Negative 1Q 2025 GDP doesn’t mean a slowing economy

Businesses imported more and built up inventories in anticipation of tariffs

In the scheme of economic data, the Bureau of Economic Analysis’ report on gross domestic product (GDP) is of somewhat lesser importance. That’s not because it doesn't have depth; in fact, it is one of the more comprehensive data points released. However, it is a lagging report and is subject to multiple revisions before being finalized, some three months after the end of the reporting quarter. In other words, it is generally old news.

Sometimes, though, as in the first quarter of this year, we can see the impact of shifts within the economy, which can give us some idea of what things might look like going forward. The high-change environment in which we find ourselves has led to behavioral changes for companies and consumers, and we can clearly see them in the Q1 2025 GDP report.

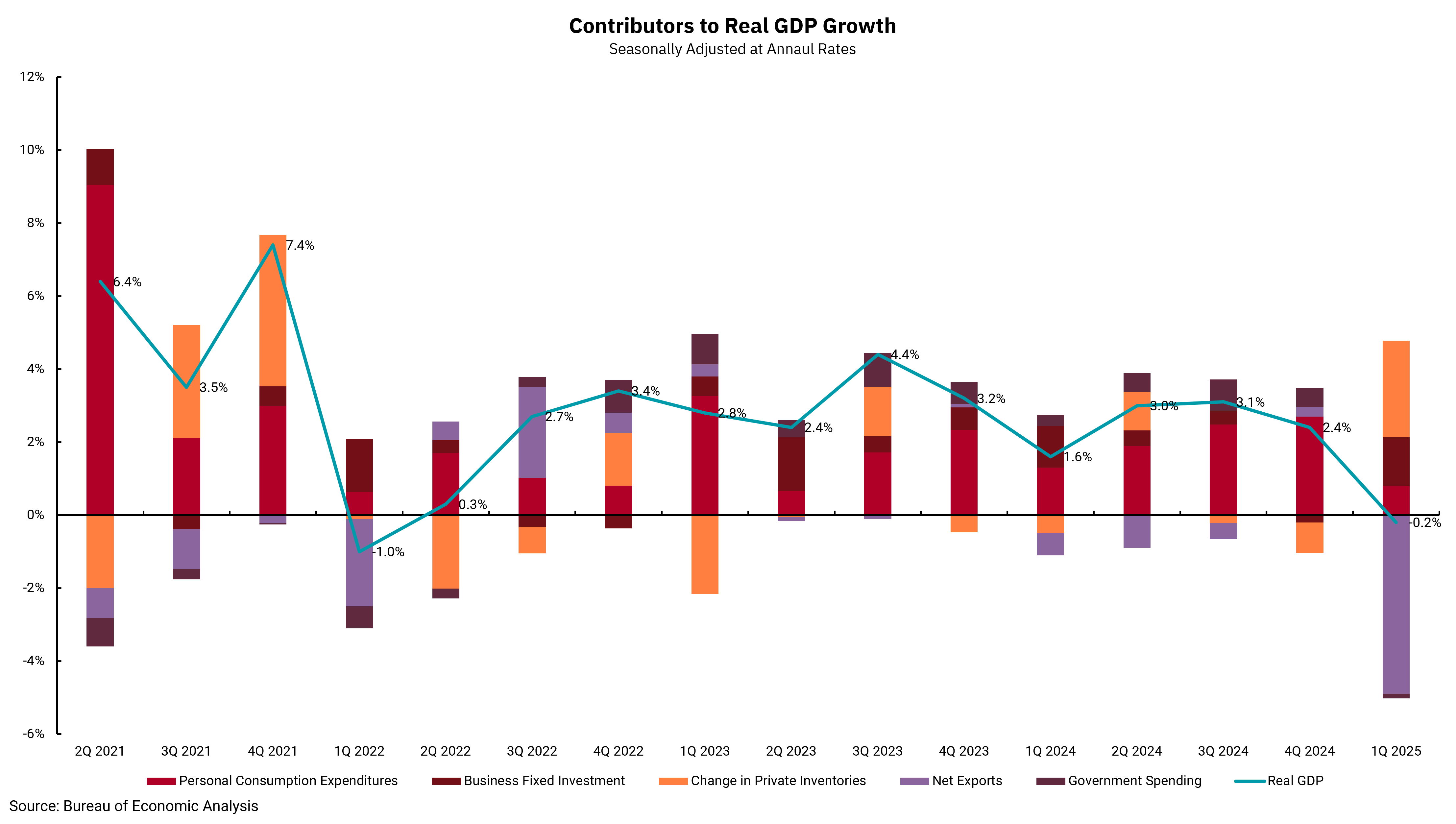

Our chart comes after our first revision to the number. Initially reported as a decline of 0.3%, the revised number now stands at a decline of 0.2%. Although not a huge change, the impacts of policy changes, primarily related to trade, remain clear. The Bureau of Economic Analysis' report allows us to see not just the overall growth rate or decline of the broad economy but also to peer into what makes up the final number. And in the first quarter, this gets interesting.

Most of the data makes sense in terms of whether they are a positive or negative component of GDP. Consumer spending, government spending and business investment are areas we watch not just for growth or contraction, but also for changes in the direction. Of these, personal consumption expenditures, or consumer spending, is the most important, as most of the U.S. economy is based on such activity.

The more interesting, and maybe puzzling, part of the first quarter is "net exports." As companies looked to avoid then-potential, now-real, , tariffs, they imported a lot. Negative net exports detract from GDP, and so this surge in imports reduced first-quarter GDP by a whopping 4.9%. The offset to this increase in imports is often a combination of consumer buying more goods, and companies increasing inventories. Indeed, inventories did grow and added 2.6% to first-quarter growth.

The net result is a slightly negative overall reading, but this is not a reflection of a reduction in overall activity. With another revision yet to come, we do not know exactly where first-quarter GDP will end up, but we can see the impact of policy changes on the behavior of businesses and consumers.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)