Small business owners optimistic for 2026 and 2027

Tax changes, enthusiasm over AI boosting hopes

We generally get two types of data as we consider the direction and speed of economic growth. So-called “hard” data covers topics like inflation and employment, while “soft” data aims to gauge public sentiment about inflation, employment and business prospects overall. It is not unusual for there to be times, as we have seen recently, where the “picture” of the economy from these two sources diverges.

Recently, despite data showing a reasonable level of economic activity, positive gross domestic product (GDP) and low unemployment, survey data on consumers and businesses were decidedly more dour. For some consumer surveys, we were at levels more closely associated with recessions, not positive growth and record equity index levels. Clearly, sometimes people “feel” differently than the economic data might reflect.

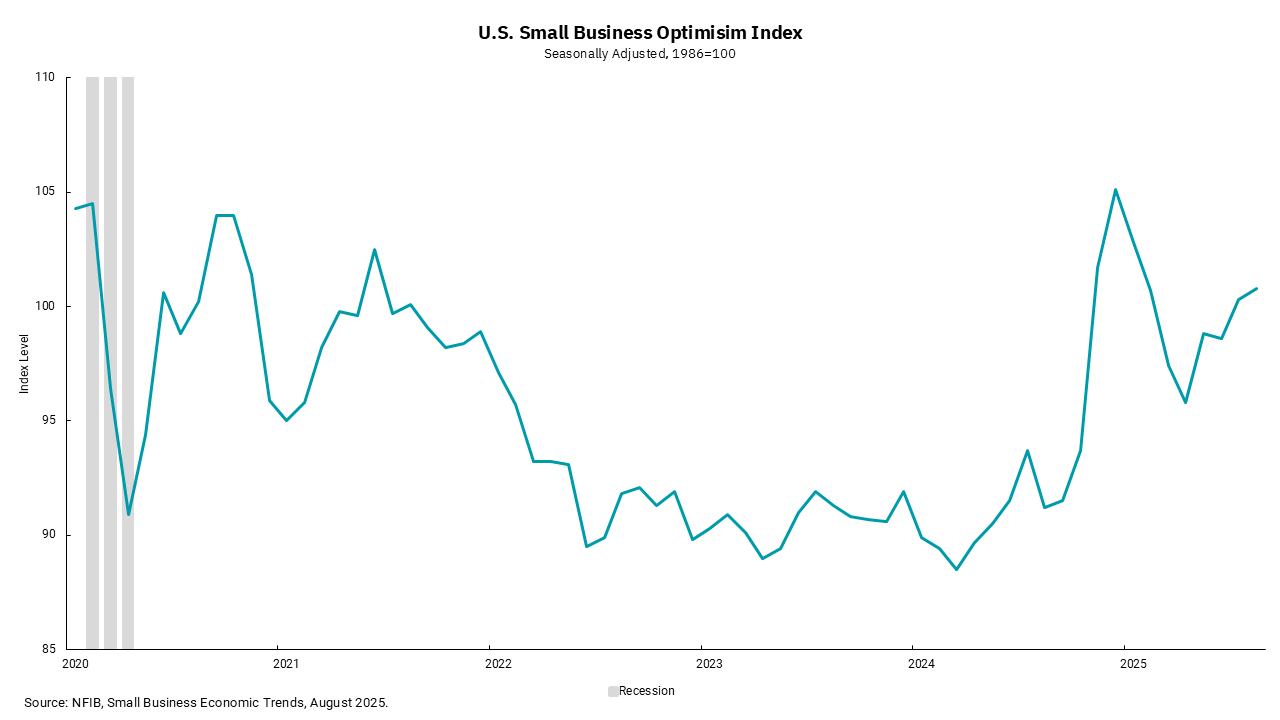

Our chart this week follows the small business optimism index. We find this index important because small businesses are responsible for a material portion of employment in the U.S. and drive much of the innovation within our economy. Many of the biggest companies in our economy today were small companies only a couple of decades, or less, ago. We took our chart back to the onset of the pandemic so we could see the rebound as the economy began to reopen, but then the U.S. went into a lengthy period of reduced optimism even as the overall economy continued to perform. The spike higher at the end of 2024 corresponded with the presidential election and an increasing sense of economic optimism.

This optimism, though, was met with the reality of some policies, like tariffs, which were viewed somewhat negatively for growth prospects. (We agree). Yet as time has gone by and the worst-case scenarios of the inelegant tariff policy roll-out have been scaled back, optimism is returning. The extension of the Tax Cuts and Jobs Act, along with the addition of some stimulative actions for consumers, has helped fuel some improvements in consumer optimism and an even greater rebound in small business optimism.

I feel this improvement when I visit with business owners during my travels. The additional benefits around expensing versus depreciation, and the ongoing burst of spending on artificial intelligence (AI), have businesses looking through our current period of slower growth and thinking about a better environment in 2026 and 2027. This could also be a factor in why it seems companies, while slowing their rate of hiring, have been slow to reduce workforces materially. Due to the memory of how hard it was to hire people over the last few years, companies might be willing to hold on to employees to make sure they are staffed for an improving economy.

We acknowledge the headwinds that the U.S. currently faces, including the recent softness in the labor market. Tame, if not declining, inflation, is going to give the Fed room to lower rates to some degree beginning this week. Lower rates can also add to a sense of small business optimism and put them, and us, in a position to remain way more optimistic than pessimistic as we think about the economy moving forward.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)