The Fed—and financial markets—face data fog

The record-long government shutdown is creating uncertainty and weighing on investor sentiment

KEY POINTS

- The government shutdown has limited access to critical economic data, forcing reliance on estimates.

- Declining survey response rates are increasing the risk of major revisions in key reports like jobs and inflation.

- Inaccurate or incomplete data could lead to misguided monetary policy decisions and market volatility.

Following the recent meeting of the Federal Reserve's interest rate-setting arm, the Federal Open Market Committee (FOMC), Chairman Jay Powell likened the environment for making decisions to "driving in a fog." The government shutdown has resulted in a dearth of economic data that the FOMC and market participants would normally use to discern what might/should be done when it comes to monetary policy. We still have a number of private and industry-related reports to view, but we are not getting the same level of insight as needed.

Beyond the lack of government data, however, a deeper shift has been taking place, which may mean that the data we normally receive is not as accurate as it was in the past. Indeed, the recent Consumer Price Index (CPI) report, which was delayed but needed as this month's measure of inflation was used to help set the annual cost-of-living adjustment for Social Security recipients, had some 40% of the data imputed. That is, the actual statistics were not available, so estimates—one might also say guesses but educated guesses—were used to reach a final number. As it turns out, Social Security recipients will get a 2.8% cost-of-living adjustment (COLA) for 2026. Anecdotally, I am unaware of many seniors who think a 2.8% COLA will keep up with their actual increases in their budgets.

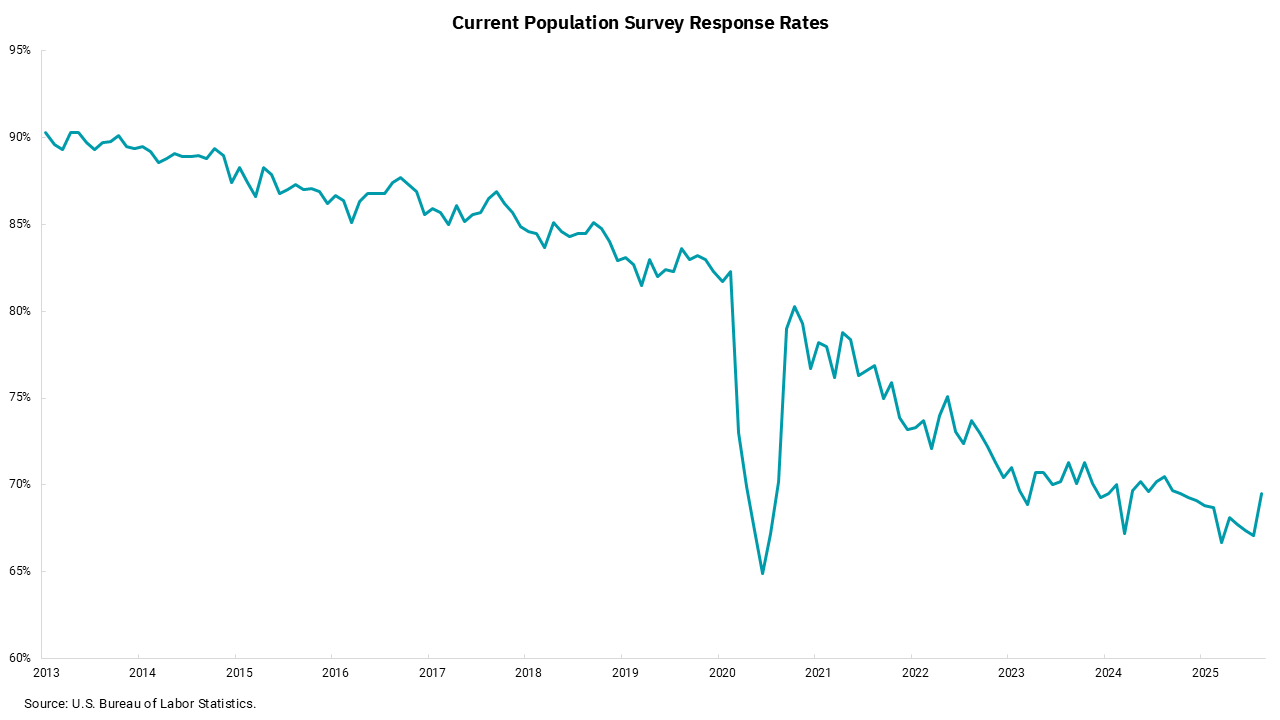

Looking at the data overall, we have been seeing a trend in response rates moving lower. Many government statistics include at least a component of survey information, where people or companies are contacted and asked to respond with information that is then used to compile reports. As with any dataset, the bigger the number of inputs, the greater the accuracy, or better stated, the lower the standard error. In lay terms, a smaller sample size means a greater chances of a big revision increase.

Our chart this week shows the response rate for population surveys, but a similar trend can be seen across the survey spectrum. The implications are that money is moving, and that markets are higher or lower based on that data, yet it might turn out to be materially different after first look. A recent annual revision on new job growth showed some 900,000 fewer jobs than initially reported. The monthly jobs report is one of the more important monthly measures we get on the economy and plays a huge role in monetary policy decisions, and yet, declines in response ratios have led to big revisions each of the last two years. It may be that a review of how we gather data is warranted, as smaller sample sizes are just less accurate.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)