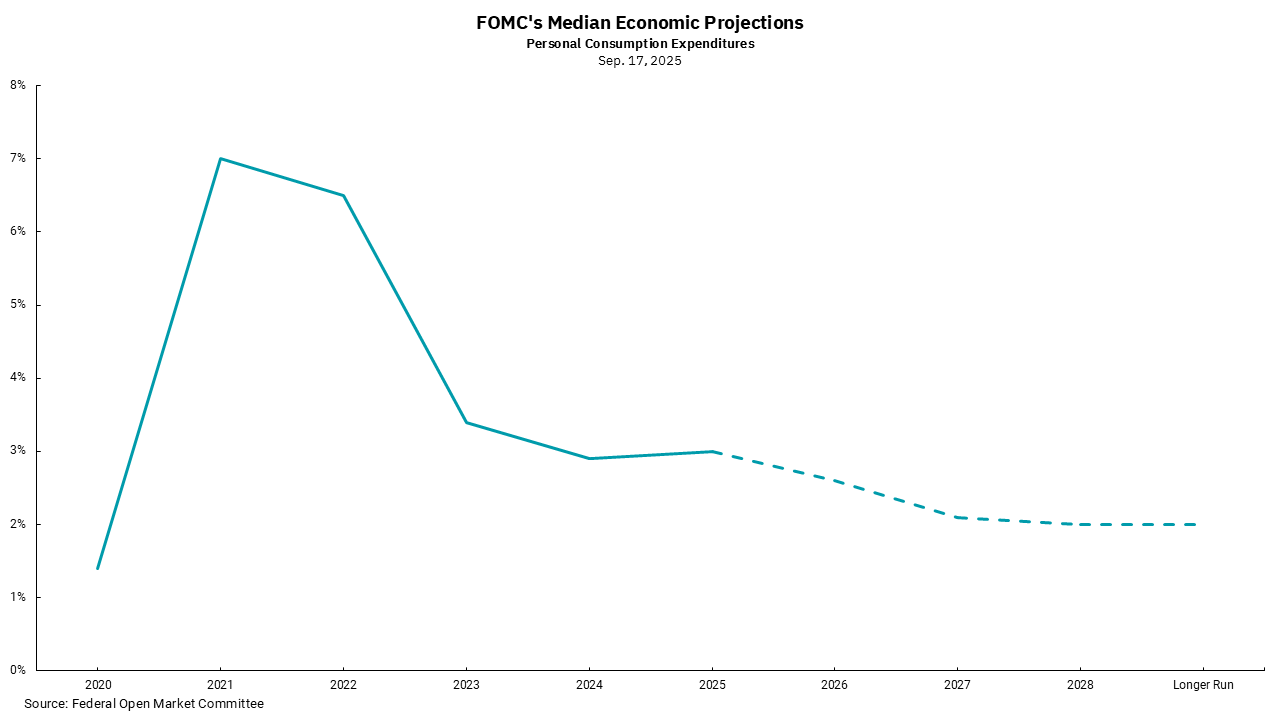

Inflation may be above 2% until 2028

Fed expecting only two more rate cuts in 2025 and one in 2026

The Federal Reserve’s decision to cut rates in September was widely expected and, for the most part, priced into the capital markets. The questions going into the Federal Open Market Committee (FOMC) meeting were primarily around the update to the Fed’s Statement of Economic Projections, or SEP. In this area, there were some differences worth discussing.

The vote was 11-1 to cut rates by 0.25%. Recall there were two dissents at the last FOMC meeting, and the one at this meeting was new Fed Board Governor Stephen Miran, who wanted a 0.5% cut. The two dissenters from the previous meeting, Governors Waller and Bowman, agreed with the move of 0.25% at this meeting. Looking forward, the central tendency of the dot plot is for two more expected rate cuts this year, but only one rate cut next year, where the market had been expecting three more. Interestingly, Governor Miran’s forecast for the rest of this year was for five rate cuts. At least we know he is an ardent supporter of the President’s views on rates.

The SEP had unemployment increasing slightly between now and year-end before beginning to decline, but remaining above 4%. Much of what happens to the unemployment rate depends on U.S. immigration policies and their impact on the size of the labor force. The Fed is forecasting continued slow job growth, while the size of the labor force shrinks slightly. Growth is also forecasted to improve as we move into 2026 and 2027, although remaining restrained at levels below 2%.

With all this in mind, our chart this week looks at the Personal Consumption Expenditures Price Index (PCE), which is the Fed’s preferred measure of inflation. Based on the FOMC’s projections, PCE will increase through year-end, which is the same as their previous forecast, before beginning to decline. However, now the Fed doesn’t see inflation declining to their 2% target until 2028. This could be a key reason the Fed is forecasting fewer rate cuts than what the market was building in. The good news is inflation will be declining; the bad news is it will be a very slow decline to 2%.

We see the factors influencing inflation as mixed at present. Housing, a material part of the inflation picture, is seeing moderation in prices and rents, with some areas seeing outright declines in rents. That is a tailwind for lower inflation. However, changes in the global trade environment and a more aggressive stance on immigration might present headwinds. While investments in plants and equipment and the need for more labor are good, they can lead to somewhat higher costs, which work their way into the inflation picture. Historically, we have seen inflation come in waves, and while the current outlook is not for a second wave of inflation, it seems clear it is going to be a while before inflation nears 2%.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)