Is the US leading the dance of deglobalization?

Tariffs both an effect of—and a catalyst for—the changing world economy

This article is part of our upcoming 2026 Annual Market Outlook. Click here to visit our outlook webpage and register for the live discussion, to be held Jan. 15, 2026 at 11am CT.

KEY POINTS

- For the U.S., tariffs have become both a revenue source and a strategic tool to attract foreign investment and boost domestic manufacturing.

- Uncertainty around tariff structures created volatility in global markets, but worst-case scenarios have since been priced out.

- The move toward regionalization and resilient supply chains marks a long-term shift from efficiency to security in global trade.

As the U.S. works to reposition itself on the world’s stage through tariffs and tax incentives, the ripple effects have been reverberating across global markets. As nations recalibrate, new trade agreements and regulatory frameworks are emerging, signaling a shift toward regionalization and friend-shoring rather than a globalized economy.

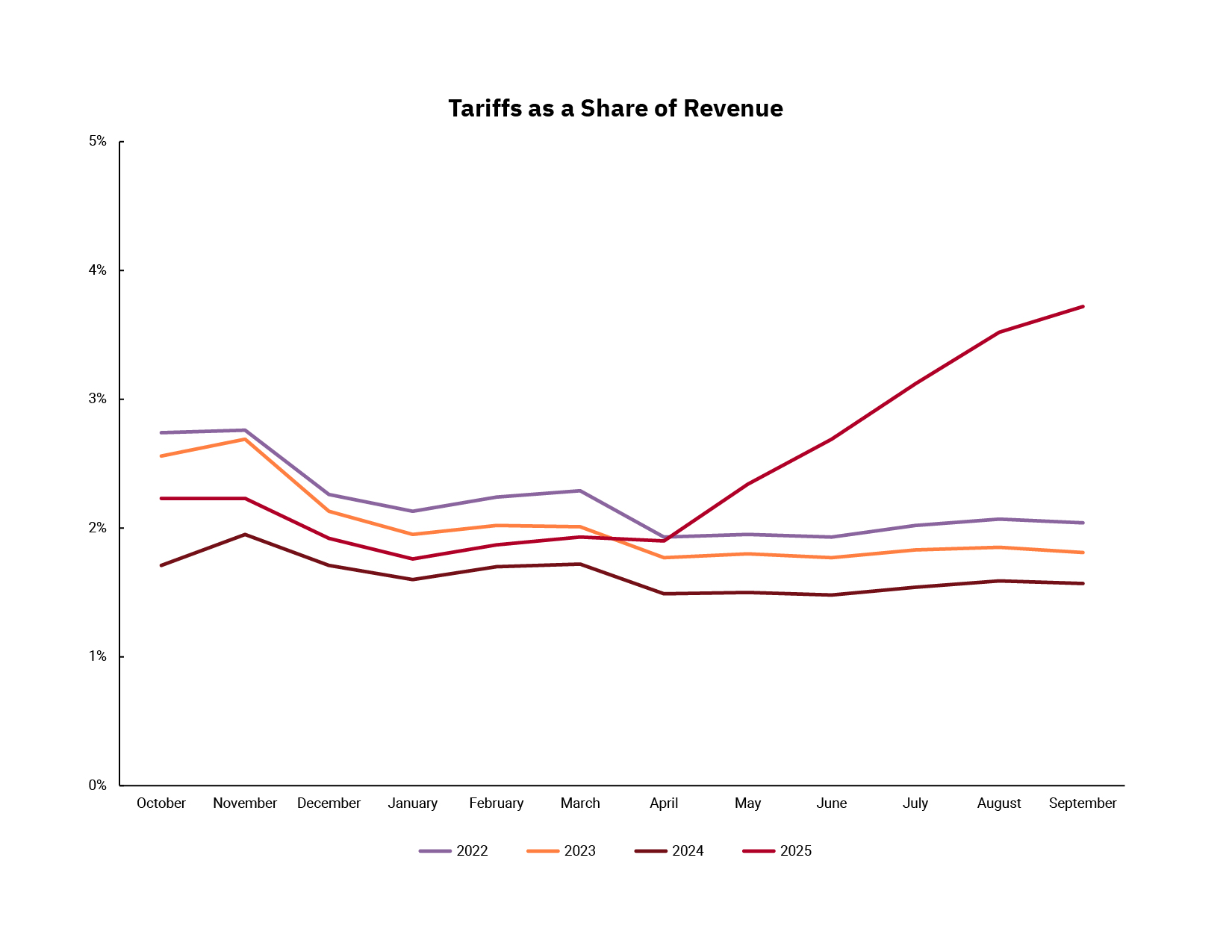

Some of these effects are clearer to see than others. Take revenue, for example. Gross tariffs and certain other excise taxes have brought in $264.7 billion in revenue into the U.S., as of Dec. 18, according to data from the Bipartisan Policy Center, calculated from daily Treasury statements. That’s around 141% more than the amount of revenue brought in by gross tariffs and other certain excise taxes by that point in 2022.

However, it’s also important to keep in mind the bigger picture around tariffs, said Brian Henderson, chief investment officer at BOK Financial®.

“Tariffs aren’t just about revenue; they create an advantage for companies already operating in the U.S. and have been used as a negotiation tool to bring foreign investment here,” he said. “That negotiation dynamic isn’t something we have seen at this scale before.”

More clarity than before—but some uncertainty persists

Going into 2025, it was already clear that tariffs would be a major part of the Trump administration’s push to revive American manufacturing and reduce the U.S. trade deficit. Yet many of the details surrounding the tariffs, including their size and scope, remained a wildcard. Furthermore, as they rolled out, it was one surprise after another, experts said.

“Early on, we thought tariff policy would mean reciprocal rates: if you tariff my exports at 10%, I tariff yours at 10%,” said Steve Wyett, chief investment strategist at BOK Financial. “Instead, what we got was a convoluted formula tied to trade deficits, which led to tariffs as high as 40%, 60% and even 80% on certain imports.”

At one point, tariffs on Chinese goods approached levels tantamount to a trade embargo, sending shockwaves through global markets and prompting fears of a recession. Although those worst-case scenarios have since been priced out, some uncertainty remains.

‘Uncertainty is the worst thing for markets’

In turn, this uncertainty has become one of the most significant headwinds for global markets. The unpredictability of tariff structures, shifting from reciprocal expectations to deficit-based calculations, created confusion for multinational corporations and investors alike, experts said.

Although those fears have since moderated, they noted that volatility remains a defining feature of the current environment. “Uncertainty is the worst thing for markets,” Wyett said. When companies cannot forecast costs or trade flows, they delay capital expenditures and hiring, slowing economic momentum. For investors, this means pricing in geopolitical risk as a permanent factor rather than a temporary disruption, a shift that experts said could reshape portfolio strategies for years to come.

Despite the turbulence, international equities recently have posted relative gains, buoyed by policy adjustments and fiscal stimulus in foreign markets. Yet, experts cautioned against extrapolating short-term performance into a structural trend. As Wyett said, “If I look over the last 15 years, it’s not even close: domestic equities have far outperformed international equities.”

Looking ahead

As tariff regimes stabilize and new trade corridors take shape, it may mean a less efficient world economy but also one that is more resilient against shocks like pandemics and geopolitical conflict, said Matt Stephani, president of Cavanal Hill Investment Management, Inc., a subsidiary of BOKF, NA.

“When you control more of your supply chain domestically, you reduce the risk of black swan events. It’s not just about economics anymore; it’s about resilience in a world where geopolitical shocks are becoming more frequent,” he said.

And it’s not just the U.S. economy that may become more resilient, but also some American companies as well, especially those in key industries like semiconductors, pharmaceuticals and defense. As Henderson said, “We’re entering a period where efficiency may take a back seat to resilience. Companies are willing to pay more for control over their supply chains, and that’s a structural shift that will define global trade for years.”

For markets, that shift represents both a challenge and an opportunity, one that experts agree may redefine the contours of global investing for years to come. In Stephani’s words: “It likely will create opportunity for innovation, for new companies to seize market share and for countries’ economies to prosper, if good policy decisions are made.”

“Global trade is being redefined,” Henderson said. “It’s not just about cost anymore: it’s about control, security and adaptability. That shift will create winners and losers, and companies that invest early in resilient supply chains will have a competitive edge.”