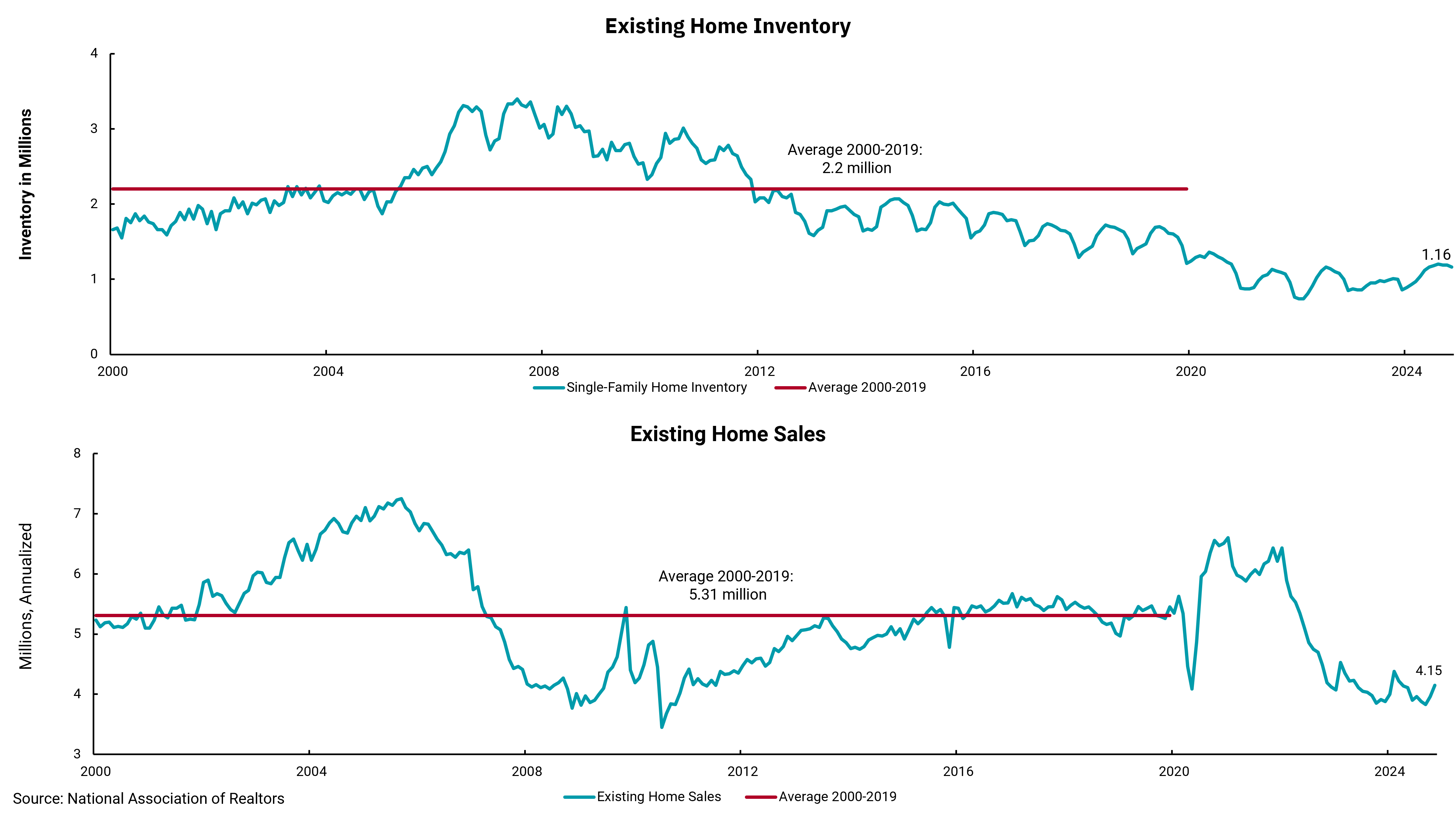

New housing market closer to ‘normal’ but overall home supply shortages persist

The new administration has been very busy changing and implementing new policies. However, one area of the economy—and a huge part of most lives, housing—has not been the subject of any recent news. It may be that the reason for this is the complexity of the problem.

The new housing market is closer to "normal" when looking at historical data, although years of underinvestment have left us millions of units short on the overall supply of single-family homes. Some period of "overbuilding" by historical standards is probably needed to help close the gap. However, high building costs, leading to high selling prices, along with mortgage rates near 7%, have resulted in home affordability measures near record lows. In addition, a regulatory environment filled with red tape and hoops through which to jump means that the idea of building affordable homes is just not profitable enough for many builders. This results in new homes being built that tend to be on the higher side of the price spectrum.

This week's charts look at the other part of the housing market, existing homes. This is a much larger part of the housing market, yet sales and supply are severely limited. Much of this limited supply is based upon the lack of incentive for existing homeowners to sell unless they have to. Why? Over 50% of existing 30-year mortgages are at 3.5% or below. Around 95% of all Americans with a mortgage are paying rates below prevailing market rates. And roughly 40% of all homes in the U.S. have no mortgage. The net effect of all this is that selling a home today means giving up a mortgage rate much lower than what is available for a new home purchase.

I would put myself personally in this position. My children are now grown, and a review of the utilitarian aspect of housing would indicate we have too much house. Downsizing would make a lot of sense, yet the mortgage I got during the pandemic means my monthly housing expense is far lower than I would be looking at, even with a smaller house and a smaller mortgage. So no, my house is not for sale. Millions of homeowners are in similar positions, so it seems difficult to see the inventory of existing homes for sale increasing anytime soon.

Since this issue is not one of demand, policies that might have made sense in the past, like down payment assistance, additional tax credits for first-time home buyers or even rate paydowns, do nothing but increase demand in a supply-constrained environment. In this scenario, affordability can get even worse as prices move up faster. Solving the supply side of things is not easy either. Affordable housing is a popular concept, but existing homeowners are loathe to see affordable options built within their comp sale area. Lessened regulation could help, but finding locations where land is affordable is difficult, and overall building costs, especially labor, remain costly. Multi-family has filled some of the gap, but single-family home ownership remains elusive for many.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)